At the start of another week of trading, it’s time to take a spin round the four currency majors: the Aussie, the British pound, the euro and the Canadian dollar, as the FOMC once again assemble, no doubt to dither and dance on a pin head, amidst a growing feeling of discord and disagreement amongst members. Rather like Greece, the markets have become bored and disinterested with the Fed who are increasingly seen as out of touch and ineffectual.

At the start of another week of trading, it’s time to take a spin round the four currency majors: the Aussie, the British pound, the euro and the Canadian dollar, as the FOMC once again assemble, no doubt to dither and dance on a pin head, amidst a growing feeling of discord and disagreement amongst members. Rather like Greece, the markets have become bored and disinterested with the Fed who are increasingly seen as out of touch and ineffectual.

With China cutting rates and Europe signalling further stimulus, the prospect of an increase for the US this year now seems increasingly unlikely. For the currency majors, it was the Aussie dollar which suffered the least, with the Euro taking the double hit of both items of news and falling dramatically on both Thursday and Friday.

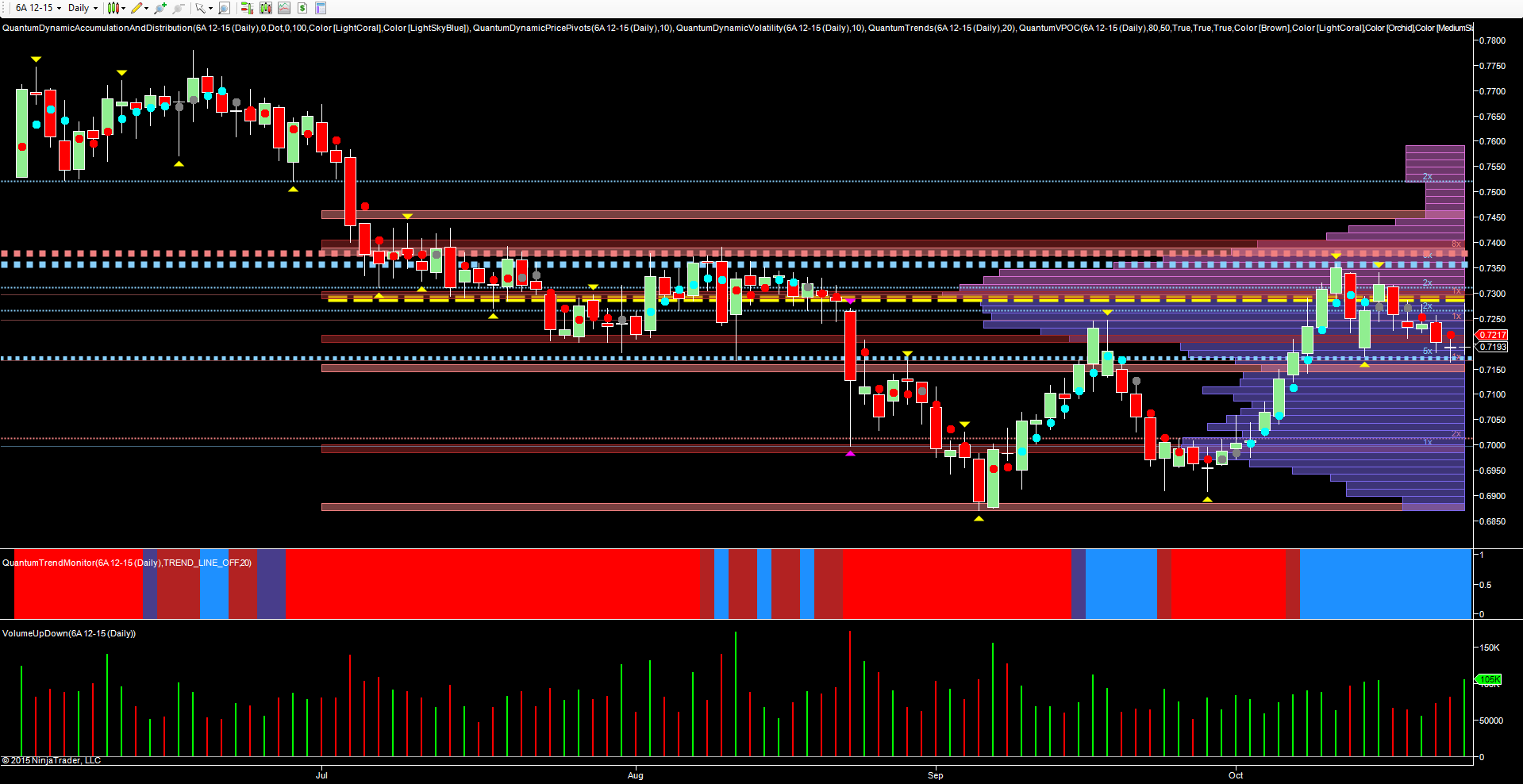

If we start with the 6A December contract for the AUD/USD on the daily chart, the recent rally for the pair ran into some stiff resistance in the 0.7350 area, as denoted by the blue dotted line on the accumulation and distribution indicator. This level was tested twice resulting in a pivot high on both occasions,and given the depth of transacted volume in this area, coupled with the sustained price action to the left of the chart, it was no surprise to see the pair move lower and back to test the platform of support now building in the 0.7190 area.

The current phase of price action is also centered around the volume point of control which is now balanced in the 0.7300 area (denoted with the yellow dotted line), and as such, we can expect to see further price congestion in this region.

