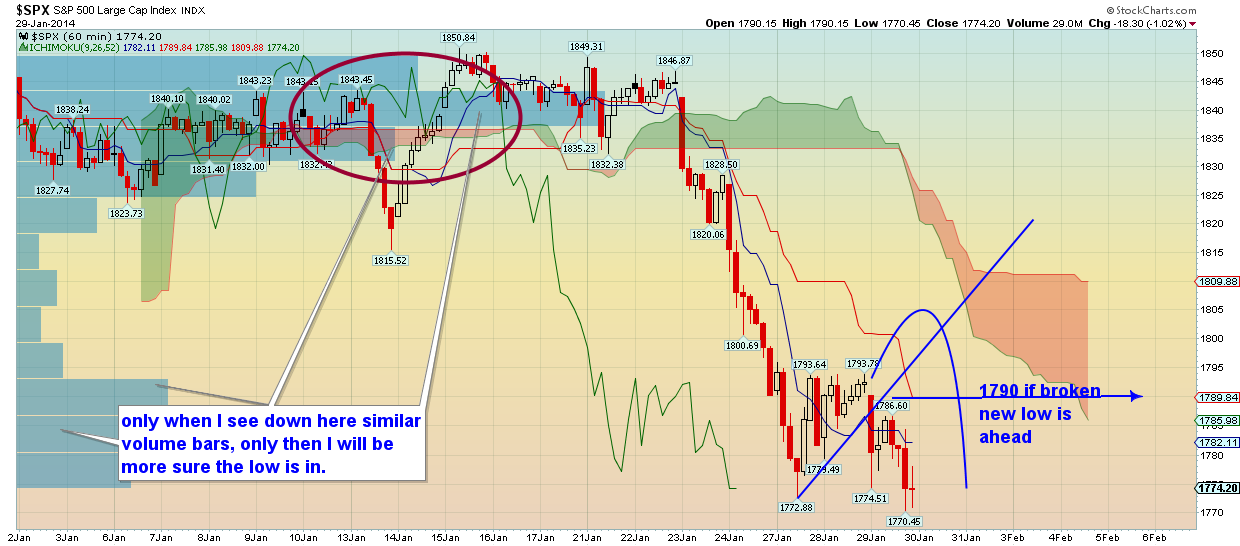

Yesterday we noted that if we saw the index below 1790 we should anticipate a new lower low. The market did not disappoint and made a new lower low that we think may be a short-term bottom. 1770 is important technical support that if broken could push the index toward 1758-63 price zone.

The volume traded in this price area around 1770 is not big enough to label this low as a longer-term bottom. A bounce toward 1810-15 is justified since we are short-term oversold; but I believe the larger downward move that started from 1850 is not over.

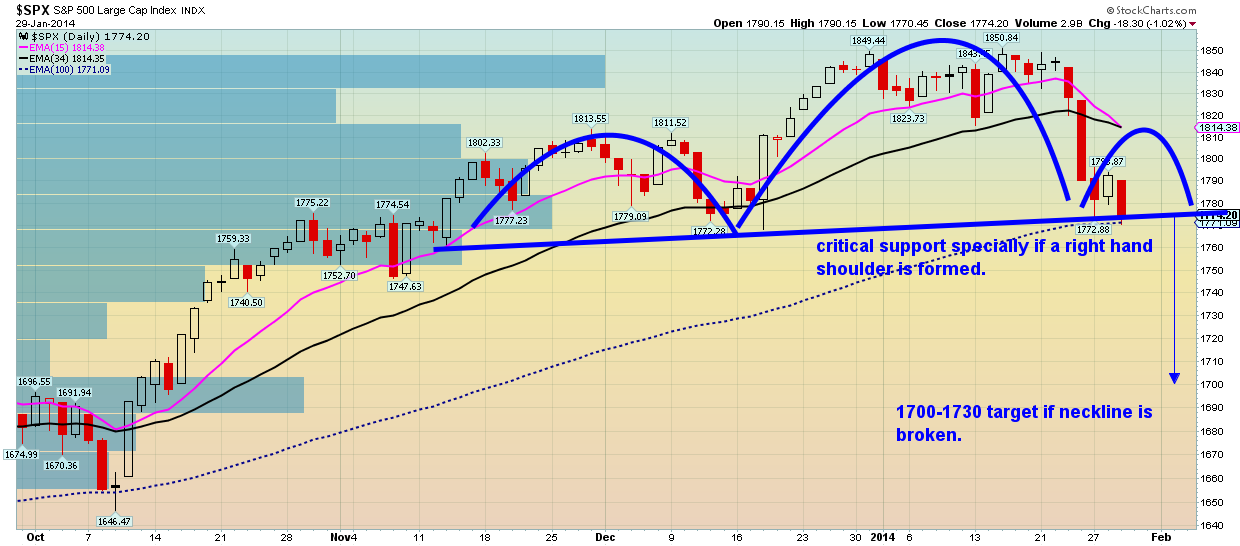

As shown in the chart above, the volume bars near the highs is a worrying signal for the longer-term bullish trend. My expectations are to see a bounce in order to complete the right-hand shoulder and then test the neckline at 1770. The slope and form of the current decline point to more downside potential after a small upward bounce. However with Emerging-markets volatility, I cannot rule out the immediate bearish scenario that pushes the index right now toward 1750-60. This scenario will come true if bulls are unable to break above 1784-90 and if support at 1770-68 fails.

As always, thank you for taking the time to read my new post.