While Wheaton’s production of gold and silver in Q219 was closely in line with – or even above – our expectations, temporary under-sales of both relative to production led to a US$6.3m negative variance in (underlying) net earnings and a 9.1% (or 1 cent) negative variance in EPS relative to our prior expectations. More significantly, given the improved metals price environment, we have upgraded our EPS forecasts for FY19 by 14% to 57c/share, which is now near the top of the range of analysts’ expectations, despite continuing to use gold prices that are 5% below spot, at US$1,416/oz and US$1,418 for Q3 and Q4, respectively. We also expect the quarterly dividend to be increased in Q4, from 9cps to 10cps.

Guidance reiterated; composition changed

Wheaton Precious Metals (WPM) has maintained its production guidance for FY19 of 690,000oz of gold equivalent, although it now estimates that this will be composed of 385,000oz of gold (cf 365,000oz previously), 22.5Moz of silver (cf 24.5Moz previously) and 22,000oz of palladium (unchanged). For the five-year period ending in FY23, the company continues to estimate that average annual gold equivalent production will be in the region of 750,000oz per year.

Hudbay to appeal Rosemont decision

On 31 July, a federal judge in Arizona issued a ruling in the lawsuits challenging the US Forest Service’s approval of the Rosemont mine. The ruling effectively blocks construction of the project, as a result of which we have removed it from our forecasts (NB this has no effect on our valuation, which is based on a multiple of FY20 earnings). However, the operator, Hudbay, has stated that it will appeal the decision. In the meantime, WPM has made no payments towards the project.

Valuation: C$45.37 in FY20

Assuming no material purchases of additional streams (which we think unlikely), we forecast a value per share for WPM of US$34.11, or C$45.37 in FY20 (cf US$33.41 or C$45.03 previously) at (unchanged) average precious metals prices of US$25.95/oz Ag and US$1,482/oz Au. This valuation excludes the value of 20.9m shares in First Majestic held by WPM, with an immediate value of C$285.9m, or US$0.48 per WPM share. In the meantime, WPM’s shares are trading on near-term financial ratios that are cheaper than those of its royalty/streaming ‘peers’ in at least 91% of financial measures considered in Exhibit 7, and the miners themselves in at least 41% (but perhaps as much as 51%) of the same measures, despite being associated with materially less operating and cost risk.