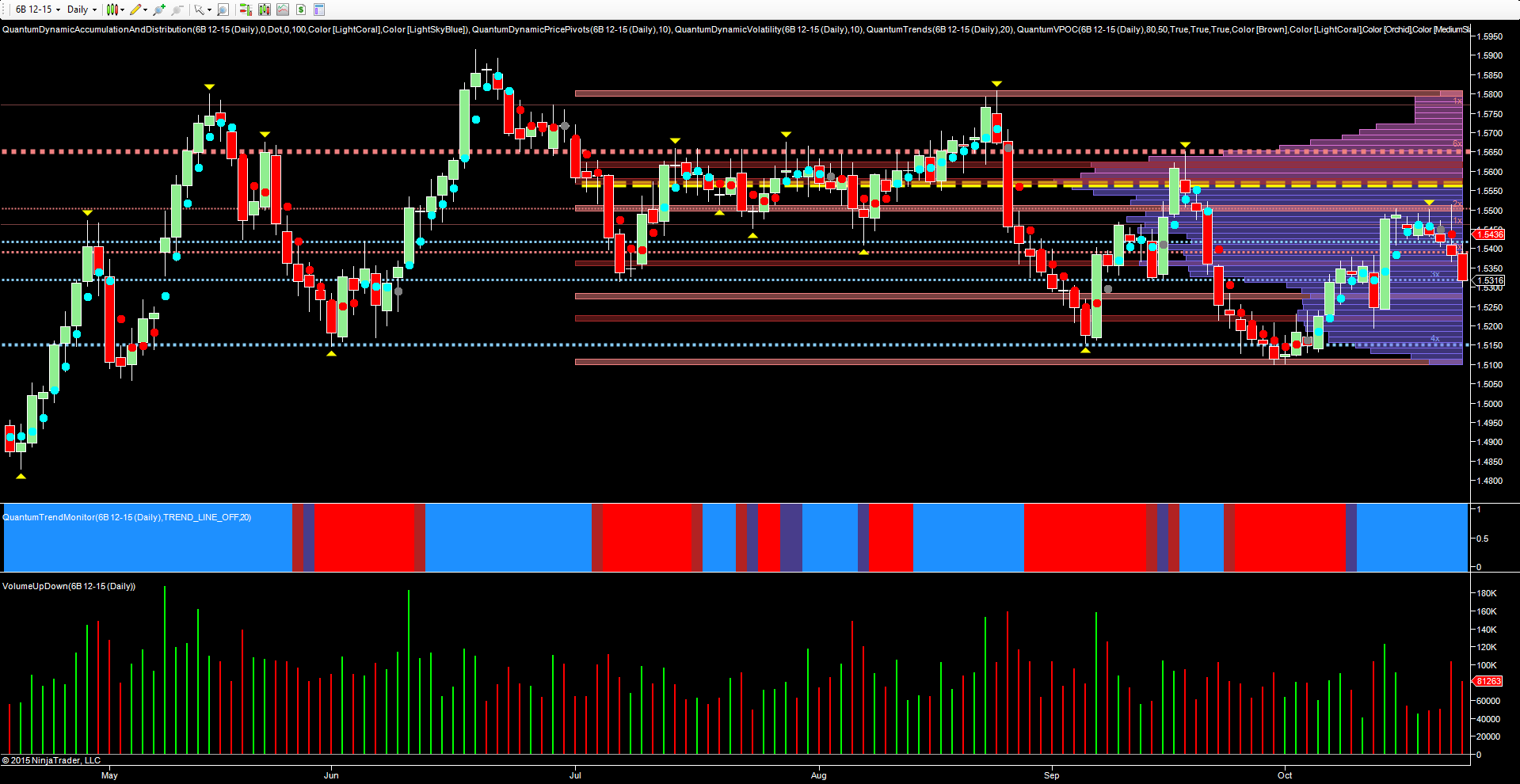

Moving to the 6B contract for the GBP/USD, the pair sold off sharply on Thursday, with the deep wick to the top of the candle suggesting further weakness ahead which duly arrived on Friday courtesy of the Chinese, with the selling pressure self evident on strong volume. The key level on the daily chart is in the 1.5550 area, which has been tested several times and again on Thursday, before the pair finally capitulated and moved lower to close the week at 1.5316.

Moving to the 6B contract for the GBP/USD, the pair sold off sharply on Thursday, with the deep wick to the top of the candle suggesting further weakness ahead which duly arrived on Friday courtesy of the Chinese, with the selling pressure self evident on strong volume. The key level on the daily chart is in the 1.5550 area, which has been tested several times and again on Thursday, before the pair finally capitulated and moved lower to close the week at 1.5316.

With the volume point of control now firmly overhead, and with little in the way of technical support below, we could see a continuation of the current bearish sentiment short term. However, over the weekend Governor Carney has stepped in to suggest that interest rates could rise but there is no guarantee – something most people could have worked out for themselves. And his exact words…a possibility not a certainty! How revealing.

