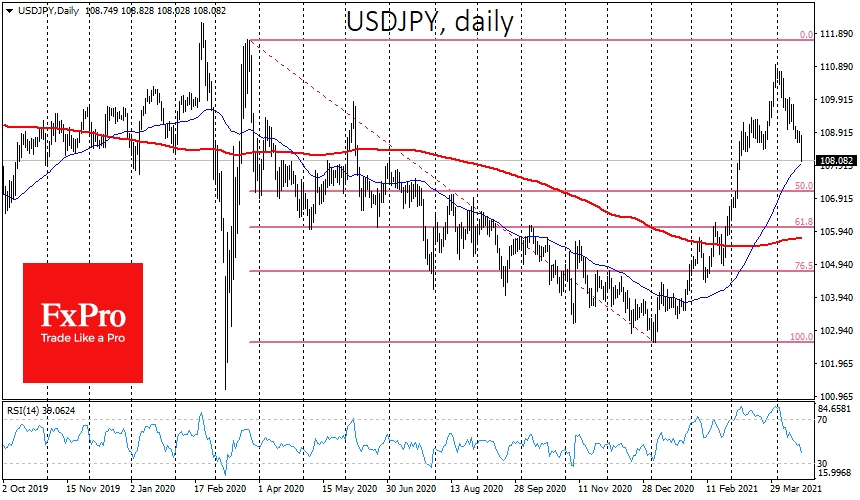

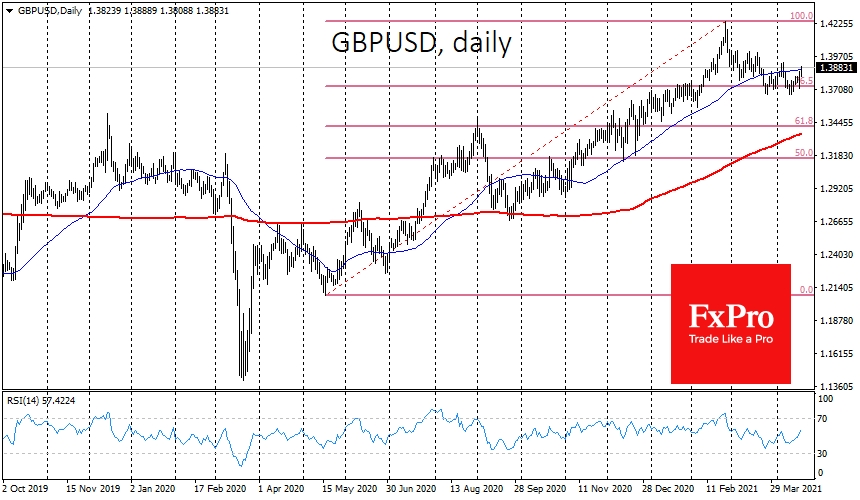

The US Dollar remains under moderate pressure at the start of the new week. The Japanese yen continues to recoup losses from the beginning of the year, with USD/JPY falling to 108.00 this morning, an area of four-week lows. GBP/USD is gaining for the sixth trading session in a row, trying to break above 1.3850 on Monday morning, where the 50-day moving average is.

GBP/USD and USD/JPY often rise during periods of high demand for risky assets and fall when investors gravitate to safe havens. We are now seeing a divergence in their dynamics due to the pressure on the Dollar.

Another barometer of risk demand, the USD/CNH, also turned down in April, acting as an indicator of investors' relatively complacent attitude towards emerging markets.

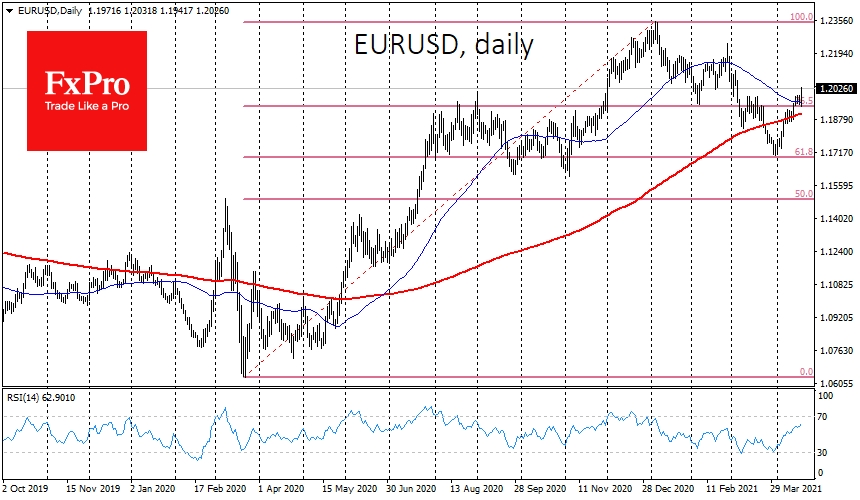

Such sustained pressure on the Dollar makes us think that its previous strengthening from January to March 2021 was just an upward correction of the May-December 2020 down-impulse within the general bearish trend.

Fundamentally, the dollar's climb since the start of the year has been supported by actual or planned bond auctions to fund a $1.9 trillion support package. Biden's $2.4 trillion Infrastructure Plan is promising to be a long-term project, already bumping up against bureaucratic hurdles. Thus, the actions of the US Treasury and President Administration are no longer pushing the dollar higher.

Rather, it's just the opposite. The Treasury has collected the money and is now handing it out to be spent on stock purchases or general consumption by households or business.

It is likely that we now see the beginning of a new impulse to weaken the dollar, compared to what happened from May to December 2020. As part of this momentum, EUR/USD could target 1.33, while GBPUSD could go as low as 1.55. USDJPY will swim against the tide in these conditions, so do not expect a renewal of the lows here, but only a pullback into the 102-105 area.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Where Will The Current Wave Of Decline Take The Dollar?

Published 04/19/2021, 06:47 AM

Updated 03/21/2024, 07:45 AM

Where Will The Current Wave Of Decline Take The Dollar?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.