I’m working on my quarterly reshaping — where I choose new companies to enter my portfolio. The first part of this is industry analysis.

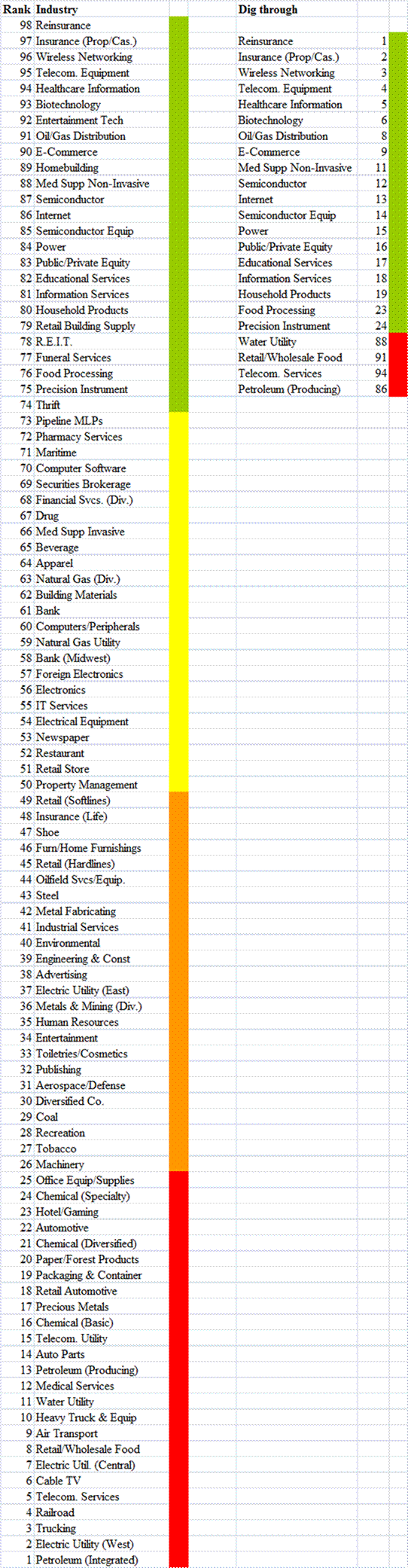

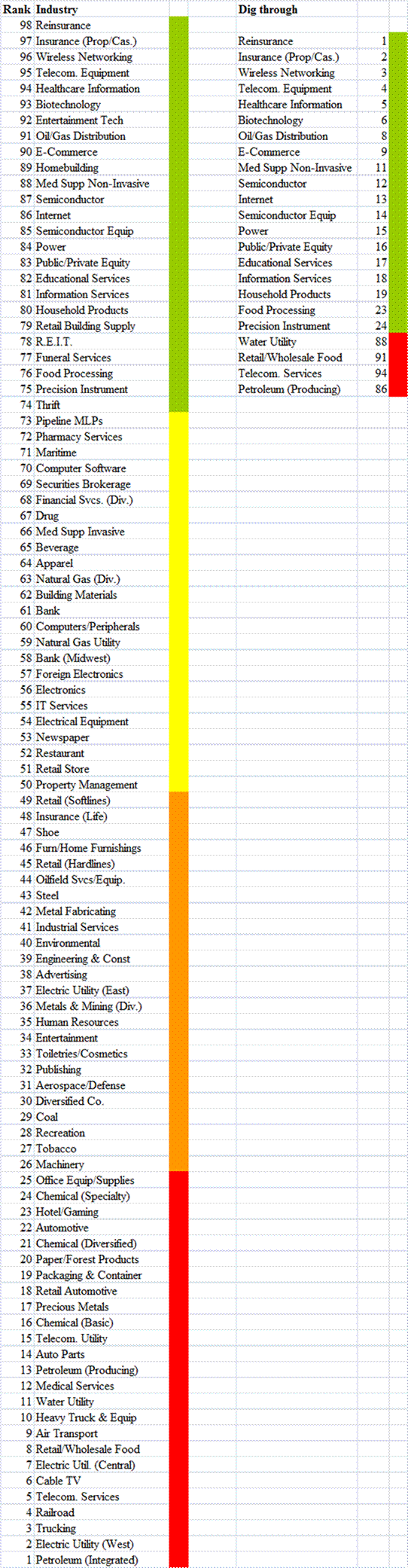

My main industry model is illustrated in the graphic. Green industries are cold. Red industries are hot. If you like to play momentum, look at the red zone, and ask the question, “Where are trends under-discounted?” Price momentum tends to persist, but look for areas where it might be even better in the near term.