Q219 results

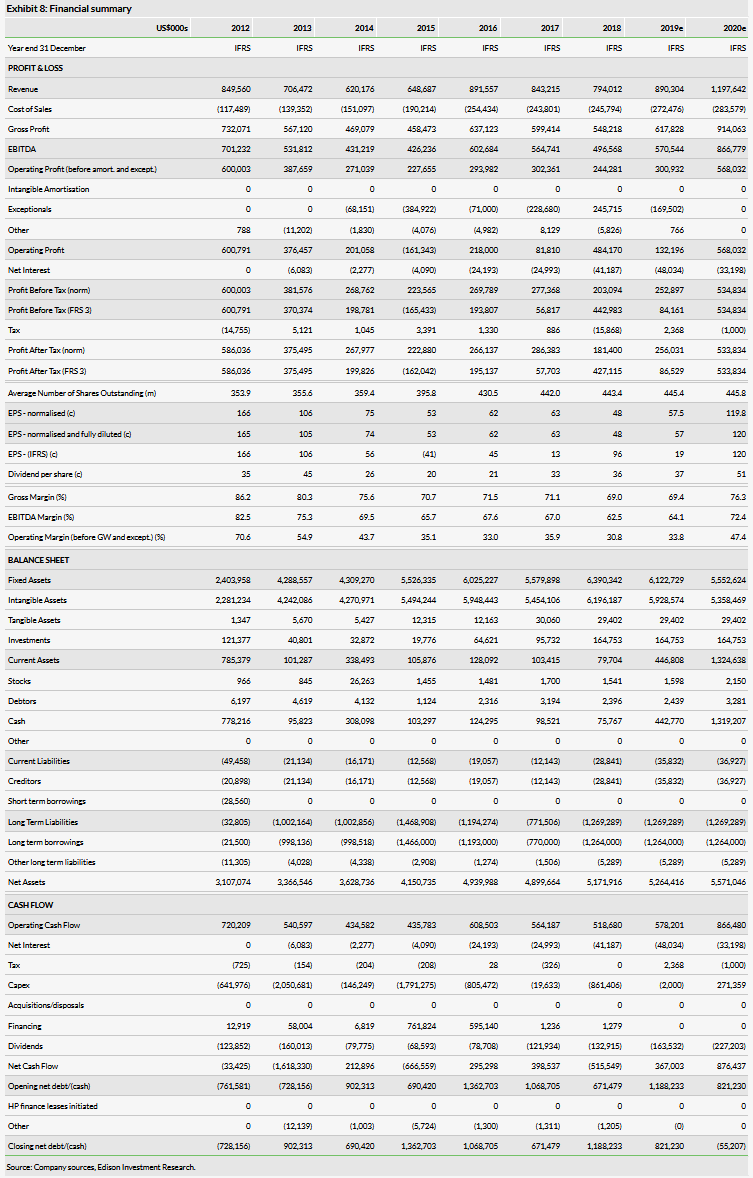

While Wheaton’s production of gold and silver in Q219 was closely in line with – or even above – our expectations, temporary under-sales of both relative to production led to a negative variance in sales of US$9.6m (or 4.8%) relative to our quarterly forecast, which, despite being partially offset by direct costs and taxes in particular, resulted in a US$6.3m negative variance in (underlying) net earnings and a 9.1% (or 1 cent) negative variance in EPS. This contrasted with Q119 results, in which a large oversale of gold relative to production (resulting from a drawdown in inventory – see ‘Ounces produced but not yet delivered – aka inventory’ on page 3) broadly offset a large under-sale of silver, resulting in a US$5.4m positive variance in revenues relative to our expectations. The other feature of the Q219 results was a US$165.9m impairment charge relating to the company’s Voisey’s Bay cobalt purchase agreement (which is not shown in the table below, but is considered in more detail on page 3, overleaf, and shown in our FY19 forecasts in Exhibit 8 on page 10). A full analysis of WPM’s underlying Q2 results relative to our prior forecasts and Q119 results is provided in the table below:

From an operational perspective, the standout performer within WPM’s portfolio of streams was once again Salobo, at which production remained at high levels, with lower throughput and recoveries almost completely offset by higher grades. A similarly positive performance was also reported at San Dimas, which benefited from higher grades in the Jessica and Victoria veins during the quarter. By contrast, Penasquito was adversely affected by a two-month stoppage in production as a result of an illegal blockade at the mine (although this was known about by Edison and taken into account in its prior Q219 forecasts). Moreover, this situation has now remedied itself and production is reported to have been ramping up since mid-June. In the meantime, production remains at lower levels at Constancia, owing to delays in mining the Pampacancha satellite deposit (which hosts significantly higher gold grades than those mined hitherto), in lieu of which WPM is entitled to receive an additional 2,005oz gold per quarter during FY19 and FY20 relative to its precious metals purchase agreement.

Voisey’s Bay

Wheaton entered into a precious metals purchase agreement (PMPA) with Vale in June 2018 to acquire from Voisey’s Bay an amount of cobalt equal to 42.4% of its output until the delivery of 31 million pounds and 21.2% of cobalt production thereafter for the life of mine for a total upfront cash payment of US$390m. At the same time, Vale also entered into a streaming agreement with Cobalt 27 Capital Corp on substantially the same terms as WPM’s Voisey's Bay PMPA.

On 18 June 2019, Cobalt 27 announced that it had entered into an agreement to be taken over by Pala Investments at a price that implied a significantly lower value for the former’s streaming agreement with Voisey's Bay than the original upfront cash payment. As a result, Wheaton made the decision to impair the value of its own asset by US$165.9m, from US$393m to US$227m (although this is, self-evidently, a non-cash charge to the income statement).

