As electric vehicles become more affordable, a growing number of drivers are making the move away from gas-fueled cars.

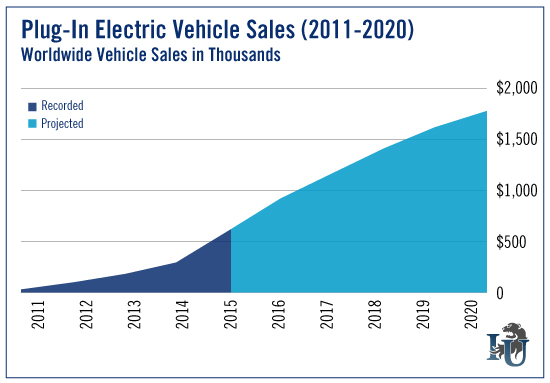

Each sale reflects the gradual but steady shift toward the inevitable: an auto market ruled by electric vehicles. And, as you can see in today’s chart, industry analysts expect sales to continue to rise through 2020.

Automakers are scrambling to get in on the action. The number of alternative fuel and hybrid electric vehicle (AFV/HEV) models on the market soared from 13 in 1995 to 187 in 2014.

Last year, the number of models increased 22.8%.

For consumers, the top benefit of owning an electric vehicle is the reduction in fuel costs. One major hurdle, however, is pricing.

The Chevy Volt, for example, starts at $34,170. And the base model Nissan (OTC:NSANY) LEAF will cost you $29,100. Meanwhile, you can drive off the lot in a gas-powered sedan for around $20,000.

To offset the difference, there are tax credits available in many states to assist in the purchasing of qualified electric vehicles - anywhere from $2,500 to $7,500.

You can be sure that as prices come down, many more people will consider replacing their older cars with all-electric ones.

So how can investors profit from these changing times?

You could invest in the companies producing and developing electric vehicles. But there’s another way to profit from this growing market as a whole...

Lithium.

Many electronics, such as smartphones, computers and cameras, rely on lithium-ion batteries for their rechargeable energy. Larger versions are used to power most electric vehicles.

The large lithium-ion battery market is expected to grow along with the electric vehicle market - up to 28% per year through 2020. The small battery market, to compare, has a 10% projected growth rate.

Investors looking to ride these uptrends should check out the Global X Lithium ETF (NYSE: LIT).