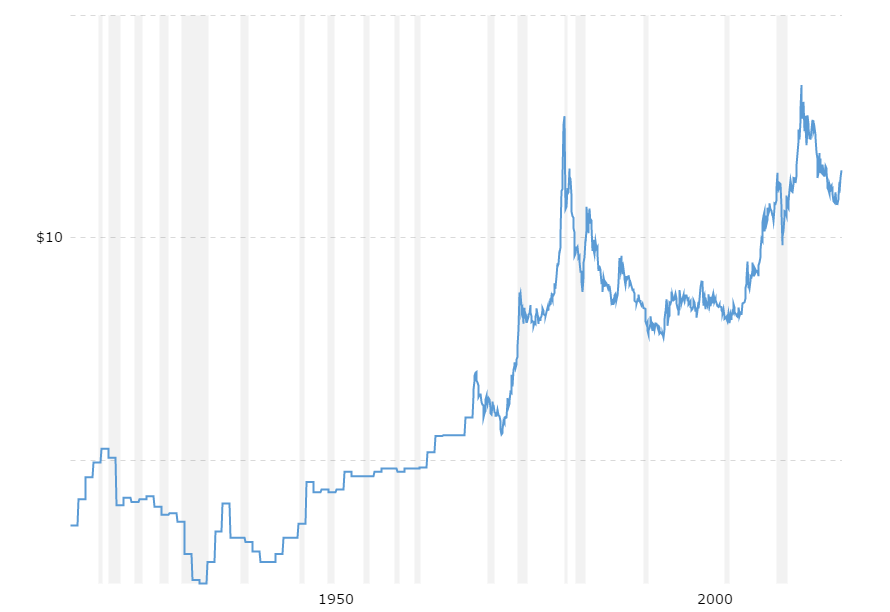

Historically, silver has largely been regarded as a safe haven in times of turmoil and unrest and an effective hedge against the effects of inflation. However, despite some significant turmoil within world financial markets there has been only a negligible impact on the precious metals prices which has seen it rally from the $15.86 an ounce mark to trade just above the $20.00 handle.

Subsequently, given the ongoing easing around the world and the linkage between expansion in the money supply and inflation, it is surprising that we are not seeing sharply higher silver prices.

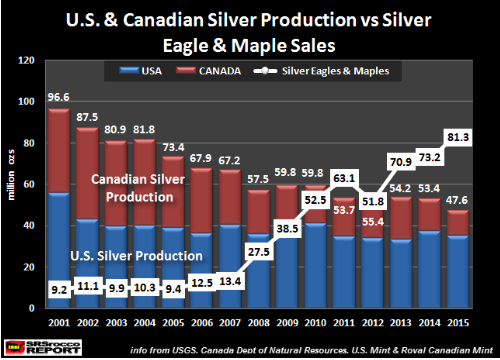

Firstly, it’s important to note that silver prices have been on the rise when you consider prices for the physical metal. In fact, demand for the actual metal has skyrocketed and has clearly been outstripping supply over the past few years.

Subsequently, in many cases consumers have been facing delays or difficulty in obtaining reasonable quantities of tradable silver bullion. However, this level of increased demand has seemingly been unable to flow into the silver derivative market

The reality is that there is little likelihood that you will see the divide between the physical and derivative markets narrow anytime soon. In particular, the COMEX market for silver derivatives is anything but fair with the big banks issuing silver derivatives at will in an attempt to keep the price below their bulwark around the 50DMA line at $20.50.

What has largely become known as the “Waterfall” effect, involves the larger financial institutions floating as much paper as needed to ensure a depressed market and some sharp declines in prices.

This is readily apparent when you realise that the inventory of physical metals within the COMEX vault available for delivery has been declining rapidly over the past few months which also coincides with a sharp rise in the amount of silver derivatives flying around.

In fact, JP Morgan has been one of the largest issuers of paper on the silver market and many of us are left questioning just how much of that silver is actually available for delivery in “physical” form.

Non-Inflation Adjusted Historical Silver Prices

In addition, there has also been a historic connection between the M2 Money Supply figures and the gold and silver price. However, since late 2012 there has been a supposed “uncoupling” of these figures which some analysts point to as evidence that the relevance of precious metals are waning in the modern world.

However, they miss the linkage between inflation and silver and the fact that the former has largely been absent in recent years (at least persistent inflation). Subsequently, the assertion that the relationship between the money supply and precious metals prices no longer exists is intellectually dishonest at best.

Ultimately, silver will need to move to a significantly higher valuation to match not only the increase in physical demand for the commodity but also the expansion in the underlying US money supply.

It’s clear that the large financial institutions will resist this move by attempting to oversupply the market with additional derivatives but this must reach a tipping point at some stage. When that happens, watch out because silver prices will roar and may very well catch many of these institutions asleep at the switch.