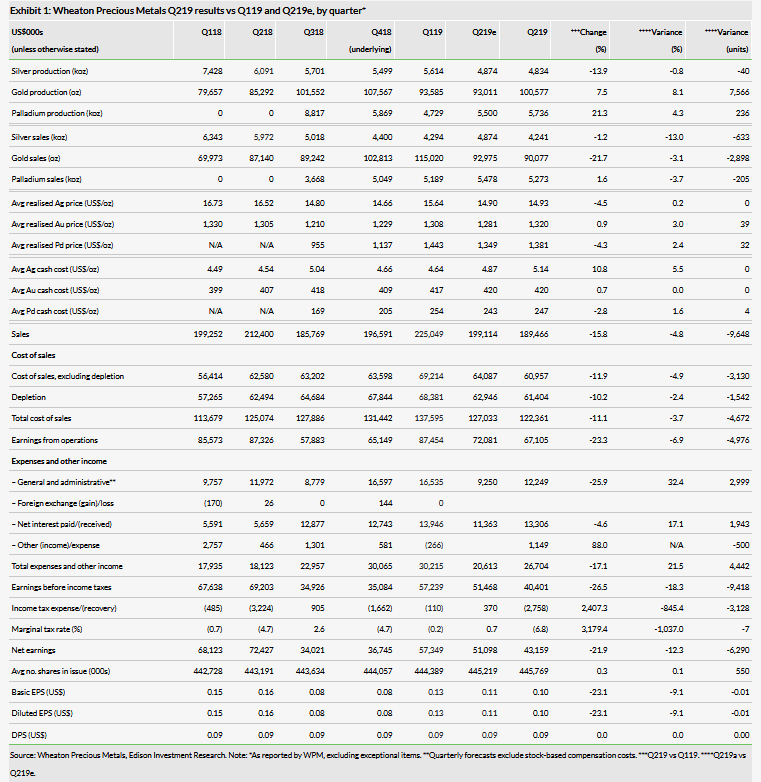

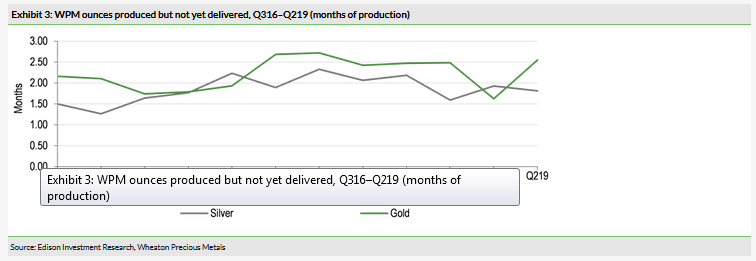

Ounces produced but not yet delivered – aka inventory

After diverging sharply in Q119, in Q219 sales of silver and gold relative to production reverted to close to their long-term average rates of 87.7% (vs a long-term average rate of 88.8%) and 89.6% (vs a long-term average rate of 92.3%), respectively.

As at 30 June, payable ounces attributable to WPM produced but not yet delivered amounted to 3.3Moz silver and 80,740oz gold (vs 3.5Moz silver and 51,515oz gold in March). This ‘inventory’ equates to 1.81 months and 2.52 months of forecast FY19 silver and gold production, respectively (vs 1.92 months and 1.66 months of forecast FY19 silver and gold production in Q119 and 1.59 months and 2.49 months of FY18 production in Q418), and compares with WPM’s target level of two months of annualised production for silver, and two to three months of annualised gold and palladium production.

Note that, for these purposes, the use of the term ‘inventory’ reflects ounces produced by WPM’s operating counterparties at the mines over which it has streaming agreements, but which have not yet been delivered to WPM. It in no way reflects the other use of the term in the mining industry itself, where it typically refers to metal in circuit (among other things) and may therefore be considered to be a consequence of metallurgical recoveries in the plant.