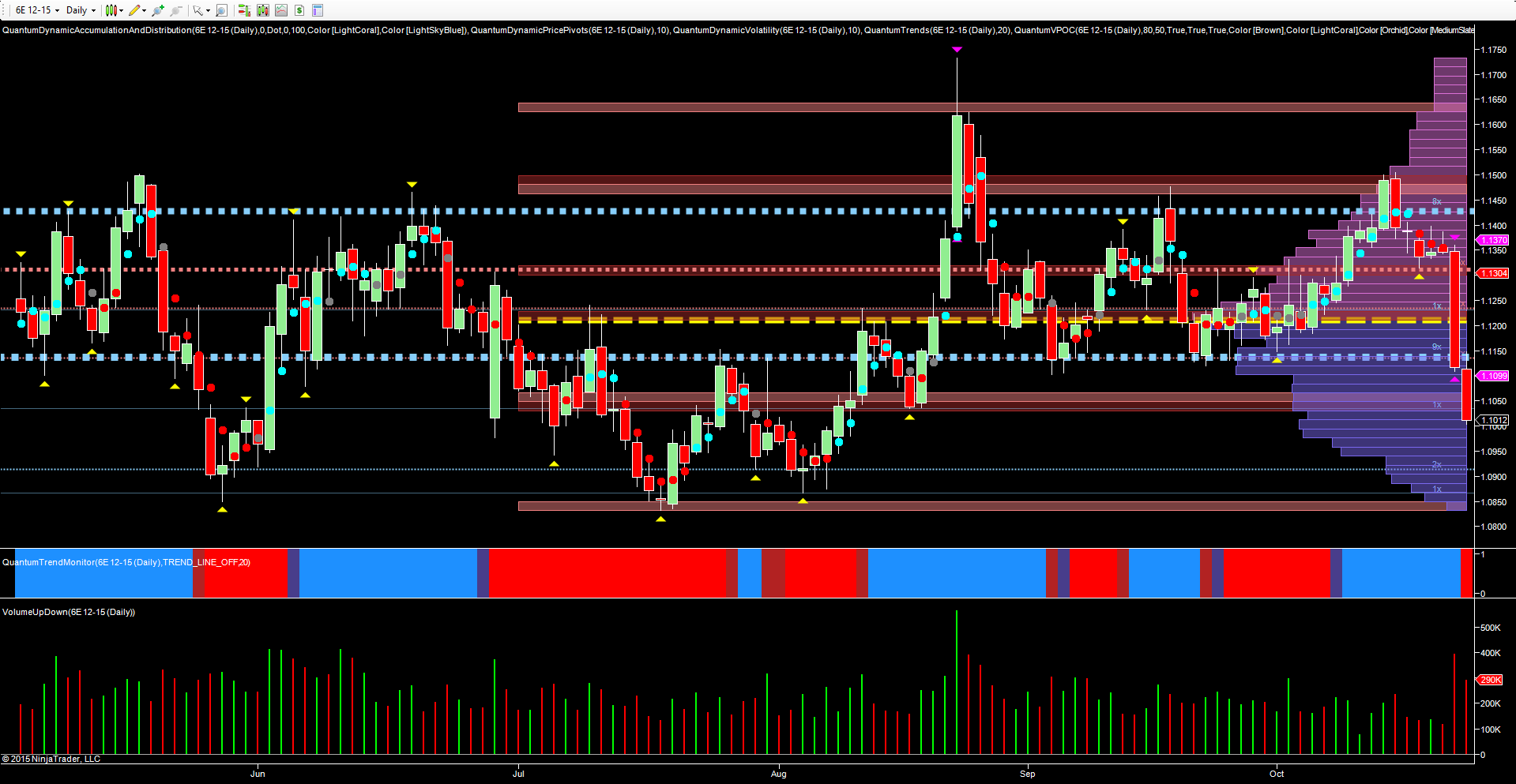

It was the 6E, the December contract for the EUR/USD which took the brunt of the fundamental news, with Thursday’s announcement sending the pair sharply lower, through a significant area of potential support in the 1.1150 region on the daily chart. In addition, and perhaps more importantly, the price action moved outside the average true range, triggering the volatility indicator which was then duly confirmed on Friday, sending a strong signal of further weakness to come.

It was the 6E, the December contract for the EUR/USD which took the brunt of the fundamental news, with Thursday’s announcement sending the pair sharply lower, through a significant area of potential support in the 1.1150 region on the daily chart. In addition, and perhaps more importantly, the price action moved outside the average true range, triggering the volatility indicator which was then duly confirmed on Friday, sending a strong signal of further weakness to come.

Both candles were associated with high volume, thereby validating the move lower. With little meaningful support now ahead, we could see the pair move to test the 1.0850 region longer term.

