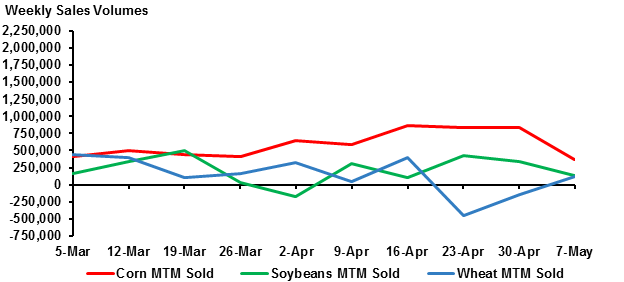

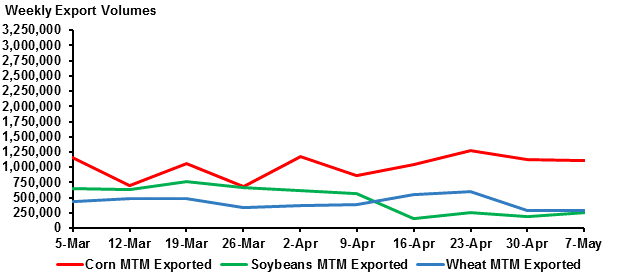

Wheat sales reported in the black this week after two consecutive weeks of reductions due to cheap prices and a lower US dollar. Corn sales decreased to a marketing-year low and soybeans sales decreased as well. Exports were more positive, soybeans and wheat both reported increases, while corn reported a slight decrease.

The USDA World Agricultural Supply and Demand Estimates (WASDE) report was released this week and production expectations are high for domestic soybeans due to the record number of planted soybean acres and good planting weather. Soybean prices declined following the report as global stocks and production remain high, which if all holds true, could trigger a fourth consecutive bumper crop for soybeans.

Weekly net corn sales were 370,000 metric tons (MT), a 56% decrease from last week and a 42% decrease from the prior 10-week average. Increases were reported from Japan, Saudi Arabia, Mexico, Colombia and Taiwan. Decreases were reported from unknown destinations, Iran, South Korea and Jamaica. Exports were 1,109,300 MT, a 2% decrease from last week, but a 6% increase from the prior 10-week average. The primary destinations were Japan, Mexico, South Korea and Colombia.

Weekly net soybean sales were 136,600 MT, a 60% decrease from last week and a 38% decrease from the prior 10-week average. Increases were reported from Mexico, the Netherlands, and unknown destinations. Decreases were reported from China, Japan and Pakistan. Exports were 250,200 MT, a 34% increase from last week, but a 53% decrease from the prior 10-week average. Primary destinations were Mexico, Pakistan, Japan and Colombia.

Weekly net wheat sales were 115,400 MT, increasing from two consecutive weeks of sales reductions. Increases were reported from Nigeria, Japan, Panama and Venezuela. Decreases were reported from unknown destinations, Mexico, Belize, Barbados and the Leeward and Windward Islands. Exports were 297,500 MT, a 4% increase from last week, but a 33% decrease from the prior 10-week average. Primary destinations were Nigeria, Japan, Mexico, Taiwan and Italy.

Source: USDA Foreign Agricultural Service

Source: USDA Foreign Agricultural Service

The data for the report was taken from the May 14, 2015 USDA Export Sales report for the week ending May 7, 2015. The information reported is an aggregate of sales and exports data reported to the USDA Foreign Agriculture Service.

- Colvin