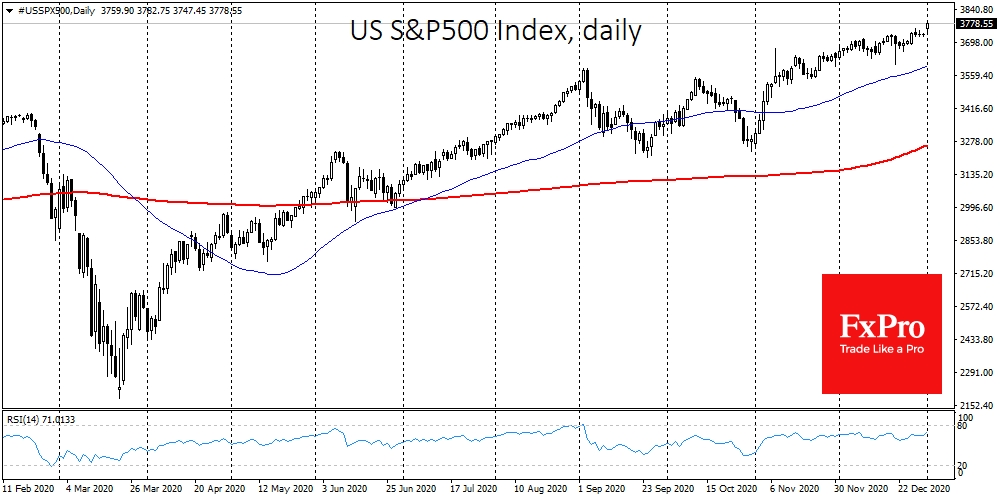

It is a common perception that the pandemic has disrupted market fundamentals. Investors continue to buy shares of companies that are more than overpriced as if nothing had happened, multiplying their gains. This trend is now reinvigorated at the start of trading in 2021.

Perhaps the main conclusion that investors will make from 2020 is that "stocks only go up". Of course, this is not the case but it could still be suitable as a motto at the start of 2021.

In most countries, governments and central bankers do not intend to switch from stimulus to austerity. Policymakers are sure to press the stimulus pedal to the metal as economies and employment are still far from pre-covid levels.

In an era of zero rates, the boom in stock prices has attracted abnormal public interest in investment. At times it seems as if everyone around us is thinking about it.

It could very well be that we have just started to climb a retail boom mountain. Created not only by retail investors with mobile apps in their pockets but also pension funds with huge assets and future liabilities. They are all looking for at least some kind of return.

The more experienced or historically familiar investors are wondering who will be the next buyer amid falling returns, secretly hoping for central banks. A similar situation of the incredible retail boom in stocks had preceded the Great Depression of the 1930s when the Fed was mistakenly quick to tighten policy.

That being said, we would like to caution against betting too early on an equities collapse. Retail investor interest is far from saturated. So far, we see a rush of interest, but not historically record shares in stock market instruments.

As investors increasingly look for bond-likes equities with predictable cash flow and price stability, it is unlikely that we should expect another year of a rapid appreciation of "growth" companies.

With the economy recovering, the travelling, energy and metals industries will appear overpriced and emotionally oversold. However, many of the 'value' companies retain a working here-and-now business and actively share profits with shareholders.

It now seems prudent to diversify your portfolio and to do so on the assumption that, after the coronavirus, life will try to get back on track.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

When Will Stocks Reach Their Ceiling?

Published 01/04/2021, 06:25 AM

Updated 03/21/2024, 07:45 AM

When Will Stocks Reach Their Ceiling?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.