The world will soon bounce back from this pandemic, but the recovery will be rough and painful. The current low oil price environment will also come to an end, with prices possibly spiking as demand recovers.

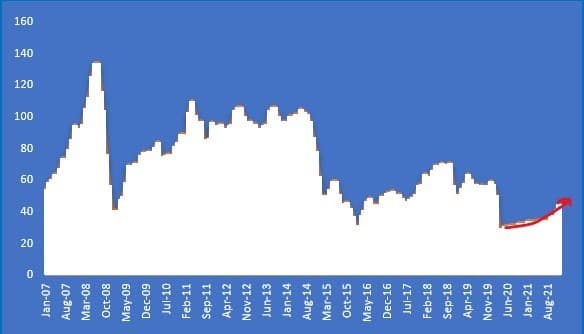

The extent of oil and gas exploration and production is largely driven by current oil prices, future expectations of oil prices, and availability of resources. Higher oil prices generally lead to large investments in upstream operations, while lower oil prices can lead to a drastic drop in investment. Persistently lower oil prices from 2014 to 2016 led to underinvestment in upstream and fewer Final Investment Decisions for oil projects. Investments in upstream, for example, plunged from $1079 billion in 2014 to $900 billion in 2015 and then further down to $583 billion in 2016. This is because lower oil prices severely affect the revenues, cashflows, and profitability of oil and gas companies. That leads to fewer resources being available for future investment in exploration and production activities. The question now, is what will happen to the oil and gas industry post-COVID-19? Should we expect the regime of lower oil prices to linger or will oil prices bounce back?

COVID-19 has devastated the global economy and it may take years to recover from the economic and social damage it has caused. The months-long lockdown has not only severely impacted businesses but has also resulted in high unemployment and all the social issues that come with it. The U.S Labor Department reported that total nonfarm payroll employment fell by 20.5 million in April, causing the unemployment rate to hit 14.7 percent. This is the highest rate of unemployment and the largest monthly increase since January 1948.

The International Labor Organization (ILO) reported that some 1.6 billion workers in the informal economy, representing nearly half of the global labor force, are in immediate danger of losing their livelihoods due to the COVID pandemic. Within the formal economy, things aren’t much better, with industries such as the aviation industry suffering through record-breaking losses. The oil industry is another front-line sector that has been hit hard. Low oil and gas prices over the past few months have not only resulted in high unemployment within the industry (the U.S. Labor Department reported that unemployment in mining, quarrying, and oil and gas extraction rose from 1.9 percent in January to 10.2 percent in April 2020.) but have also hit revenues, profit, and cash flows hard. As such, most of the major oil companies have already incurred huge losses. For example, Occidental Petroleum Corp (NYSE:OXY). reported a net loss of $2.2 billion, BP (NYSE:BP) reported $4.4-billion net loss in the 1st quarter, ExxonMobil (NYSE:XOM) reported an estimated first-quarter loss of $610 million and also announced 30 percent cut in its capex for 2020 to $23 billion, compared to the $33 billion earlier announced. Italian oil and gas company Eni SpA (NYSE:E) reported its first-quarter net loss was 2.93 billion euros, compared to a net profit of 1.09 billion euros a year ago. Many companies within the oil and gas industry will go out of business as the losses mount and prices remain low.

Rystad Energy estimated that E&P companies will see revenues plunge by around $1 trillion in 2020, falling to $1.47 trillion from $2.47 trillion last year. They were also of the view that 2020 will see the lowest project sanctioning activity since the 1950s in terms of total sanctioned investments, which stands at $110 billion – only 33 percent of the investments in 2019. Many companies have already abandoned or deferred their major projects.

So what does this all mean? It simply means that fewer resources will be made available for future investments in exploration and production - hindering the ability of companies to invest in future projects. A decrease in exploration and production investment will lead to a supply squeeze in the future once demand comes back online.

The coming recovery will require enormous financial and energy resources to rectify the damages caused by COVID-19. During this recovery process, global oil demand will slowly move towards normalcy and may even surpass global supply. Even if the oil industry were to increase investment, there is always a lag involved in bringing production online. It takes a number of years to discover, acquire, and develop a project. Even shale oil wells may struggle to come back online as it is difficult to return a well that has been shut-in to its previous production levels. Then there are the disruptions at manufacturing sites (where plants & equipment for future delivery are under construction) to consider. These delays may impact a project’s completion date. The list of variables that could impact the supply side of the oil market in the near future is a very long one.

The world has witnessed various cycles in the past, but there has never been anything as complete and intensive as this. The time-scale of the oil price recovery will depend upon how quickly the global economy is revived and how fast the surplus oil is consumed by increasing demand. The ability of OPEC to comply with its production cut deal will also play a role in the oil market recovery.

While the timescale remains unclear, a new oil price cycle is in the making, and the serious lack of investment in exploration and production as well as other supply-side issues could send oil prices significantly higher.