Should you buy when there is blood in the streets? While the prospect of buying low may sound great, a beaten-up asset can always get battered some more. There’s no certainty when it comes to recognizing precisely when the bludgeoning will stop or when the knife will hit the floor.

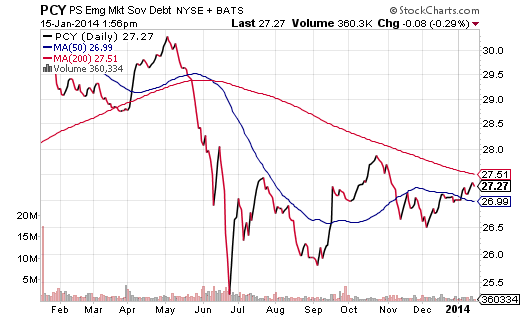

There are times, however, when enough evidence comes to the forefront to make a rational re-entry. For example, few asset classes received as much “hate mail” as emerging market debt in the May-June tapering swoon of 2013. Whereas U.S. intermediate bonds may have witnessed a 7%-8% drop from the high to the low, ETFs like PowerShares Emerging Market Sovereign Debt (PCY) experienced an 18% bashing.

Since late June, many investors have been wading back into the volatile waters. While the recovery has been inconsistent at best, the current price of PCY is within spitting distance of a long-term 200-day trendline. The 30-day SEC yield of 5% appears to be enticing income hunters. What’s more, in the first few weeks of 2014, emerging market sovereign nations have collectively sold nearly $19 billion in bonds. According to Dealogic, that represents three times the amount sold at the beginning of last year.

Commodities are another asset class that have been struggling mightily. Unlike the rate spike that pounded emerging market bonds, the nearly 3-year downtrend on iPath DJ Total Commodity (DJP) can be linked to global deflationary scares. Yet both asset types experienced dramatic price declines as investors stampeded for the exit doors; in truth, if you are holding onto the wrong “stuff” at the wrong time, you’re likely to get bruised, bashed and bloodied.

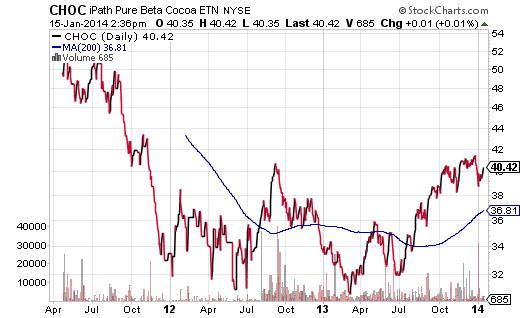

Some publicly traded commodities are making a comeback, though. Cocoa had lost nearly 44% in value in a two-year bearish period (4/11-3/13). Since then, the tide has changed considerably. Not only has iPath Pure Cocoa (CHOC) moved 30% higher off of its 2013 lows, but the current price is roughly 10% above its 200-day moving average.

So how might an investor judge whether a new long-term uptrend is for real? Might the price movement be yet another head fake in a viciously deceptive deflationary cycle? Perhaps. Still, if one combines technical price movement with fundamental data, he/she can make an educated decision about an investment’s potential. According to the European Cocoa Association, European chocolate makers increased their processing of cocoa by 6.2% in the final three months of 2013. That data point far exceeded expectations. And with traders responding favorably to the data on the chocolate-making ingredient, CHOC may very well make a powerful run at earlier highs set back in 2011.

Even when fundamental data and technical price movement support the notion that an asset type has upside potential, I recommend the use of stop-limit loss orders and/or low-correlating assets. “Stops” can minimize the possibility of large losses while low-correlating assets can reduce portfolio volatility.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

When Exchange Traded Investments Recover

Published 01/16/2014, 05:37 AM

Updated 03/09/2019, 08:30 AM

When Exchange Traded Investments Recover

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.