The search for yield is on.

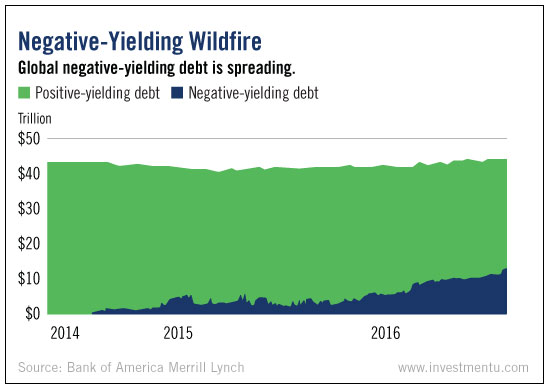

This week’s chart shows the growth of a scary trend... negative-yielding debt. It’s spreading throughout the world like an uncontrollable wildfire.

Who started this fire? You could blame global central banks for taking monetary policies to the extreme. Or, more specifically, you could rail against our government’s broken fiscal policy tactics.

Really, it’s a mixture of both.

But regardless of whom you’d rather point the finger at, we do know where the blaze started.

It began in Europe in late 2014. This is when the Swiss imposed the first negative deposit rate in more than 30 years. It quickly spread to Japan and other European nations.

To put this all into perspective, there were virtually zero negative-yielding bonds two years ago. What is happening today is unprecedented.

Right now, 80% of German and Japanese bonds are yielding below zero. And all of Switzerland’s bonds require investors to pay borrowers for the honor of lending them money.

Brexit has only helped fan the flames.

According to Bank of America Merrill Lynch (NYSE:BAC), there is now $13 trillion in global negative-yielding debt. Before Brexit, that number was sitting at $11 trillion.

We are in uncharted waters. And it’s making investors go crazy as they search for the best yield. As Steve McDonald recently told his Oxford Bond Advantage subscribers:

The factor driving bond buying has been the uncertainty in the EU, which has negative bond yields. Most of the consequential buying there has been in our Treasurys, but the global quest for any kind of yield has spilled into our corporate positions.This spillover has driven $4.35 billion into high-yield bond funds and ETFs, the second-largest recorded inflow ever. The record, $4.97 billion, was set in March of this year... exactly when our bonds turned around and started their run.

And I know this buying has only begun. I think we’ve only seen the beginning of the EU’s problems, which could drive Treasury yields below 1%. If that happens - and I think it will - the only place there will be worthwhile yields of any kind will be in corporates.

Steve mentions the huge inflow into high-yield corporate bond ETFs. This type of action should only continue in the months and years ahead.

If you are hungry for yield like the rest of the world, corporate bonds are one of the best places to look. Just remember: High-yield comes with high risk. So before you place a buy order, think long and hard about how much risk you’re willing to stomach.

Otherwise you might get scorched.