Medium-term outlook

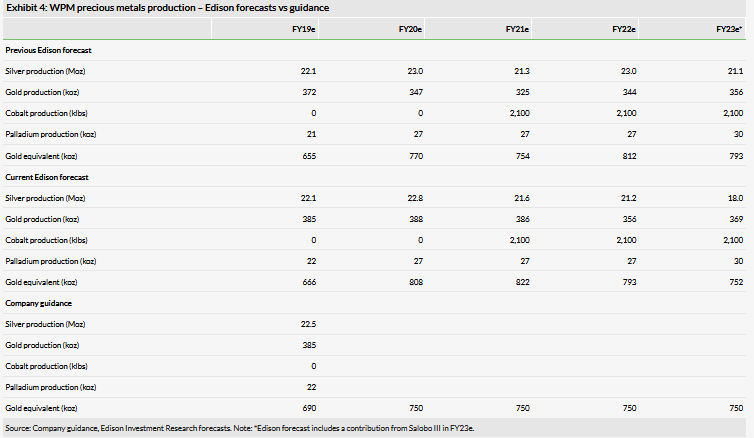

WPM has maintained its production guidance for FY19 of 690,000oz of gold equivalent, although it now estimates that this will be composed of 385,000oz of gold (cf 365,000oz previously), 22.5Moz of silver (cf 24.5Moz previously) and 22,000oz of palladium (unchanged). For the five-year period ending in FY23, the company continues to estimate that average annual gold equivalent production will amount to 750,000 ounces per year. This compares with Edison’s (updated) longer-term forecasts, as follows:

The major changes to Edison’s immediate gold production forecasts arise from alterations to assumed Salobo production over the period in order to align our assumptions more closely to Vale’s latest technical report. Otherwise, the major differences between Edison’s gold equivalent production forecasts and Wheaton’s may be explained by the ratio of the gold price to the silver price. Whereas Wheaton assumes an 81.3x ratio, which roughly approximates current conditions in the market, Edison assumes that the ratio will revert to closer to 57x from FY20 onwards, which roughly approximates its long-term average since 1971. In addition, Edison is also anticipating a production contribution from Salobo III in FY23. However, in the light of recent events (see ‘Rosemont’, below), it has removed any contribution from Rosemont until there is more clarity regarding the legal situation.

In the medium term, silver output from Penasquito attributable to WPM is expected to recover back to its steady-state level of 7Moz as the Chile Colorado pit contributes to mill feed and grades improve once again at the main Penasco pit with mine sequencing. It will also benefit from the development of the Pyrite Leach Project, which will add an additional 1.0–1.5Moz of silver attributable to WPM per year by recovering 48% of the silver that previously reported to tailings. Production of palladium and gold at that Stillwater mine is also anticipated to increase as the Blitz project ramps up to full capacity in FY21.

Longer-term outlook

Salobo

On 24 October 2018, Vale announced the approval of the Salobo III brownfields mine expansion, intended to increase processing capacity at Salobo from 24Mtpa to 36Mtpa, with start-up scheduled for H122 and an estimated ramp-up time of 15 months. According to its agreement with Vale, depending on the grade of the material processed, WPM will be required to make a payment to Vale in respect of this expansion, which WPM estimates will be in the range US$550–650m in FY23, in return for which it will be entitled to its full 75% attributable share of gold production. Note: this compares to its purchase of a 25% stream in August 2017 for an estimated consideration of US$820.8m (including renegotiated warrants and cost inflation terms) and the US$900m it paid in March 2015 (when the gold price averaged US$1,179/oz) for another 25% gold stream from Salobo (see our note, Silver Wheaton: Going for gold, published on 30 August 2016).

Potential future growth

WPM is ostensibly a precious metals streaming company (plus one cobalt stream). Considering only the silver component of its investible universe, WPM estimates the size of the potential market open to it to be the lower half of the cost curve of the 70% of global silver production of c 870Moz in FY17 that was produced as a by-product of either gold or base metal mines (ie approximately 305Moz pa silver vs WPM’s production of 28.5Moz Ag in FY17). Inevitably, WPM’s investible universe may be further refined by the requirement for the operations to be located in good mining jurisdictions, with relatively low political risk. Nevertheless, such figures serve to illustrate the fact that WPM’s marketplace is far from saturated or mature.

As a consequence, WPM reports that it is busy on the corporate development front. It has the potential for up to six deals with a value in the range US$100–300m, thus fully financeable via the c US$0.99bn available to WPM in cash and under its US$2bn revolving credit facility as at end-Q219.

