To say that today’s broad market picture is “unpredictable” would be a gross understatement.

On a macro level, there are enough cross currents and shifting dynamics to give even the most seasoned trader vertigo.

Europe continues to capture headlines as the fight between austerity and insolvency rages. From a very rational perspective, it is clear that there simply are NO good answers to the situation.

Whether countries like Greece, Spain and Italy default, restructure, or kill economic growth with drastic austerity plans, the repercussions will be very dark.

But despite the extremely bearish environment, traders have to protect themselves against a “rip-your-face-off” rally which could easily happen at a moment's notice. All it would take is a rumor that Germany is putting together a bailout package, or some other seemingly positive development, and sentiment could shift on a dime.

Of course even if there WAS a positive turn of events for the European situation, clouds are gathering over China where the “hard landing / soft landing” debate is tilting farther toward a crash scenario.

An unexpected drop in electricity consumption has raised red flags for observant economists – even while government officials force power plant managers to fudge the data and keep the weakening demand under wraps.

With so much macro uncertainty, it is important not to become attached to a particular expected short-term directional play.

When a statement (or lack of a statement) from a particular politician can cause global markets to gap materially higher or lower without notice, traders have to protect capital as a first priority, and look for opportunities that allow risk to be kept at very conservative levels.

Although we have reduced our exposure levels significantly (dialing back the number of signals we take – and keeping tight risk envelopes on individual positions), we have still remained active – bobbing and weaving as we take signals on micro chart patterns.

We are keeping the majority of our powder dry so that as the macro situation evolves and better reward-to-risk opportunities emerge, we will have our capital intact to take advantage of new “big game” setups.

Below are a few of the areas we are involved in heading into the week:

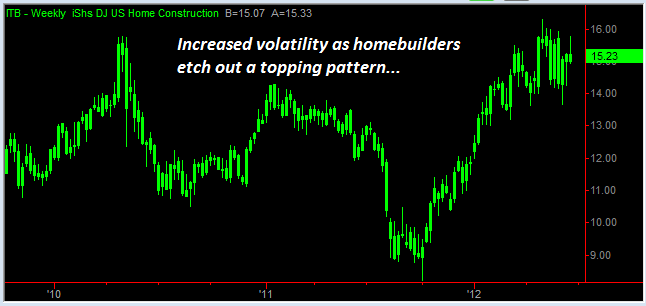

Homebuilders Etch Out a Broad Topping Pattern

The home construction sector is at an interesting crossroads, both in terms of industry fundamentals, and investor sentiment.

Homebuilder stocks have rallied since the second half of last year as investors have anticipated a major turn for the area.

Low interest rates were expected to help borrowers, and ultimately create demand for new homes. Reduced foreclosure rates created optimism as investors believed that “shadow inventory” issues with bank owned properties may have subsided. Meanwhile compelling valuations for homebuilder stocks sucked in deep value investors.

But now it looks like homebuilder stocks could turn out to be the next bear market victims as the US economy stumbles and financial institutions have to re-evaluate their loosened foreclosure policies.

A change in the fundamental picture has the potential to create a major sentiment imbalance as deep value investors no longer have cheap prices to justify their holdings, and turnaround investors now face questions as to whether the industry really HAS turned.

The situation leaves the group vulnerable to a major price drop as PE multiples compress, while earnings levels simultaneously deteriorate.

On the weekly chart, volatility for the iShares US Home Construction (ITB) ETF has picked up as the group hits a resistance area from early 2010.

Last week, we took a short-term swing position on the ETF, as the daily and 60-minute chart created an attractive reward-to-risk trade opportunity.

Looking farther down the road, as the group continues to weaken, we have the ability to allocate more capital to this area. In order to justify building horizontal (more individual positions) or vertical (larger positions) to this area, we need to have a bit more clarity on the macro front.

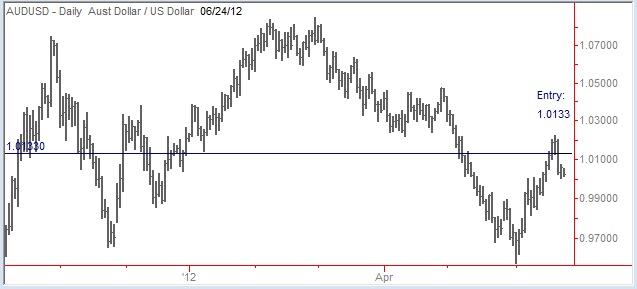

The China / Aussie Link

Another trade on our books as we enter a new week, is our short AUD/USD position.

Australia is directly linked to China’s fortunes as much of the demand for raw materials (base metals, dry bulk shipping, coal etc.) benefits the land down under.

In 2012, we have seen a transition from an argument of whether China’s growth will stall, to how hard the economic landing will be. As reports surface regarding lower electricity consumption (one of the more reliable statistics that is harder to fudge), traders are seeing the writing on the wall.

This is actually the second time this quarter that we have shorted the Aussie dollar. In early May, we initiated a bearish position as the AUD/USD consolidated for a few weeks after topping out. We were able to capture 2.9 R profits (2.9 times the initial capital at risk) before cashing out on June 6th.

More recently, the Aussie has rebounded – resolving the oversold price action. But the fundamental picture is still extremely bearish and the Australian dollar looks poised to fall once again.

Our new short position generated unrealized profits very quickly – giving us a chance to tighten our risk point while keeping the full trade in play.

At this point, the pattern continues to look very attractive (for bearish traders), and we’ll continue to manage the risk while letting the trend run as long as possible.

As overnight pre-market futures begin trading (Sunday night for US traders), S&P futures are indicating a lower open. Although this could certainly change before today’s open, it appears traders are at least considering the possibility of follow-through after Thursday’s frightening plunge.

Our trading book is relatively light, with a bearish bent and a particular interest in the AUD/USD action.

We have to respect both the chance of a major air pocket (gap lower) with any negative European news – along with the potential for an intense relief rally to kick in.

Respecting the market’s ability to turn in either direction is important for any traders’s longevity – especially in this uncertain environment. Keep the powder dry and limit your risk as we pick our way through the macro minefield.

Disclosure: This content is general info only, not to be taken as investment advice. Click here for disclaimer.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

When The Macro Picture Turns Cloudy, Exploit The Micro

Published 06/25/2012, 12:40 AM

Updated 07/09/2023, 06:31 AM

When The Macro Picture Turns Cloudy, Exploit The Micro

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.