If you are a value player, look at the green zone, and ask where trends are over-discounted. Yes, things are bad, but are they all that bad? Perhaps the is room for mean reversion.

My candidates from both categories are in the column labeled “Dig through.”

If you use any of this, choose what you use off of your own trading style. If you trade frequently, stay in the red zone. Trading infrequently, play in the green zone — don’t look for momentum, look for mean reversion.

Whatever you do, be consistent in your methods regarding momentum/mean-reversion, and only change methods if your current method is working well.

Huh? Why change if things are working well? I’m not saying to change if things are working well. I’m saying don’t change if things are working badly. Price momentum and mean-reversion are cyclical, and we tend to make changes at the worst possible moments, just before the pattern changes. Maximum pain drives changes for most people, which is why average investors don’t make much money.

Maximum pleasure when things are going right leaves investors fat, dumb, and happy — no one thinks of changing then. This is why a disciplined approach that forces changes on a portfolio is useful, as I do 3-4 times a year. It forces me to be bloodless and sell stocks with less potential for those with more potential over the next 1-5 years.

I like some technology names here, some energy some healthcare-related names, P&C Insurance and Reinsurance, particularly those that are strongly capitalized. I’m not concerned about the healthcare bill; necessary services will be delivered, and healthcare companies will get paid.

A word on banks and REITs: the credit cycle has not been repealed, and there are still issues unresolved from the last cycle — I am not interested there even at present levels. The modest unwind currently happening in the credit markets, if it expands, would imply significant issues for banks and their “regulators.”

I’m looking for undervalued and stable industries. I’m not saying that there is always a bull market out there, and I will find it for you. But there are places that are relatively better, and I have done relatively well in finding them.

At present, I am trying to be defensive. I don’t have a lot of faith in the market as a whole, so I am biased toward the green zone, looking for mean-reversion, rather than momentum persisting. The red zone is pretty cyclical at present. I will be very happy hanging out in dull stocks for a while.

P&C Insurers and Reinsurers Look Cheap

After the heavy disaster year of 2011, P&C insurers and reinsurers look cheap. Many trade below tangible book, and at single-digit P/Es, which has always been a strong area for me, if the companies are well-capitalized, which they are.

I already own a spread of well-run, inexpensive P&C insurers & reinsurers. Would I increase the overweight here? Yes, I might, because I view the group as absolutely cheap; it could make me money even in a down market. Now, I would do my series of analyses such that I would be happy with the reserving and the investing policies of each insurer, but after that, I would be willing to add to my holdings.

Do your own due diligence on this, because I am often wrong. One more note, I am still not tempted by banks or real estate related stocks. I am beginning to wonder when the right time to buy them as a sector is. As for that, I am open to advice.

Implications

So, given that the Industry Rank categories above come from Value Line, I went to their stock screener, selected the industries, and asked for all of the companies that:

are in their top 5 (of 9) categories for balance sheet strength, and

their horribly overworked analysts think can return at least 15%/yr over the next 3-5 years.

This combines safety, growth potential, valuation, and in my view, how promising industry prospects are. Here are the results:

ABC ADM ADTN AKAM ALL AMAT AMX AOL APOL ARB ARRS BIDU BRKR BX CAH CBEY CECO CELL CKP CL CNQ CPB CPSI CREE CTRP DNR DRIV DV EBAY EDU EFX ERIC ESI FST GMCR GOOG HCC HRC IN INFA INTC ISIL ITRI IVC JNPR K KKR KR LIFE LRCX LTRE MASI MCHP MDCI MKC NFLX NIHD NILE NOK NTRI NVDA NXY ONNN OTEX QGEN QLGC QSII RAX RIMM RMD SHEN SOHU STM STRA SWKS SWY SYY T THG TMO TNDM TRH TRI TSM TSRA TUP TXN UNTD UPL UTHR VOD VOLC VZ WBMD WBSN YHOO ZBRA

When I do my next portfolio reshaping for clients in the next week or so, these stocks (and a few others) will compete against the 35 existing portfolio names for the 34-36 slots in the portfolio.