While it is difficult, or impossible, to predict potential future stream acquisition targets with any degree of certainty, it is perhaps possible to highlight two that may be of interest to WPM in due course for which it already has strong, existing counterparty relationships:

the platinum group metal (PGM) by-product stream at Sudbury; and

the 50% of the gold output at Constancia that is currently not subject to any streaming arrangement.

Rosemont

One further, major project that had been moving closer to development is the Rosemont copper project in Arizona, after its operator, Hudbay, announced that it had received both a Section 404 Water Permit from the US Army Corps of Engineers and its Mine Plan of Operations (MPO) from the US Forest Service. The Section 404 permit regulates the discharge of fill material into waterways according to the Clean Water Act and was effectively the final material administrative step before the mine could be developed. Subsequently, Hudbay indicated it would seek board approval to commence construction work by the end of the year, which ‘should enable first production by the end of 2022’. In the meantime, it commenced an early works programme to run concurrently with financing activities (including a potential joint venture partner) for the remainder of the year.

On 31 July however, the US District Court for the District of Arizona issued a ruling in the lawsuits challenging the US Forest Service’s issuance of the Final Record of Decision effectively halting construction of the mine, saying that:

The US Forest Service ‘abdicated its duty to protect the Coronado National Forest’ when it failed to consider whether the mining company held valid unpatented mining claims; and

The Coronado Forest Service had ‘no factual basis to determine that Rosemont had valid unpatented mining claims’ on 2,447 acres and that the claims were invalid under the Mining Law of 1872.

In its reaction to the ruling, Hudbay said that it believed that the ruling was without precedent and that the court had misinterpreted federal mining laws and Forest Service regulations as they apply to Rosemont. It pointed out that the Forest Service issued its decision in 2017 after a ‘thorough process of ten years involving 17 co-operating agencies at various levels of government, 16 hearings, over 1,000 studies, and 245 days of public comment resulting in more than 36,000 comments’ and with a long list of studies that have examined the potential effects on the environment. Hudbay also pointed out that various agencies had accepted that the company could operate the mine in compliance with environmental laws. In conclusion, it said that it will appeal the ruling to the Ninth Circuit Court of Appeals. Nevertheless, in the light of the uncertainty about the timing and development of the project we have, for the moment, at least, removed it from all of our forecasts.

The proposed Rosemont development is located near a number of large porphyry-type producing copper mines and is expected to be one of the largest three copper mines in the US, with output of c 112,000t copper in concentrate per year and accounting for c 10% of total US copper production. Total by-product production of silver and gold attributable to WPM will be c 2.7Moz Ag pa and c 16,100oz Au pa and we estimate it could contribute an average c US$0.13 per share to WPM’s basic EPS in its first nine years of operations from FY22–30 for an upfront payment of US$230m (equivalent to US$0.52/share) in two instalments of US$50m and US$180m (of which neither has yet been paid).

Other matters

General and administrative expenses

WPM has forecast non-stock general and administrative expenses for FY19 in the range US$36–38m, or US$9.0–9.5m per quarter (vs a comparable forecast of US$34–36m, or US$8.5–9.0m per quarter, for FY18), including all employee-related expenses, charitable contributions, etc. Investors should note, however, that stock-based compensation costs are excluded from our financial forecasts in Exhibits 5 and 8 owing to their inherently unpredictable nature.

