The question everyone is asking is where is the oil price heading next in the medium term, and for a possible answer, we need to move away from the intraday oscillations of the daily chart, to the weekly chart which is more revealing.

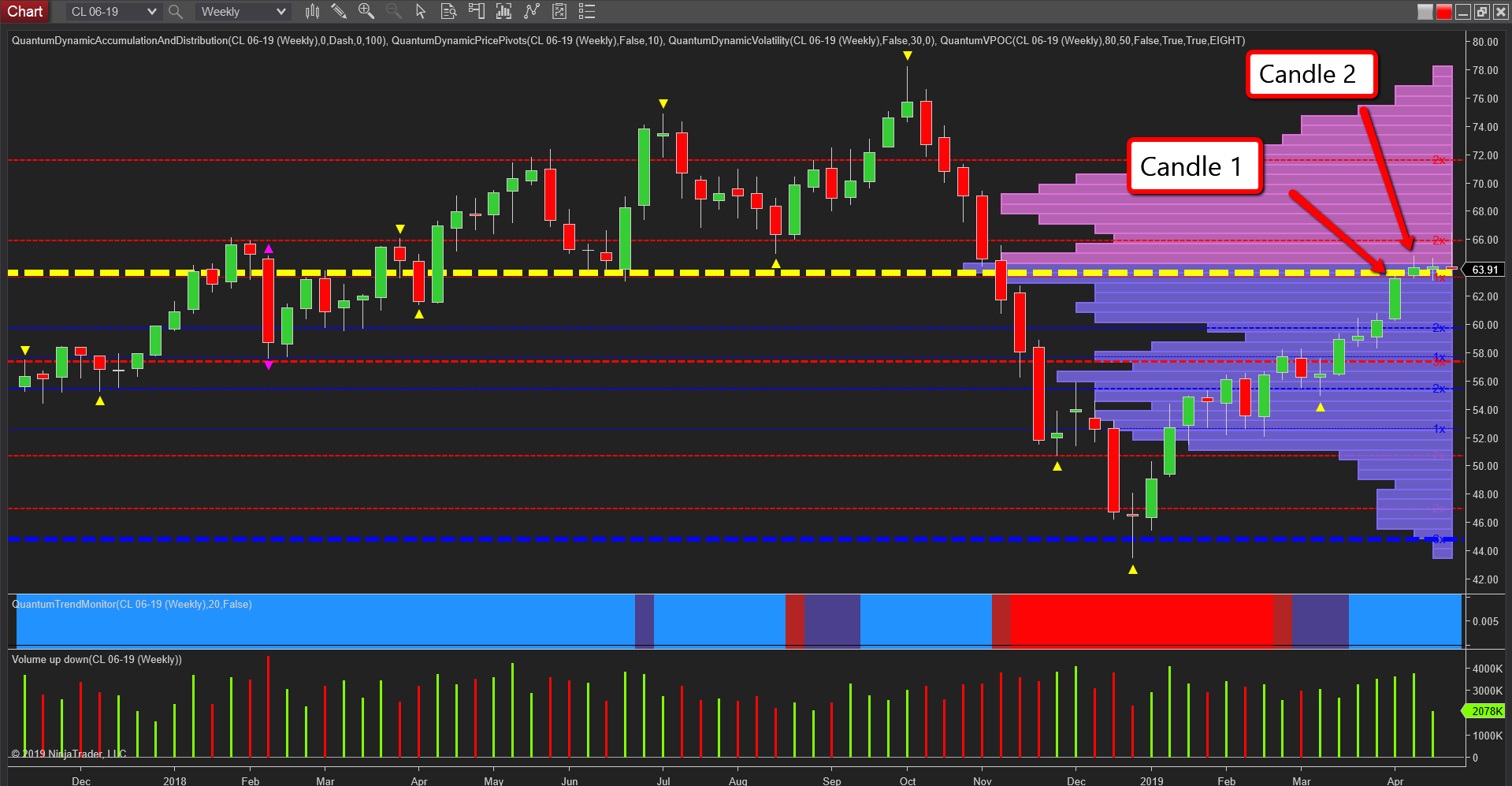

And if we start with the technical picture, there are several signals to suggest we are likely to see a pause and consolidation in the current price area. The first of these signals arrived two weeks ago with the narrow spread up candle on high volume, and the key here is to consider this volume when compared to that of the previous week which saw the price of oil close with a wide spread up candle, and only marginally lower volume than the week which followed. So to put this into Wyckoffian language, effort and result on candle 2 are in disagreement, whilst on candle 1 they are in agreement. The conclusion we can then draw from this anomaly is the big operators are selling into weakness at this level, a facet of price behaviour we are seeing replicated once more this week.

The second and equally compelling reason for the pause is oil is now trading around the volume point of control which sits in the $64 per barrel region, and as such, is, therefore, signalling further sideways price action to follow. The volume point of control is denoted with the yellow dashed line on the VPOC indicator and signals price agreement and is now the fulcrum of the market with no strong bias to one side or the other. This is where we have the heaviest concentration of volume on the weekly chart, and as we can see from the volume histogram there are high volume nodes through to $70 per barrel and beyond. And whilst there is little in the way of price resistance, these high volume nodes present a significant barrier to any progress higher for oil in the short term.

So, in summary, we can expect to see oil congest around the $60 to $66 per barrel price corridor, with any sustained break higher requiring sustained buying from the big operators to breach the deep volume resistance now waiting ahead between $66 and $70 per barrel.

The fundamental picture will also play its part, and in particular, as the US toughens its stance towards Iran which has helped to drive the price higher in the short term. Indeed this may be enough to drive oil through the technical levels discussed above, with supply-side shortages helping to provide further impetus.