Full disclosure: Long HCC, INTC, THG, VOD

My main industry model is illustrated in the graphic. Green industries are cold. Red industries are hot. If you like to play momentum, look at the red zone, and ask the question, “Where are trends under-discounted?” Price momentum tends to persist, but look for areas where it might be even better in the near term.

If you are a value player, look at the green zone, and ask where trends are over-discounted. Yes, things are bad, but are they all that bad? Perhaps the is room for mean reversion.

My candidates from both categories are in the column labeled “Dig through.”

If you use any of this, choose what you use off of your own trading style. If you trade frequently, stay in the red zone. Trading infrequently, play in the green zone — don’t look for momentum, look for mean reversion.

Whatever you do, be consistent in your methods regarding momentum/mean-reversion, and only change methods if your current method is working well.

Huh? Why change if things are working well? I’m not saying to change if things are working well. I’m saying don’t change if things are working badly. Price momentum and mean-reversion are cyclical, and we tend to make changes at the worst possible moments, just before the pattern changes. Maximum pain drives changes for most people, which is why average investors don’t make much money.

Maximum pleasure when things are going right leaves investors fat, dumb, and happy — no one thinks of changing then. This is why a disciplined approach that forces changes on a portfolio is useful, as I do 3-4 times a year. It forces me to be bloodless and sell stocks with less potential for those with more potential over the next 1-5 years.

I like some technology names here, some energy some healthcare-related names, P&C Insurance and Reinsurance, particularly those that are strongly capitalized. I’m not concerned about the healthcare bill; necessary services will be delivered, and healthcare companies will get paid.

A word on banks and REITs: the credit cycle has not been repealed, and there are still issues unresolved from the last cycle — I am not interested there even at present levels. The modest unwind currently happening in the credit markets, if it expands, would imply significant issues for banks and their “regulators.”

I’m looking for undervalued and stable industries. I’m not saying that there is always a bull market out there, and I will find it for you. But there are places that are relatively better, and I have done relatively well in finding them.

At present, I am trying to be defensive. I don’t have a lot of faith in the market as a whole, so I am biased toward the green zone, looking for mean-reversion, rather than momentum persisting. The red zone is pretty cyclical at present. I will be very happy hanging out in dull stocks for a while.

P&C Insurers and Reinsurers Look Cheap

After the heavy disaster year of 2011, P&C insurers and reinsurers look cheap. Many trade below tangible book, and at single-digit P/Es, which has always been a strong area for me, if the companies are well-capitalized, which they are.

I already own a spread of well-run, inexpensive P&C insurers & reinsurers. Would I increase the overweight here? Yes, I might, because I view the group as absolutely cheap; it could make me money even in a down market. Now, I would do my series of analyses such that I would be happy with the reserving and the investing policies of each insurer, but after that, I would be willing to add to my holdings.

Do your own due diligence on this, because I am often wrong. One more note, I am still not tempted by banks or real estate related stocks. I am beginning to wonder when the right time to buy them as a sector is. As for that, I am open to advice.

Implications

So, given that the Industry Rank categories above come from Value Line, I went to their stock screener, selected the industries, and asked for all of the companies that:

are in their top 5 (of 9) categories for balance sheet strength, and

their horribly overworked analysts think can return at least 15%/yr over the next 3-5 years.

This combines safety, growth potential, valuation, and in my view, how promising industry prospects are. Here are the results:

ABC ADM ADTN AKAM ALL AMAT AMX AOL APOL ARB ARRS BIDU BRKR BX CAH CBEY CECO CELL CKP CL CNQ CPB CPSI CREE CTRP DNR DRIV DV EBAY EDU EFX ERIC ESI FST GMCR GOOG HCC HRC IN INFA INTC ISIL ITRI IVC JNPR K KKR KR LIFE LRCX LTRE MASI MCHP MDCI MKC NFLX NIHD NILE NOK NTRI NVDA NXY ONNN OTEX QGEN QLGC QSII RAX RIMM RMD SHEN SOHU STM STRA SWKS SWY SYY T THG TMO TNDM TRH TRI TSM TSRA TUP TXN UNTD UPL UTHR VOD VOLC VZ WBMD WBSN YHOO ZBRA

When I do my next portfolio reshaping for clients in the next week or so, these stocks (and a few others) will compete against the 35 existing portfolio names for the 34-36 slots in the portfolio.

Full disclosure: Long HCC, INTC, THG, VOD