Wednesday could prove to have been a pivotal day for the market. With a gap down in the major indices the market continued to sell-off until finding some late-day support, especially in the Dow which closed green.

A key to what happens from here over the next few days could be decided on Thursday.

Citigroup (NYSE:C) said they see a 10% correction adding to the worries of many traders. With frothy conditions, that is understandable.

On the other hand, should Thursday see a higher market, we will most likely also see a new round of buying.

Luckily, by looking at the technical of the major indices we can plan what to expect, and more importantly what to do if the market decides to head lower.

With that said, charting is not a crystal ball, but I believe it is the next best thing.

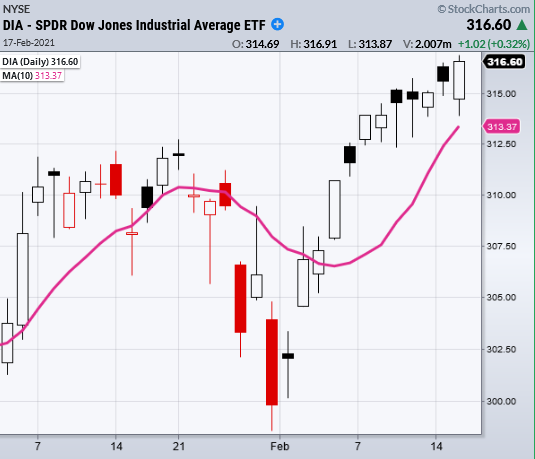

First let us look at yesterday's index leader the DIA, which was able to close at new all-time highs.

Even more, the DIA was the only major index to not break its 10-day moving average at $313.37.

When it comes to support, $211 is an important area to watch as there has been much consolidation from January there.

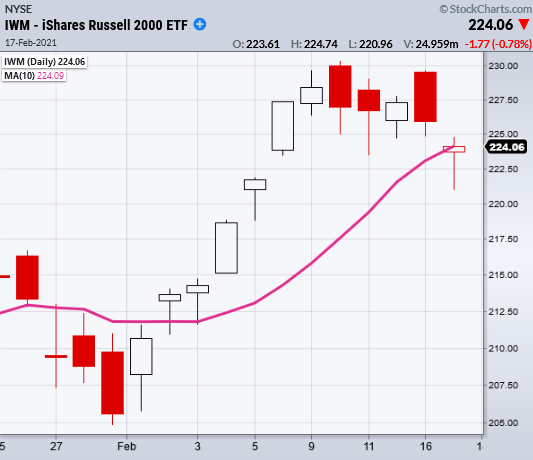

Next, we have the Russell 2000 (IWM) which closed just a single penny over its 10-DMA at $224.09.

Important support levels to watch are $222 and $214 area.

Technically, IWM had a potential topping pattern. Nonetheless, we have seen that type of pattern many times over the last few months and Wednesday's volume did not indicate extreme fear.

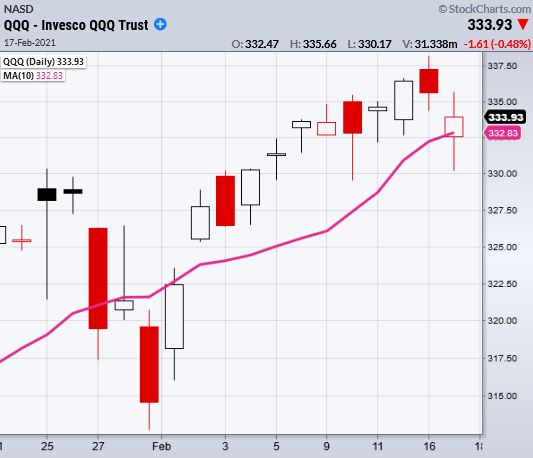

The NASDAQ (QQQ) has the clearest support price to watch.

If you draw a line at $329.50 you can see multiple support points align on the chart.

This creates a pivotal area to watch for support to hold or break.

However, with the price back over its 10-DMA at $332.83, the highs are not far off.

Last, we have good old S&P 500 (SPY) holding the price range from the past couple weeks.

The most recent support comes in at $385 but like the rest of its index friends it is again holding over the 10-DMA at $389.47.

Technically we have great levels to watch for the market to hold, but we also can’t forget that we have underlying support from the Fed.

The Fed again announced that they will keep an accommodative stance. Yet for the first time, a few members said that inflation could become a factor.

Perhaps even bigger than the Fed is the Biden administration considering not only stimulus, but also college loan cancelation and reparations for African Americans.

More printing, from the government or the Central Banks will most likely put more money in the hands of the Reddit and Clubhouse traders. And with hearings on tap Thursday, we will be closely tuned in.

- S&P (SPY) 385 support

- Russell 2000 (IWM) 230 resistance. 222 support area

- Dow (DIA) New highs. 312 support area

- NASDAQ (QQQ) 329.50 support

- KRE (Regional Banks) Doji Day. 60.00 support

- SMH (Semiconductors) 246 support

- IYT (Transportation) 224 support the 50-DMA

- IBB (Biotechnology) Support the 50-DMA at 158

- XRT (Retail) Needs to clear 81.46. 75.28 next support