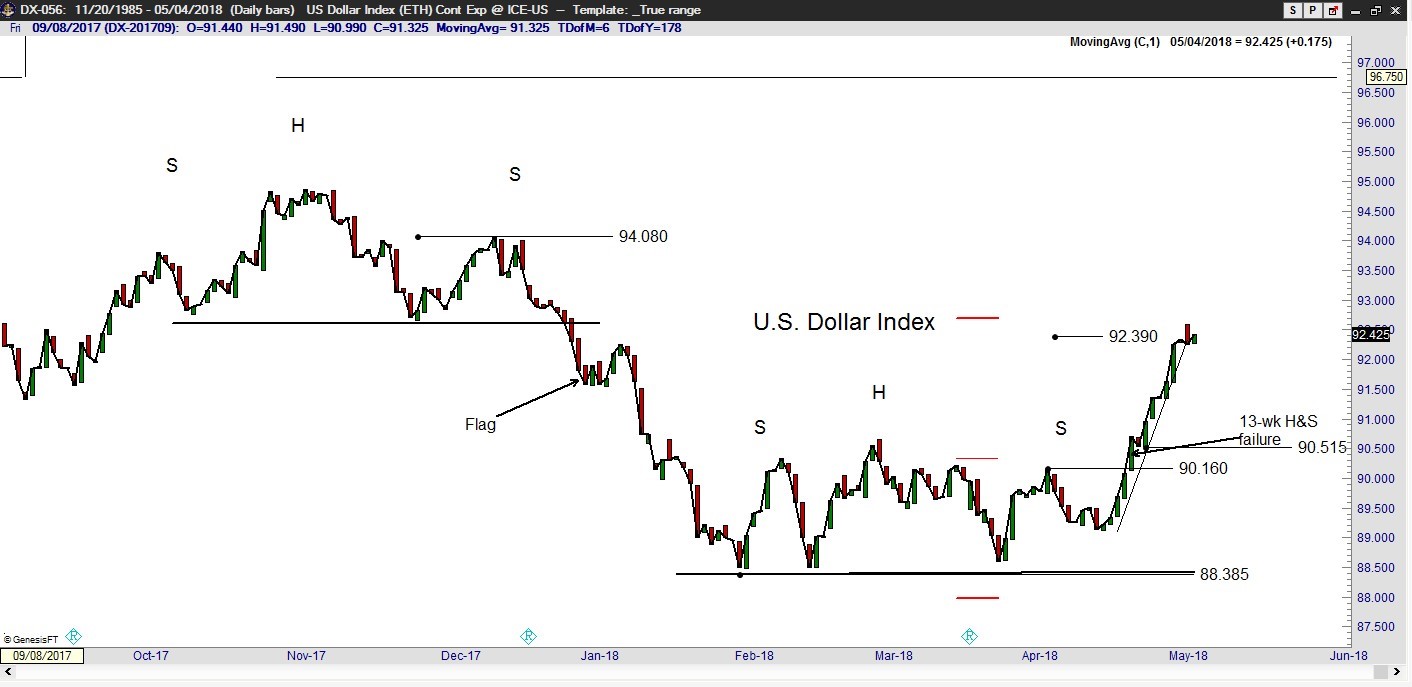

U.S. Dollar Index

The advance this past week exceeded the upside price target of 92.38 and I exited my long position. I will monitor this market for a possible continuation pattern. I believe the U.S. Dollar Index will continue to trend higher. Factor is flat.

Aussie Dollar

The dominant chart construction is the completed 28-month channel on the weekly chart. The general targeting rule for a channel breakdown is that prices will travel a distance equal to the width of the channel (see red parallel lines). The channel is a diagonal pattern – and thus is more difficult to trade than a horizontal pattern. The Factor Tracking Account is short AUD/USD.

USD/TRY (Turkish Lira)

The dominant chart construction is the completed 14-month Cup and Handle pattern. Factor is long. I tightened my stop late last week and fully expected to be stopped out. The protective stop survived Monday’s dip and the rally on Tuesday completed a 2-week pennant.