Sterling may suffer the same destiny as on the referendum day or the fate of the Swiss franc in January, 2015.

If the market is almost confident that the UK Parliament will reject Theresa May’s draft Brexit deal, then why isn’t the sterling is not flying down? The GBP/USD pair is going over the edge close to 1.27. The ministers warn that they could be leaving their posts if the Prime Minister doesn’t delay the vote and fly to Brussels to secure more concessions, than have been made so far. Large banks are counting the votes, lost by May; and “a very real risk of no Brexit” is being discussed in Forex more and more often.

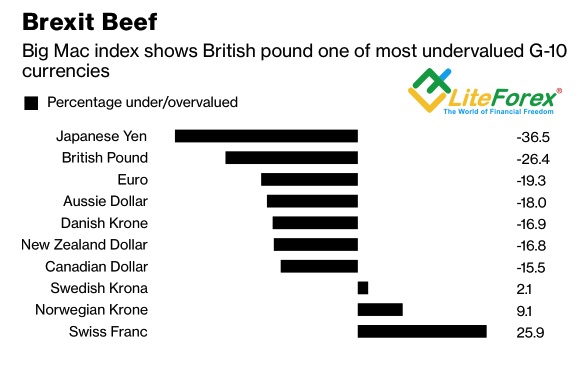

From a fundamental point of view, if a currency remains stable amid the approaching negative, then the most of it has already been priced. In fact, over the past six months, the sterling has already lost about 4.7% of its value against the U.S. dollar, being one of the G10 outsiders. As the UK employment is strong, the Bank of England sounds hawkish and the GDP rate is going up, then the GBP price is being affected by unfavorable political environment. Furthermore, as the GBP has been 15% down since the referendum on the UK membership in the EU, it is now a strongly undervalued currency, based on various tools of fundamental analysis. For example, according to purchasing power parity, based on the Big Mac Index, only the Japanese yen has a greater potential for revaluing

Purchasing power parity of G10 currencies

Source: Bloomberg.

But we know that the market is driven by speculators, rather than mathematical models. Traders’ unwillingness to avoid entering any trades ahead the important event results the sterling’s going over the edge. A single wrong step, and the GBP, according to Bloomberg experts’ consensus forecast, may drop to $1.2. The most aggressive bears suggest $1.1; and the BoE is scaring the parliamentarians by the parity. After all, according to some banks, the GBP/USD stability will depend on the number of the votes, lost by Theresa May. If they will be fewer than 75, Barclays (LON:BARC) expects the pair t o be 0.5%-0.75% up. Mizuho Bank recommends buying the sterling if the Prime minister’s draft deal will get 300 votes out of the above required 320 ones. Moreover, investors more and more often suggest the opinion that even May’s defeat won’t result in the disaster for the pound. In this case, there will be more chances for another referendum or canceling Brexit at all.

Possible scenarios of the future UK situation

Source: Bloomberg.

In my previous articles, I noted a limited potential for the GBP/USD fall, and I still stick to this idea. Once the political situation in the UK improves, the transparency will return to the financial markets, the volatility will decline, and investors will again focus on macroeconomic statistics. And the latter suggests the British pound is much undervalued.

On February 11, 2019, the pound may suffers the same destiny as it was on the day of Brexit referendum in summer, 2016. Or it may follow EUR/CHF crash when the SNB ended its minimum exchange rate in January, 2015. It is about high level of risk and uncertainty, and so, I don’t recommend entering any trades. In future, it makes sense to look for long trades as the GBP/USD is going down.