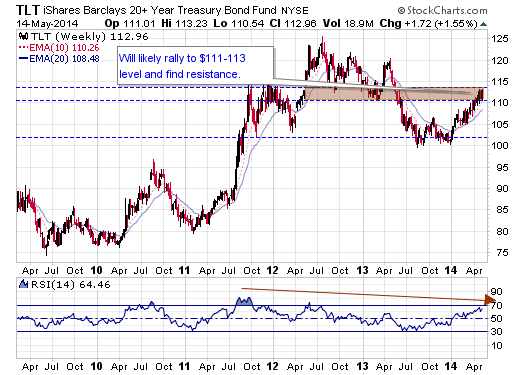

Back at the end of February I wrote this article on the iShares Barclays 20+ Year Treasury Fund (ARCA:TLT), outlining a short term bullish move in this back to $111-115 level (then it was trading at $108).It's finally hit that target, so now what? Given that I’m overall bearish on the equity markets, or maybe a better way to put it is not bullish and rather uninterested in trading the long side right now, I'm bearish by default. It’s also what my market timing signal is suggesting is the way to position my portfolio so that plays into it.

But am I really bullish on bonds. Still, here…I would say no. I can see a few scenarios playing out if my bearish thesis on the general markets materializes. If we get a sell-off in equities we could simply see a neutral/range-bound market in TLT where it trades between $111-115 for a while, maybe going up to $118. Or if things really get intense to the downside, maybe this has one last attempt to break out and trades up to $125 and forms a massive double top. Either way, I don’t feel all that comfortable buying TLT for a trade-able move higher, but I wouldn’t be surprised to see it trade higher – if that makes sense.

I feel that the best trade right now is short the major US indexes.