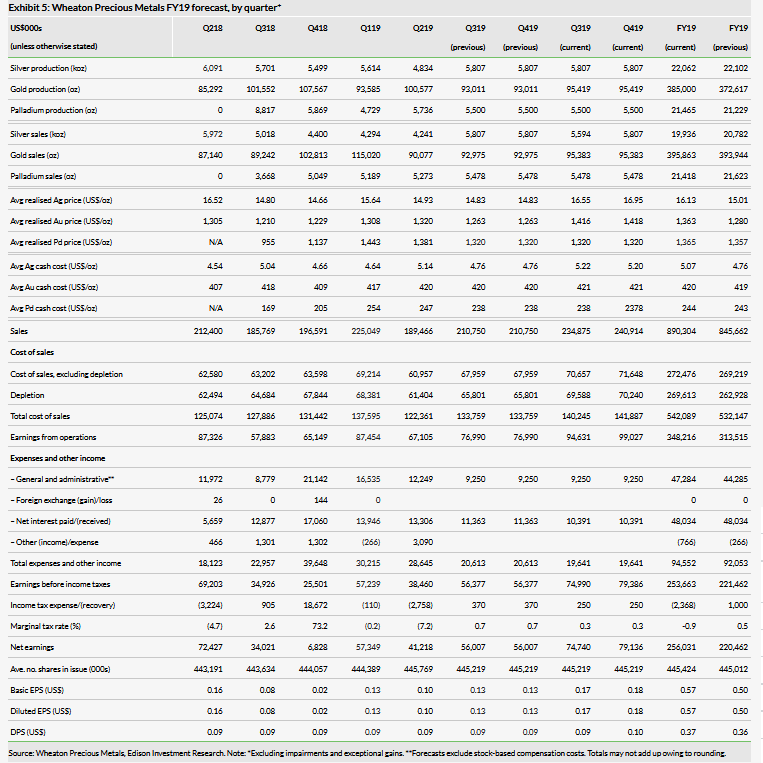

FY19 by quarter

Taking into account the aforementioned considerations, plus the improved precious metal pricing environment so far in H219, our updated forecasts for WPM for FY19, by quarter, are now as follows:

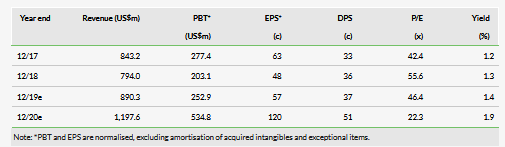

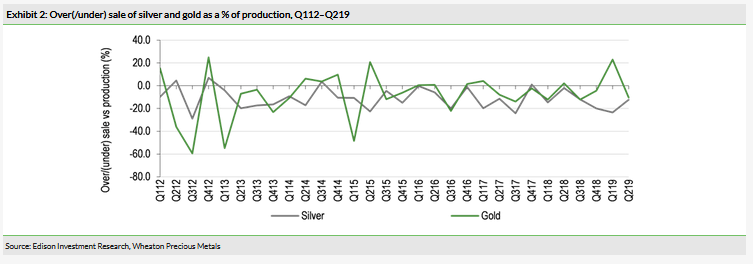

Our basic EPS forecast of US$0.57/share (vs US$0.50/share previously) for FY19 compares with a consensus forecast of US$0.53/share (source: Refinitiv, 16 August 2019), within a range of US$0.49–0.64 per share. Note however that, within the context of current spot prices, our forecasts for the gold price for Q3 and Q4 are relatively conservative. Should gold, in particular, remain at current levels, we estimate that WPM would instead report US$0.60 in EPS.

Our US$1.20 basic EPS forecast for FY20 (see Exhibit 8) compares with a consensus of US$0.70 (source: Refinitiv, 16 August), within an erstwhile range of US$0.52–1.17. This estimate is predicated on an average gold price during the year of US$1,482/oz (which we have maintained consistently since November 2017) and an average silver price of US$25.95/oz, which, in the latter case, is 53.1% above the current spot price. One of the central assumptions behind our silver price forecast is that it will, at some point, revert to the long-term correlation that it has exhibited with gold since the latter was demonetised in 1971. In the event that it remains at current levels instead (US$16.95/oz at the time of writing), we forecast that WPM would instead earn US$0.76 per share in FY20.

