It’s Myth-Busting Monday. And that means it’s time to tackle a topic that’s potentially contentious.

Today, I’m taking on the idea of rarity in the financial markets. Specifically, whether or not “rare events” truly end up being a rare occurrence.

While the findings might not surprise you, the implications for our investing strategies certainly will. So let’s get to it.

“Unlikely” Doesn’t Mean “Never”

By definition, rare events should seldom occur.

Applying that understanding to financial markets, however, assumes that all market events follow a normal distribution. Or, in layman’s terms, a bell-shaped curve. (If you’re still clueless, fetch your Statistics 101 textbook from the attic to achieve enlightenment.)

More specifically, the statistics say that 99.7% of all daily movements should fall within three standard deviations of the mean, no more.

Well, guess what? New research suggests that they clearly don’t follow such a pattern.

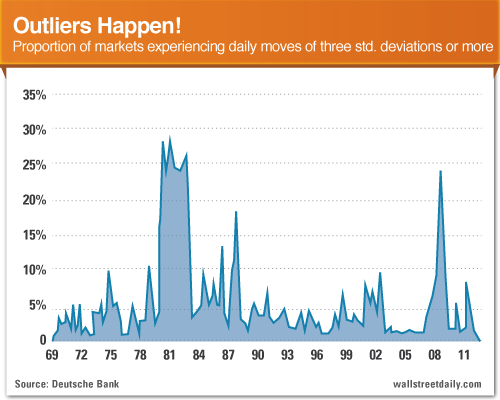

Deutsche Bank recently measured the occurrence of rare events – defined as daily movements of three standard deviations or more from the mean – for various markets. Like stocks, 10-year Treasuries, the U.S. dollar/Japanese yen exchange rate… the list goes on.

As you can see, the proportion of three standard deviation movements hardly ranks as rare. In some instances, including the financial collapse in 2008, it happens over 25% of the time.

Long story short, outliers happen! Way too frequently. So, clearly, financial markets don’t follow a normal distribution.

Or if you prefer a more eloquent explanation, here’s how Deutsche Bank puts it:

“When thinking about the year ahead, it is tempting to extrapolate the recent past whether looking at risks or one’s base case. Moreover, there is a tendency not to deviate too far from consensus, perhaps seeing safety in being part of the herd. From a statistical perspective, this is very similar to assuming markets follow a normal or Gaussian distribution. That is, markets are well behaved and extreme outcomes are rare. The financial crisis of 2008 taught us otherwise, yet it is very difficult to shrug off the bias to assume normality in markets.”

Either way, the implications couldn’t be more straightforward. We should prepare for outliers.

Such advice is particularly timely, considering that we’re still in the middle of the season when pundits dole out predictions like breath mints.

We should be seeking out the wildest and boldest predictions. Because they could actually happen – and, in turn, we could score some serious contrarian profits.

Discarding the obvious in favor of the outrageous is easier said than done, of course.

We naturally gravitate toward predictions that jive with our own personal convictions. Psychologically speaking, it’s called “confirmatory bias.” We seek out information congruent with our own beliefs with much more fervor than contradictory data.

But based on what we’ve learned so far, it’s imperative to think outside the box if we want to identify new profit opportunities before anyone else.

Six Outrageous Predictions for 2013

Since I’m supposed to be here to help, let me share six outrageous predictions with you for 2013. Some are mine, and some came from elsewhere.

~Prediction #1: The burgeoning rally in Japanese stocks endures.

I know that’s crazy talk. But I’m no longer the only one guilty of it. So is Blackstone Advisory Partners’ Vice Chairman, Byron Wien. In his annual “Surprises” list, he pegged the Nikkei 225 trading “above 12,000 as exports improve and investors return to the stocks of the world’s third-largest economy” as a possibility. Go long Japanese stocks, but beware of a falling yen sapping your profits.

~Prediction #2: Congress actually passes a budget.

It hasn’t happened since April 29, 2009. But it’s hard to curb spending when you don’t know how much you’re allowed to spend. (Just saying.) From an investment perspective, such an occurrence could help ward off a sovereign debt downgrade and help Treasury prices continue to defy gravity.

~Prediction #3: Stocks soar by more than 15%.

Bull markets aren’t supposed to last this long, until they do. I selfishly hope that nobody buys into this one, because it’ll serve as a strong contrarian indicator that the bull market will, indeed, charge higher. And that means more profits for the few, the proud, the bulls.

~Prediction #4: Ben Bernanke gets tired of buying bonds and opts for stocks instead.

All credit goes to the boys at Deutsche Bank for this one. As they said:

“With the U.S. housing sector apparently turning the corner, stronger equities may be the necessary tonic to further increase household wealth, and also to boost investment… While the Fed does have restrictions on what assets it can buy, it can invoke Section 13(3) of the Federal Reserve Act that allows more extreme actions in ‘unusual and exigent circumstances.’”

Who knew such a monetary policy measure was even legal? I’m suddenly getting more bullish about stocks. As the saying goes, we never want to fight the Fed.

~Prediction #5: Inflation returns with a vengeance.

The Nostradamuses over at Morgan Stanley (MS) say: “Inflation could be triggered by a combination of another drought which limits agricultural production, stronger-than-expected recoveries from [the] world’s economic powerhouses (China and the U.S.), and ballooning central bank balance sheets.”

That actually doesn’t sound so outrageous, now does it? Hurry up and stuff your portfolio with gold, silver, timberland, real estate and, yes, stocks. (They’re the most unloved, but best inflation hedge, of the bunch.)

~Prediction #6: Greece discovers gas reserves worth more than all of the debt it owes.

I know what you’re thinking. There’s also a bottomless pot of gold at the end of a rainbow in Ireland, right? This prediction from Deutsche Bank might not be so far-fetched, though. As they note, “Greece has sizeable undersea terrain in the Mediterranean, and several Mediterranean countries have already discovered and are exploiting undersea natural resources.”

If you’ve got moxie, you can prove it by pushing a few chips in on the Global X FTSE Greece 20 (GREK). It’s in full-on rally mode – up 60% over the last six months. So it’s not really that outrageous of a bet. It’s a momentum play.

~Bonus Prediction: Lindsay Lohan avoids any run-ins with the police.

This is one prediction I won’t even consider betting a single dollar on. I may be a dyed-in-the-wool contrarian. But I’m not a sucker. However, if you’ve got a friend willing to bet that she avoids the law in 2013, bet the house… And make him pay up!

Bottom line: Just because something is unlikely, doesn’t mean it won’t happen. Especially in the financial markets.

So be a contrarian and bet on the unexpected happening much more frequently than everyone else. You’ll have a bigger net worth to show for your courage. Just ask John Templeton: “It is impossible to produce superior performance unless you do something that is different from the majority.”

And he practiced what he preached.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

When Rare Events Aren’t All That Rare

Published 01/21/2013, 06:30 AM

Updated 05/14/2017, 06:45 AM

When Rare Events Aren’t All That Rare

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.