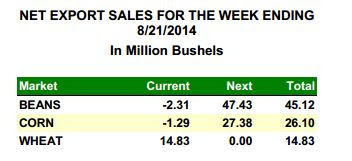

US Wheat is lower by 25% in the last five months consolidating in a 40 cent range over the last six weeks. Like a coiled spring the longer prices remain constrained in this tight range the larger the breakout I anticipate. Thursday marked the first trade above the 50-day MA (dark blue line) in the last four months. Volumes have consistently been around 50-60,000 contracts per day on the December contract throughout the month of August, with open interest swelling to near 250,000.

At this post, wheat futures have appreciated 1.7% Thursday largely due to tensions escalating between Ukraine and Russia, causing speculation that instability in the region could prompt buyers to seek US supplies of grain. Wheat was bid overnight on reports that Ukraine had accused Russia of invading the country, seizing parts of the border and supplying supplies to rebels in the area. Both Russia and Ukraine are large grain exporters and the perceived instability diminishes hopes of a peace deal and in turn could influence supplies being shipped from these regions. Fund short covering also likely contributed to the recent jump. While this move higher may have legs in the short run, I do not see the geopolitical headline risk changing the fundamental picture, so do not expect more than a bounce. That said, I am not ruling out a move to the 38.2% Fibonacci level, which stands just above $6.25 and represents approximately a $2500 per contract.