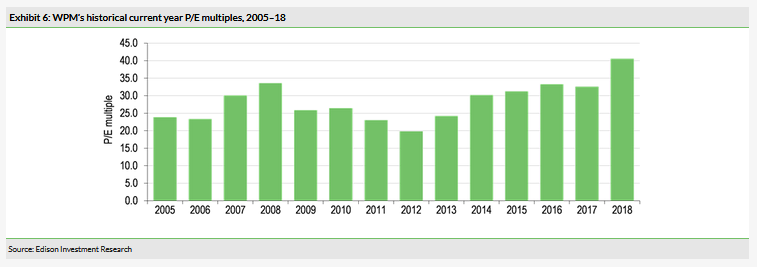

Valuation

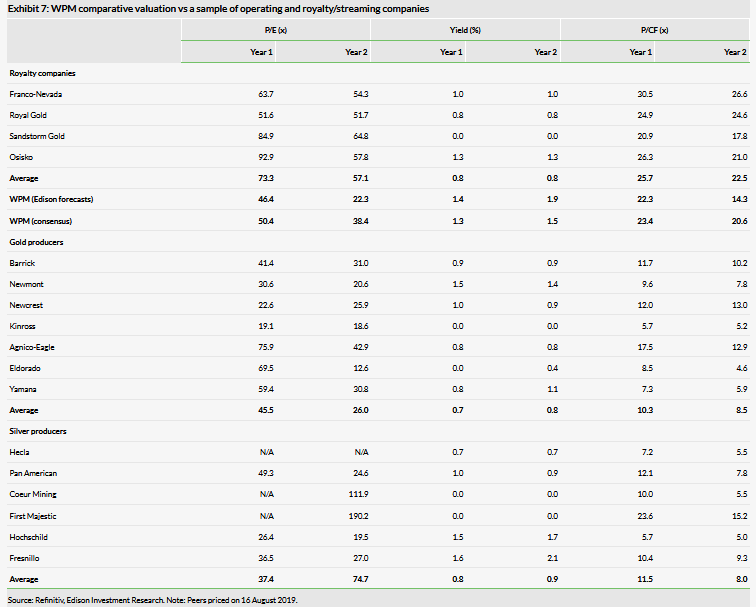

Excluding FY04 (part-year), WPM’s shares have historically traded on an average P/E multiple of 28.5x current year basic underlying EPS, excluding impairments (vs 46.4x Edison or 50.4x Refinitiv consensus FY19e, currently – see Exhibit 7).

Applying this 28.5x multiple to our updated EPS forecast of US$1.20 in FY20 (vs US$1.17 previously) implies a potential value per share for WPM of US$34.11, or C$45.37 in that year (vs US$33.41, or C$45.03 previously). Note that this valuation excludes the value of 20.9m shares in First Majestic currently held by WPM, with an immediate value, 9 August, of C$285.9m (cf C$165.9m previously), or US$0.48 per WPM share (cf US$0.28 previously).

In the meantime, from a relative perspective, it is notable that WPM is cheaper than its royalty/streaming ‘peers’ in at least 91% (22 out of 24) of the valuation measures used in Exhibit 7 and on multiples that are cheaper even than the miners themselves in at least 41% (32 out of 78), but perhaps as many as 51% (if Edison forecasts are used), of the same valuation measures, despite being associated with materially less operational and cost risk (since WPM’s costs are contractually predetermined).

Financials: Solid equity base

As at 30 June 2019, WPM had US$87.2m in cash and US$1,100.0m of debt outstanding, 99.6% of which is under its US$2bn revolving credit facility (which attracts an interest rate of Libor plus 120–220bp and matures in February 2024), such that it had net debt of US$1,012.8m overall, after US$107.4m (US$0.24/share) of pre-financing cash inflows during the quarter. Relative to the company’s Q1 balance sheet equity of US$5,111.9m, this level of net debt equates to a financial gearing (net debt/equity) ratio of 19.8% and a leverage (net debt/[net debt+equity]) ratio of 16.5%. It also compares with a net debt position of US$1,057.7m as at end-March, US$1,188.2m as at end-December and US$1,261.1m as at end-September 2018. Self-evidently, such a level of debt is well within the tolerances required by its banking covenants that:

net debt should be no more than 0.75x tangible net worth; and

interest should be no less than 3x covered by EBITDA (we estimate that it will be covered 11.9x in FY19).

All other things being equal and subject to it making no further major acquisitions (which is unlikely in our view), on our current cash flow projections WPM will be net debt free late in FY20.