It was widely assumed that once Amazon.com (NASDAQ:AMZN) started selling sports apparel that companies like Foot Locker (NYSE:FL) would have to step up or go broke trying to compete.

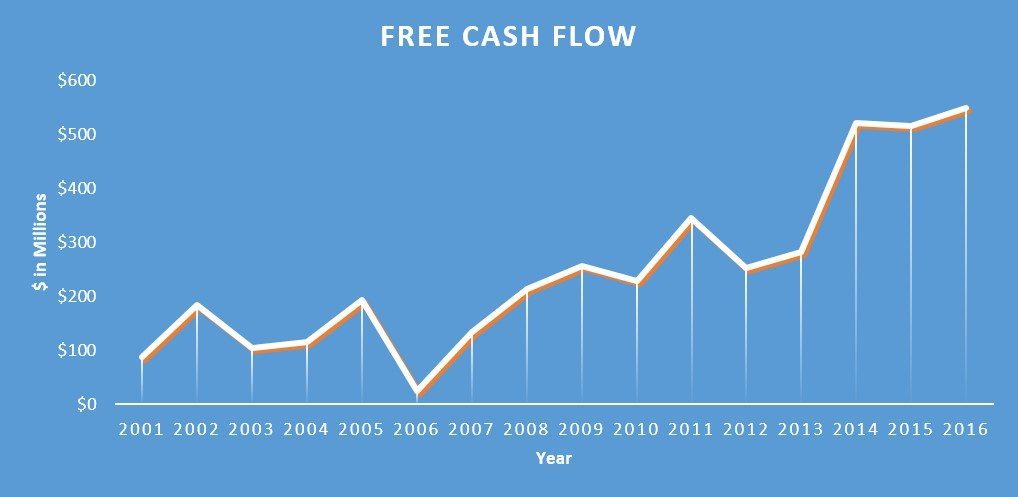

But something else is happening. Take a look at Foot Locker's past performance since 2000.

What Amazon Effect?

As individual investors we need to challenge our own perceptions and assumptions. We need to think like Arthur Conan Doyle's fictional character Sherlock Holmes.

But how?

By applying the method of deduction.

The Amazon effect is based upon an assumption.

Amazon will have a highly destructive effect on Foot Locker's ability to compete on price and it's fairly safe to assume that sales and profitability will decrease sharply in the coming years.

Applying deductive reasoning, we first look at the facts. From the tables provided above we see that Foot Locker has slowly been increasing its ability to produce growing free cash flows. According to the headlines, this should not be happening.

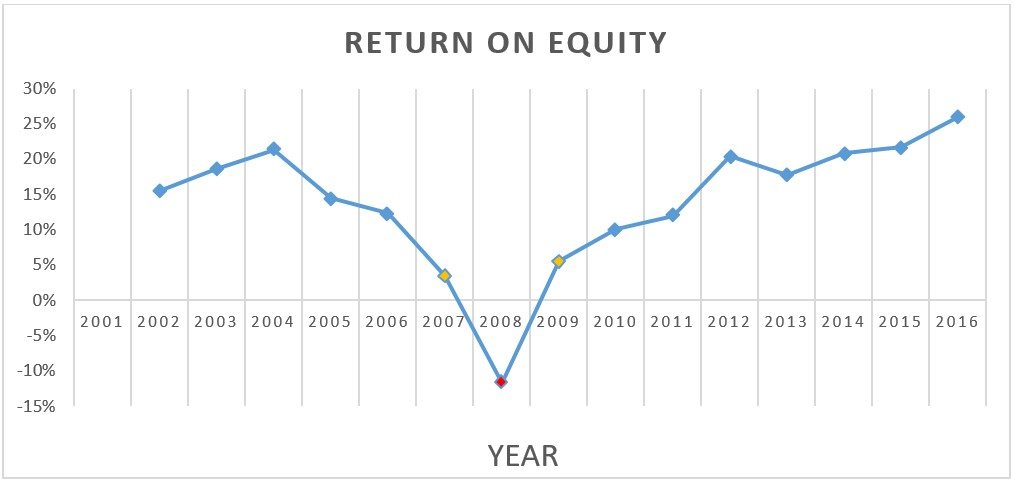

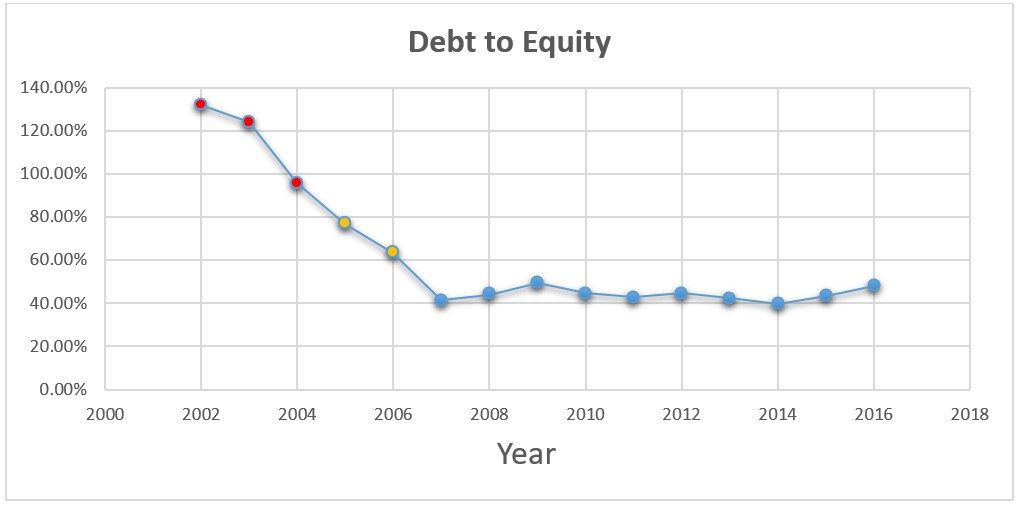

And we see more evidence in the form of high returns on equity, which means that Foot Locker is able to maintain high levels of profitability while maintaining a low level of debt.

From these facts we can start explore several lines of reasoning as to how Foot Locker can maintain and even grow these high levels of profitability while competing against Amazon.

For instance, one line of reasoning could be, Foot Locker operates with greater economies of scale and captive customers. Then you look for facts that both support or oppose your line of reasoning.

Once you eliminate the impossible, whatever remains, no matter how improbable, must be the truth.

Arthur Conan Doyle

With Foot Locker trading at 8 times earnings, indicating an earnings yield of 12.5%, you’ll be hard-pressed to find a better earnings rate for your money.