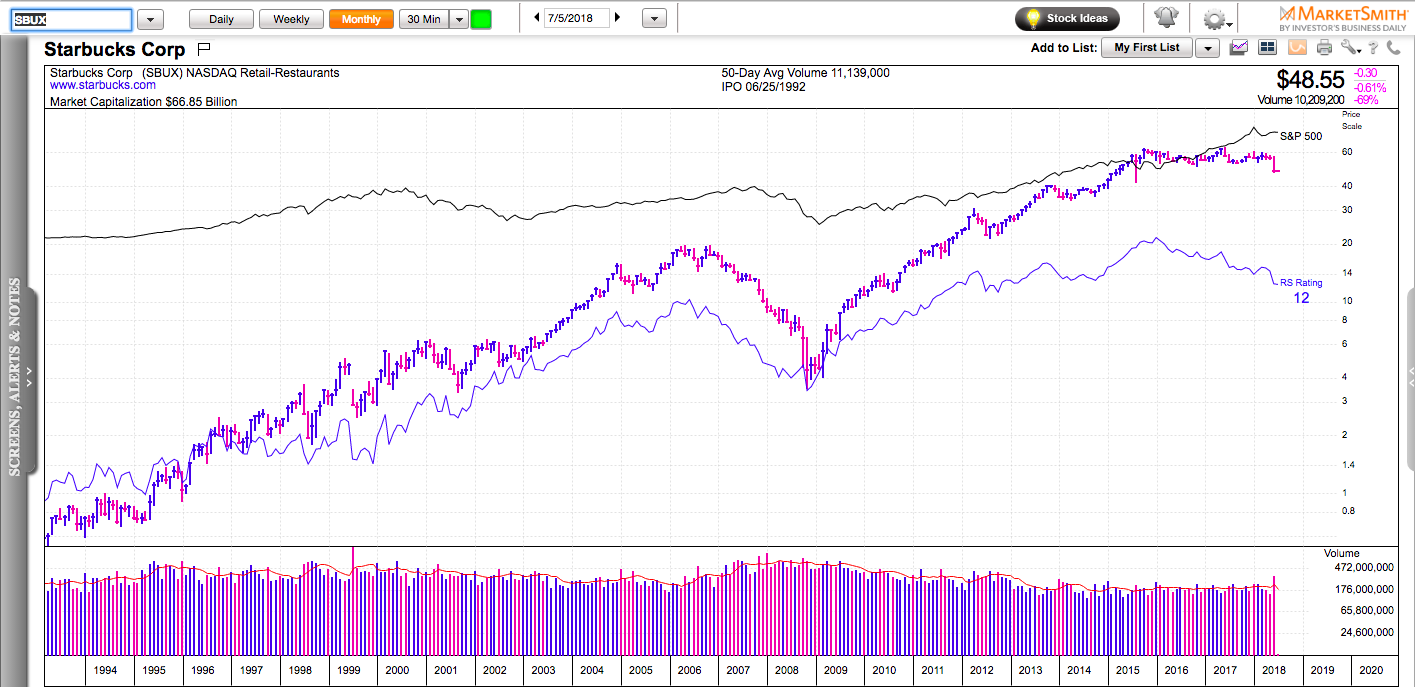

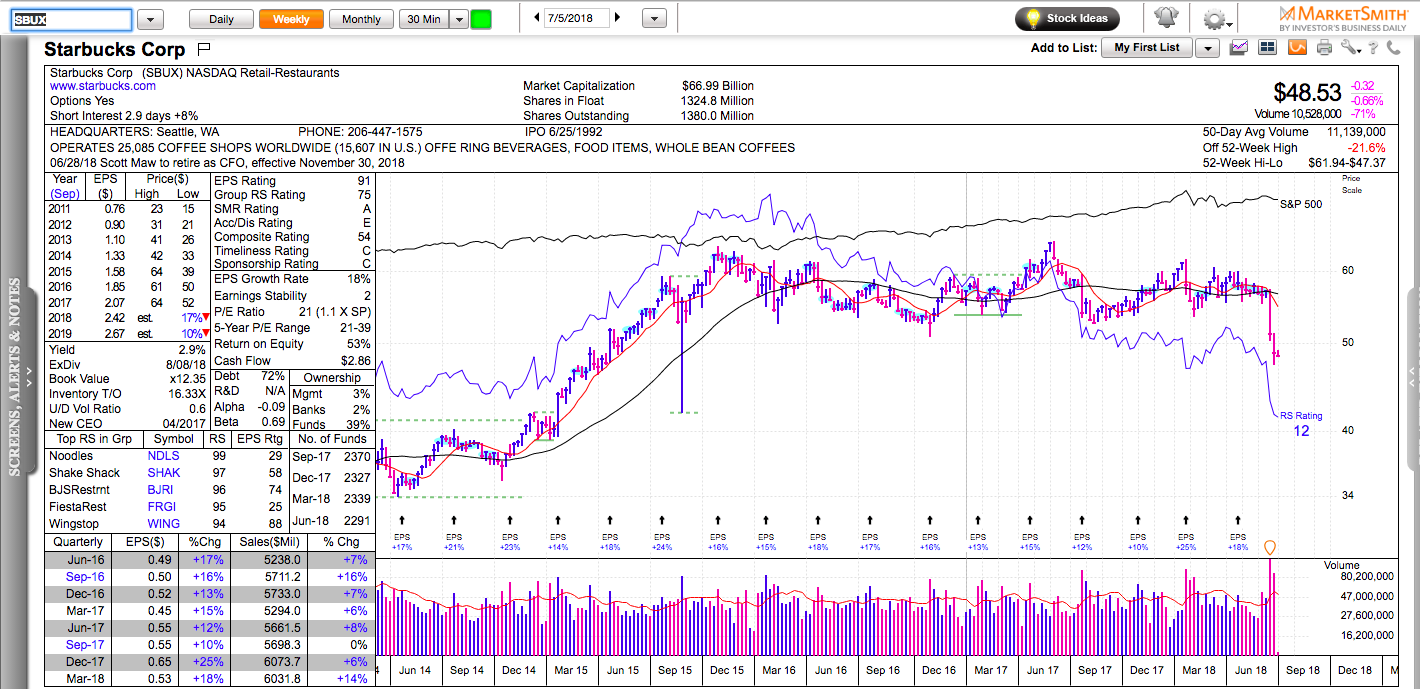

Stock and ETF charts in this post are powered by MarketSmith.

Starbucks (NASDAQ:SBUX) has tripled its earnings since 2011 and yet its stock is trading near 3-year lows. It has underperformed 88% of all stocks and ETFs in the past year. What’s wrong with it?

Last week, Starbucks announced that it will close 150 of its underperforming stores in heavily penetrated areas. The next day, SBUX gapped down and it has been in a falling mode ever since.

150 is a drop in a bucket. Starbucks has more than 27,000 stores worldwide and it regularly closes about 50 a year. Then why the fierce market reaction?

There are two major ways a profitable company’s stock can appreciate:

a) Earnings growth

b) Multiple expansion – when the market is willing to pay a higher multiple for a company’s earnings. And by multiple, obviously, I mean P/E or a Price to Earnings ratio.

P/E reflects the market’s expectations about the near-term future of a company. SBUX is currently trading with a P/E of 21, which is its lowest multiple in the past 5 years.

The market is forward-looking and apparently, it has lost faith in the ability of Starbuck’s management to continue to grow at the same pace.

This is not an actionable post. I imagine a pullback near $40 will attract the attention of many value-oriented dip buyers because Starbucks is still a cash-printing machine and one of the most recognized brands around the world. They will probably figure out a way to jump on the current taste trend and offer better variety and organic options. They certainly have the money to acquire chains that are excelling in those attributes.

Buying on weakness is not my cup of coffee. I rather buy stocks that break out to new 52-week highs from solid bases. Risk management is a lot easier when I trade in the direction of the trend.