So, what do you think will happen from here with bitcoin?

We’ve already seen a massive crash and the cryptocurrency seems stuck around the $8,000 mark, after reaching $6,630 recently.

But I don’t think this crash is done. I expect we’ll see bitcoin ultimately lose well over 90% of its value before rallying again longer term.

Then it’ll be the buy of the century, just like the internet stocks were in late 2002 after a similar, dramatic 16-month bubble and then a 93% crash.

I know this because I’ve studied ALL the great bubbles throughout modern history.

The first was the Dutch Tulip bubble in 1636. It was based on the first futures markets in agriculture, and tulips were the glory hound.

Stocks emerged with the first trading company, the East India Company in England, which started trading publicly in 1612. It wasn’t long before the South Seas Company emerged and became the first great stock bubble in history (1711 to 1720).

And there was the Mississippi Land Company in France, which fueled a greater bubble because it was powered by the first central bank. The bank was John Law’s solution to paying off the huge debts from wars with England. Basically, France offered low-cost financing from the government for “swamp land” in America.

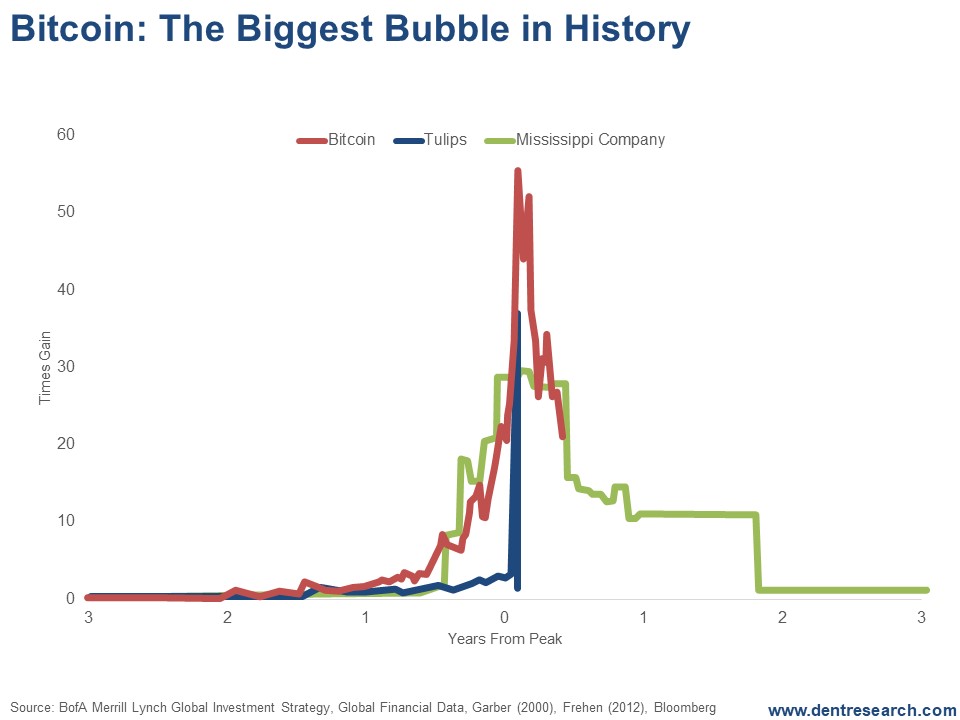

There have been many major bubbles in history. This chart below shows the most B.S., and hence the most extreme, ones.

As you can see, bitcoin is the biggest of the lot!

The 1920s bubble in the U.S., the 1980s bubble in Japan, the 1990s bubble in tech stocks and even the gold bubble into 2011 were based on strong fundamental trends that were exaggerated by investors’ “animal spirits.”

But the Tulip, South Seas, Mississippi and now bitcoin bubbles were ALL largely just B.S. They had little by way of fundamentals backing them. That’s what made them the most extreme in history.

At its peak, the bitcoin and cryptocurrencies bubble surpassed even the infamous tulip bubble.

Interestingly, the bitcoin bubble seems to be following the same path as the Mississippi Bubble. In the former, investors clambered after shares in unseen American swamp land. In the latter, investors are buying unseen bits and bytes up in droves!