Investing.com’s stocks of the week

Unseasonably cool and wet spring will result in millions of acres of unplanted corn and wheat in the United States. Corn and wheat are global commodities, so poor growing conditions in one region of the world doesn't mean supply disruptions are guaranteed. The dollar is rallying. So unless you listening to the talking heads telling us the dollar ready to collapse despite a solid uptrend, it's far more productive to listen to the invisible hand than chatter.

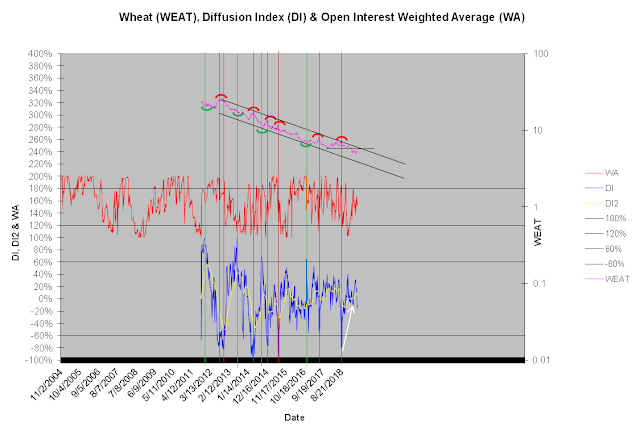

The invisible hand is saying neither "buy, buy, buy" or "sell, sell, sell" but rather consolidation. Wheat's DI is neutral with a negative bias despite the report that wheat is going to the moon. If it is, it's going to need energy, and we're not seeing that. No way disciplined traders buy without double or triple upside alignment. Talking heads can talk about tail risk and potential supply disruptions, but I'll listen to the message of the market.