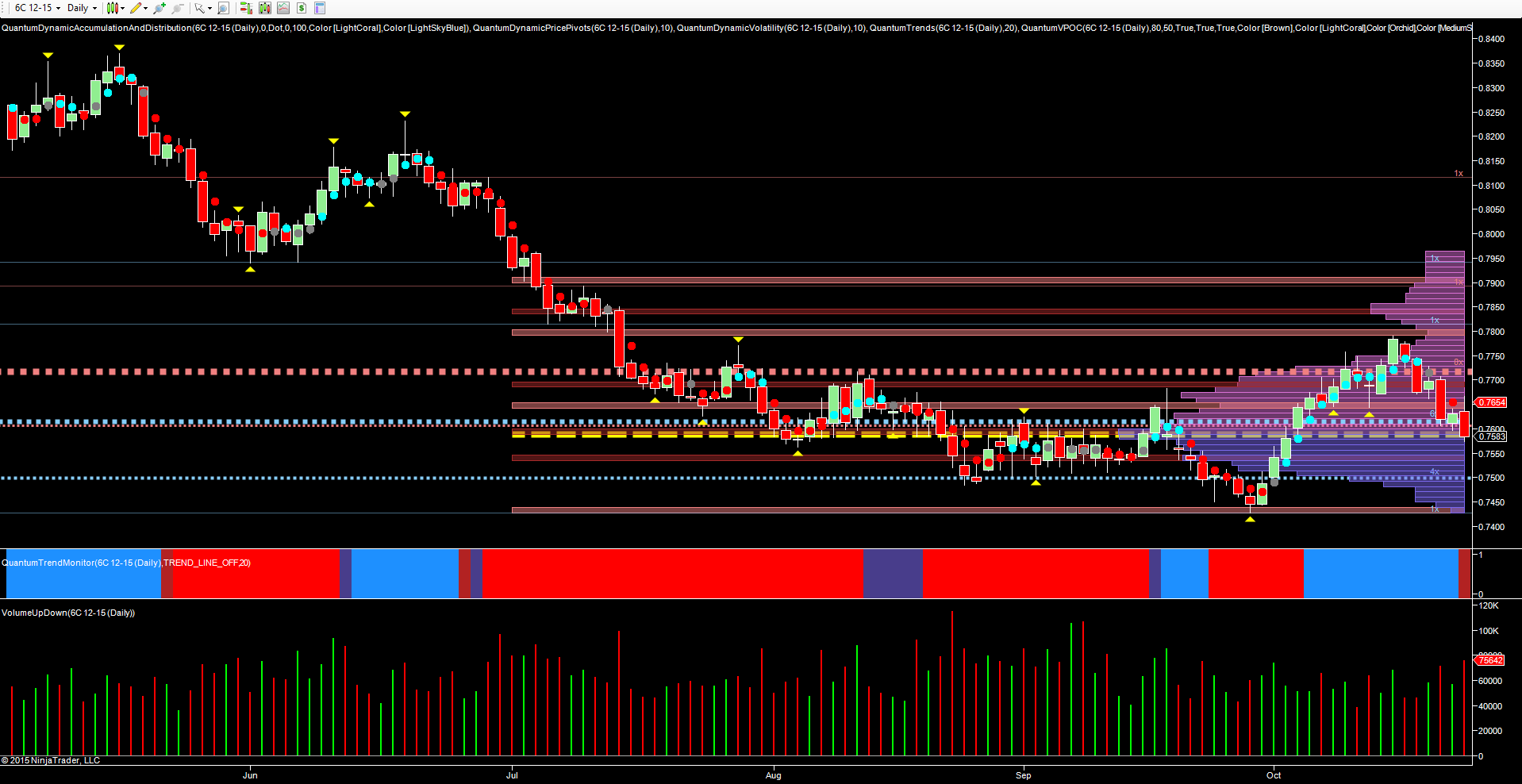

Finally to the 6C, the December contract for the CAD/USD whose recent rally, just like the 6A, appears to have run out of steam. With oil prices also falling, the Canadian dollar is under pressure on all sides as it approaches the volume point of control once again.

Finally to the 6C, the December contract for the CAD/USD whose recent rally, just like the 6A, appears to have run out of steam. With oil prices also falling, the Canadian dollar is under pressure on all sides as it approaches the volume point of control once again.

With volumes rising and the market falling we can expect to see the pair move lower in the short term and possibly back to retest the support in the 0.7430 area in the medium term with further consolidation around the VPOC in due course.