In the field, raw natural gas often occurs with other hydrocarbons such as ethane, propane, butane and iso-butane. These heavier hydrocarbons are collectively known as natural gas liquids (NGL).

Processing involves separating the NGLs from the raw gas, which ensures that the methane (natural gas) meets purity requirements for transportation on the interstate pipeline network and delivery to homes and businesses.

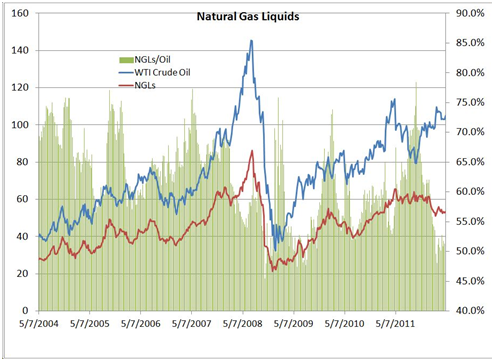

More important, NGLs have value as discrete commodities; the relative spread between the price of natural gas and a barrel of NGLs drives demand for processing. That is, if natural gas prices are low compared to the price of a barrel of NGLs, companies have an incentive to extract as much of this content as possible from the raw gas. Conversely, if gas prices are expensive relative to NGLs, demand for processing would suffer. In this instance, companies would leave as much NGLs as possible in the gas stream without violating pipeline requirements.

Fortunately, the market value of a barrel of NGLs tends to follow the oil prices rather than the price of natural gas, as ethane and propane can replace naphtha and other crude derivatives in certain petrochemical processes. The combination of elevated oil prices and depressed natural gas prices has been a boon for MLPs that own processing capacity, though NGL prices have softened somewhat of late.

Several factors are behind the moderate decoupling between oil and NGL prices. Frenzied drilling activity in liquids-rich plays such as Appalachia’s Marcellus Shale, south Texas’ Eagle Ford Shale and parts of the Barnett Shale near Fort Worth, Texas, have led to a surge in NGL production.

Nevertheless, investors shouldn’t fret that NGL output will swamp demand and weigh on prices. For one, international demand for US propane exports has outstripped existing capacity, prompting Enterprise Products Partners LP (NYSE: EPD) and Targa Resources Partners LP (NYSE: NGLS) to announced plans to build or expand their terminals on the Gulf Coast. Propane and other NGLs are far more expensive in other areas of the world, giving US exports a competitive advantage against local supplies.

The revivification of the domestic petrochemical industry also ensures that NGL prices won’t tank. To take advantage of low US NGL prices and plentiful supplies, several major chemicals manufacturers have reopened manufacturing facilities in the US and announced plans to build new ethane and propane crackers. With demand for natural gas processing expected to remain robust in the current pricing environment, I consider Enterprise Products Partners LP and Targa Resources Partners LP to be good MLP Investments.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Where's The Growth In Natural Gas Markets?

Published 05/17/2012, 01:20 AM

Updated 07/09/2023, 06:31 AM

Where's The Growth In Natural Gas Markets?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.