Summary: Despite a 10% rally, investors on Twitter Finance have not turned more bullish, even when given a strong disincentive to be bearish. From a pure sentiment basis, this implies that the current rally probably has further upside ahead.

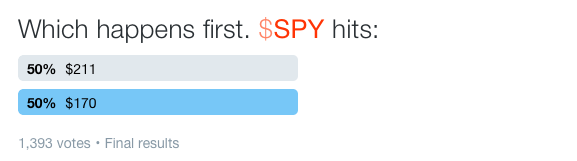

The day after the February low, we posted a survey on Twitter Finance: would SPDR S&P 500 (NYSE:SPY) rise $15 or fall $15. From a price of $185, these were symmetrical outcomes.

The result of the survey was a bit surprising: a small majority foresaw a further fall. At the time, SPY had already fallen by about 14% and investors sentiment was extremely bearish. A good hypothesis would have been that many more on Twitter Finance would be bearish than the survey showed.

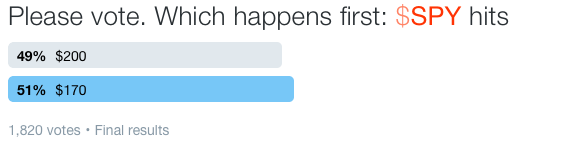

This week, we posted a second survey: would SPY rise $10 or fall $30? Instead of a symmetrical outcome like in the first survey, we made it much easier to choose the bullish option. The survey also came after SPY had risen 10% in three weeks. A good hypothesis would have been that many more on Twitter Finance would have turned bullish. Instead, there was no change from the first survey.

Despite the strong rally over the past month, flows into equity funds have continued to be negative. Sentiment surveys from a number of sources have shown only a small uptick in bulls (click here for an example). An interesting study by Brett Steenbarger shows that shares in SPY have been redeemed on a net basis over the past several weeks, meaning: "Investors have not believed in this rally and, if history holds, that's one indication that the rise could continue".

In the same way, our Twitter Finance surveys showed no increase in bulls even after a 10% rally and the addition of a low bull hurdle/high bear hurdle as an incentive to choose the bullish option. From a pure sentiment basis, this implies that the current rally probably has further upside ahead.