As the global economic cycle heats up, it's worth posing the question: when does "so good" become "too good"? It's a reference to one of the principles in my analysis. My approach is to look at multiple factors, whether it's valuations, monetary policy settings, sentiment, technicals, or the earnings/economic cycle. Each indicator and combination of indicators carry different signals at different stages of the cycle. When it comes to economic cycle indicators there is a point where it gets "so bad that it's good" e.g. the 2009 bottom where economic sentiment was so morose that it really only had one place to go. Likewise when things get too euphoric, when the economy is booming, there is also a point where good becomes bad.

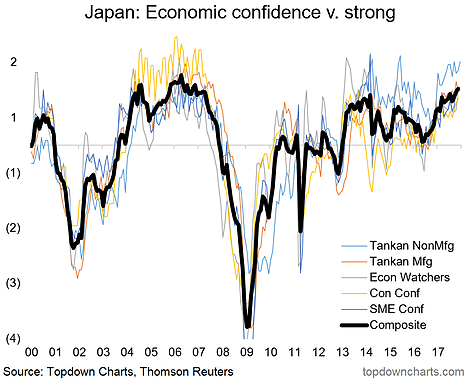

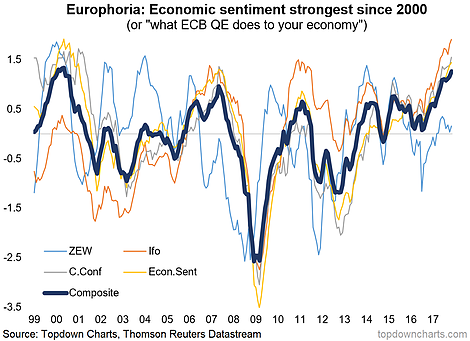

I wanted to highlight 2 key charts that I believe will be absolutely vital to have front of mind in 2018. They show composite economic sentiment metrics for Europe and Japan. The bottom line is that conditions look about as good as it gets – economic optimism is at a fever pitch. The issue is both economies have central banks which are easing full-tilt.

So the simple answer or implication is that so good becomes too good when the ECB and BOJ decide their work is done and it's time to meaningfully pull back from extraordinary easing. America has already moved from QE to QT, and it's inevitable that the ECB and BOJ will follow suite, and when they do it will add to the big macro theme of the global turning of the tides in monetary policy. These are interesting times, and relatively uncharted waters for both the global economy and financial markets and could make 2018 a more challenging year for investors..

Europhoria: economic sentiment is the strongest since 2000 – even better than the pre-crisis credit boom times. This chart will make it increasingly harder for the ECB to keep going with QE.

Similarly, Japan is seeing increasingly buoyant economic confidence and the BOJ remains a substantial easer on the global monetary policy front, so any changes here could have wide-reaching implications.