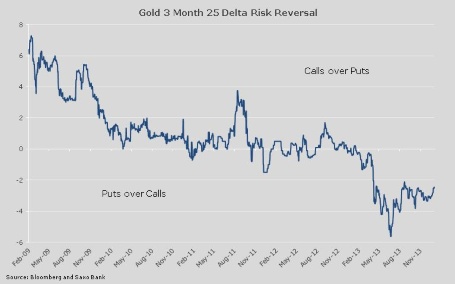

The risk reversal (RR) in options markets is defined as the implied volatility for call options minus the implied volatility for put options, both with the same delta. In this, we take a look at the development of the 25-delta risk reversals with a three-month maturity. Given the above, a positive value indicate calls being more expensive than puts (upside protection on the underlying gold spot is relatively more expensive), while negative values indicate puts are more expensive than calls (downside protection is relatively more expensive).

A significant change in the price of the risk reversal is often used to help determine whether a change in market expectations for the future direction in the underlying market has begun to unfold.

Following a long period of positive value during the bull market, the RR turned negative in early 2013 as the price outlook for gold began to deteriorate. When the panic peaked back in late June, the cost of buying puts over calls rose to a high of 5.6 percent. Since then, it has stabilised within a 2-4 percent range.

The recent revisit to the June lows has not been accompanied by a renewed interest for protection which indicates much-reduced nervousness in the market. When that is said, the market is clearly still mostly worried about additional weakness over the coming months and I will be looking for a move at back below two percent before the options market also begin to price in and looking for a potential recovery.

By Ole Hansen

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

What’s ‘Risk Reversal' Saying About Gold?

Published 01/07/2014, 10:54 AM

Updated 07/09/2023, 06:31 AM

What’s ‘Risk Reversal' Saying About Gold?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.