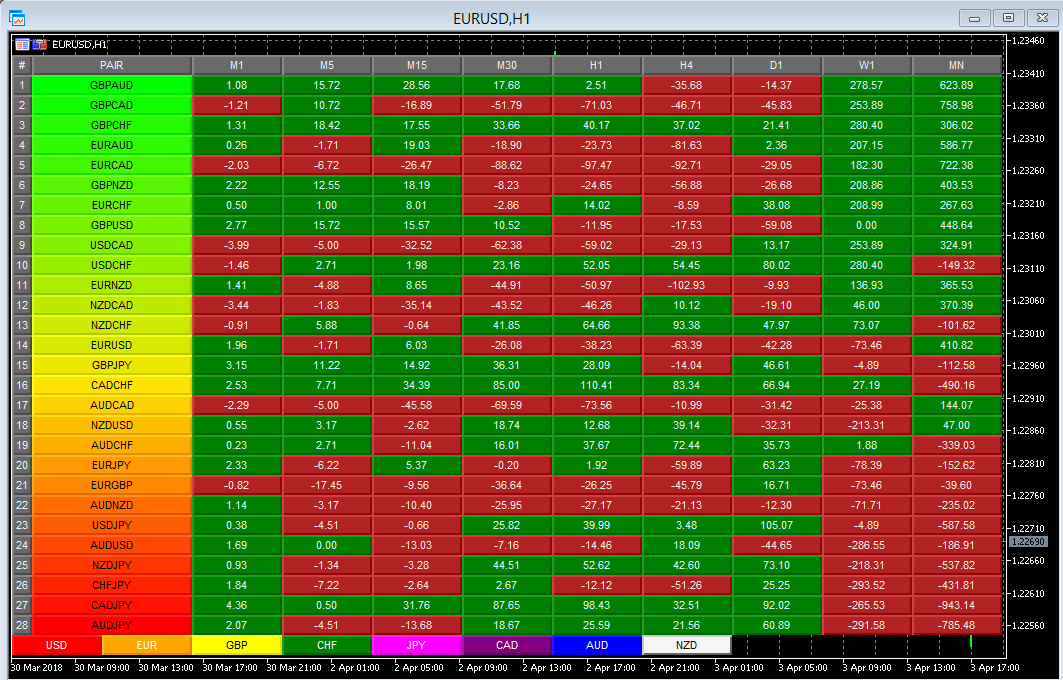

It never ceases to amaze me the extent to which markets can stay overbought and oversold, which is one of the reasons why David and I decided to develop the Quantum heat map indicator for MT4 and now for MT5. This indicator not only allows us to rank our 28 currency pairs in terms of their strength and weakness, but it also does this across multiple time frames. This means we can now quickly determine market sentiment toward an individual currency and also determine the performance of that currency against its peers so helping to identify those pairs that are likely to provide the best trading opportunity.

Two FX Standouts

And looking at the heatmap at the start of this fresh trading month and start of the new quarter, two currencies really stand out and feature both at the top and the bottom of the indicator, namely the Australian and the Canadian dollar. And as we can see on the heatmap, we have weakness for both these currencies against the Japanese yen, and at the top of the heat map they are both very weak against the British pound (GBP/AUD, GBP/CAD).

As I mentioned earlier, markets and currencies can stay overbought and oversold for very long periods of time, but at some point they are going to turn. It’s not a question of if they are going to turn, only a question of when. So when we see a particular currency and currency pair at such extremes, it’s really highlighting that it may be time to look at the charts to see if a trading opportunity is on the horizon, and that's what we're looking at today, particularly for AUD/JPY and GBP/AUD.

AUD/JPY

For the AUD/JPY, it is the daily timeframe that is now developing an interesting phase of price action from a technical perspective, with the floor of support building steadily in the 80.48 area. Above this a ceiling of resistance is also developing in the 82.00 region, which has been tested on several occasions over the last few days, but should this be breached, and in particular the strong resistance line at the 82.56 price point as shown on the MT5 support and resistance indicator, the move through here then opens up further bullish potential to test the next level at 84.22. Much of course will depend on two things. First, a recovery in US equities, and second the number of tweets from the White House, which are increasingly dictating intraday price action and self evident with repeated two-bar reversals in this area, with any move also higher supported by strong and rising volume.

