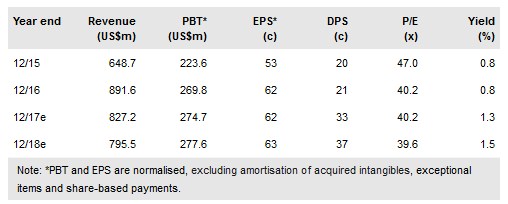

On 12 January, First Majestic Silver Corp (TO:FR) (FR, C$8.65) announced that it is to buy Primero Mining (the operator of the San Dimas mine, over which WPM holds a silver stream). As a result, the existing silver purchase agreement covering 100% (effectively) of the silver produced by the mine will be replaced by one covering 25% of gold production plus an additional amount of gold equal to 25% of silver production converted into gold at a fixed gold:silver ratio of 70:1. This has caused us to revise our FY18 EPS forecast from 67c to 63c on a like-for-like basis (vs a consensus of 64.5c, within a range 49-80c). In lieu of this, First Majestic will also issue to WPM 20.9m FR common shares with an aggregate value at the time of writing of US$145m (equivalent to US$0.33 per WPM share).

WPM to become majority gold streaming

For each ounce of gold delivered, Wheaton will pay a production payment equal to the lesser of US$600/oz (subject to a 1% annual inflationary adjustment) and the prevailing market price. Discounted at Edison’s standard 10% discount rate for mining companies, we value the cash flows to WPM from San Dimas for the period FY18-33 at US$252.9, or US$0.57 per WPM share, on the basis of Edison’s long-term gold price assumptions. On the basis of the current spot price of gold (US$1,320/oz at the time of writing), we value them at US$238.7m, or US$0.54 per WPM share. As a result of the conversion of the stream from a silver one to (effectively) a gold one, we expect WPM to become a majority gold streaming company from the date of the conclusion of the FR-PMO transaction (albeit there will inevitably be some quarterly fluctuations depending upon the balance of production, sales etc).

To read the entire report Please click on the pdf File Below: