Wheat: Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

Tired of following experts or 'gurus' that consistently provide after-the-fact and non-actionable interpretations? Follow the message of the market instead. Markets are either focused bull or bear opportunities, or consolidation/profit-taking (CP) against them.

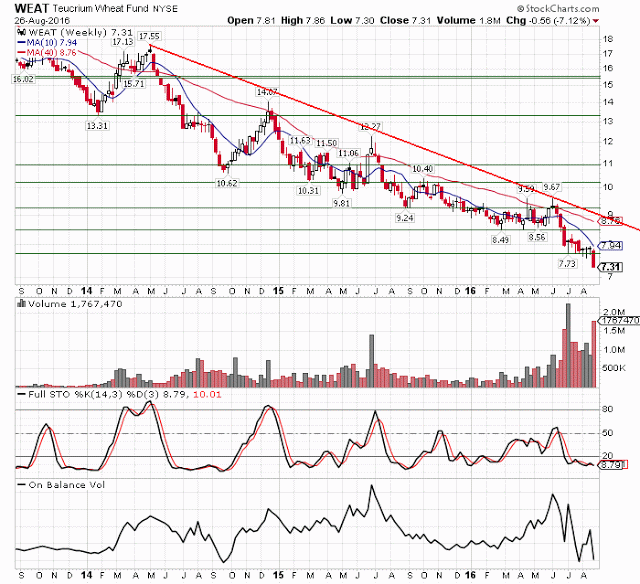

The wheat's focused bear opp has produced an impressive 117% annualized return for the bears since the first week of July (see COT Matrix 07/05/16). This opp recorded 97% after the fourth week of July. Disciplined bears that booked partial profits and reduced risk in July and August are letting their profits run.

COT Matrix 07/05/16

A weekly close above resistance from 7.73 pauses the down impulse and favors at least a retest of the June of previous support from 8.49 to 8.56.

On Balance Volume, a crude measure of trend energy, indicates distribution. This favors the bears.