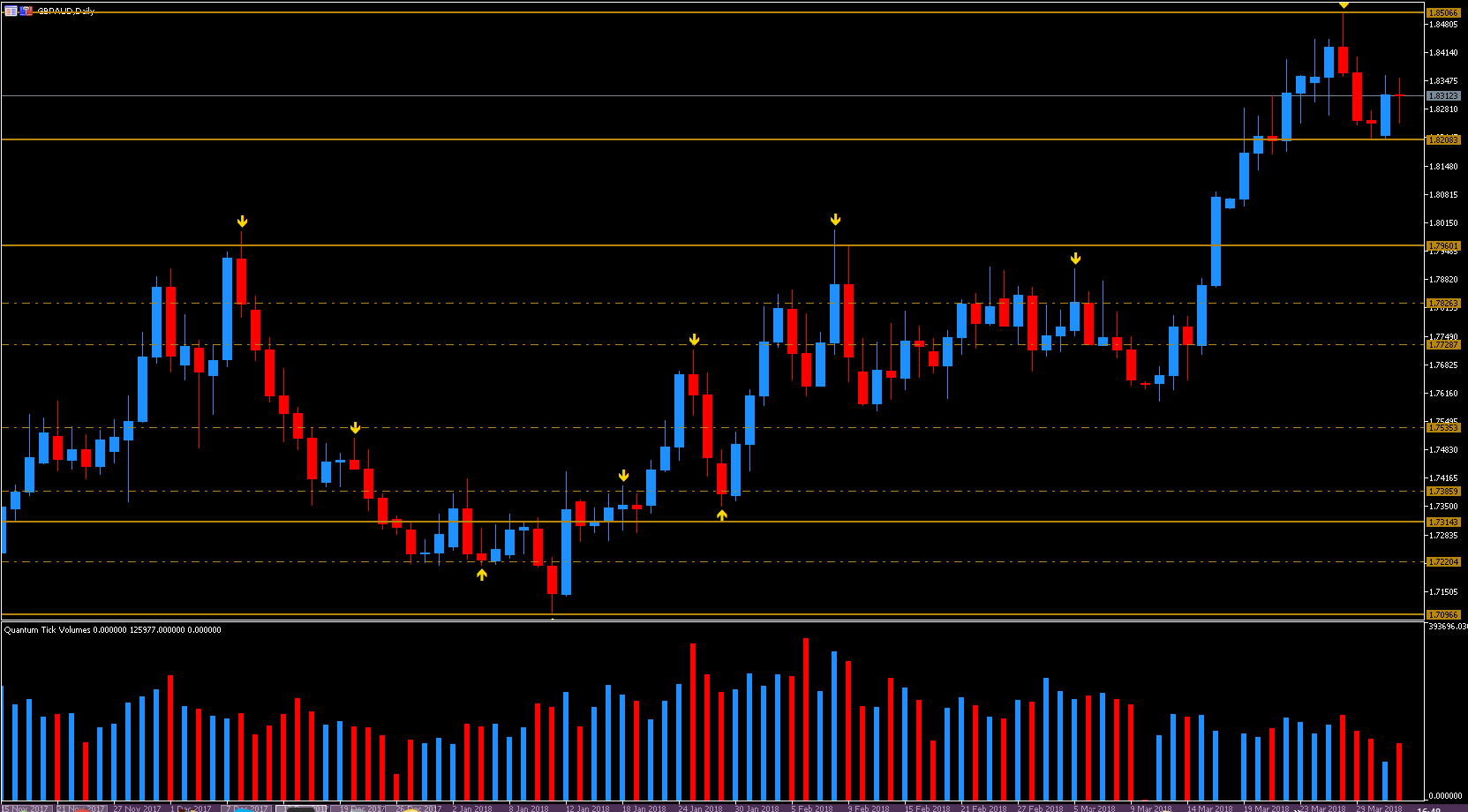

GBP/AUD

Moving to the daily chart for the GBP/AUD, this is perhaps more clear-cut with the steady decline in bullish volumes in a rising market telling its own story. Indeed in the last week we have seen the 1.85066 level tested, which held firm with a platform of support now established in the 1.8208 area. But if this is breached, this will likely create a deeper move toward the further well-defined area of potential support around 1.17960.