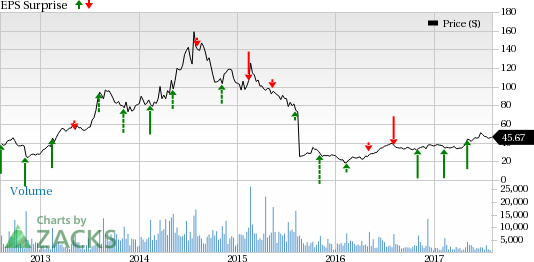

Zillow Group, Inc. (NASDAQ:ZG) is set to report second-quarter 2017 results on Aug 8. The company has beaten the Zack Consensus Estimate thrice and missed it once, delivering an average positive surprise of 35.73%.

Last quarter, the company reported a loss of 3 cents per share, narrower than the Zacks Consensus Estimate of a loss of 10 cents. Revenues increased 32% year over year to $245.8 million and beat the Zacks Consensus Estimate of $236 million. The improved result reflects its growing clout in the Premier Agent and Rentals marketplaces.

Following strong first-quarter results, the company raised its guidance for 2017. Revenues are anticipated to be in the range of $1.05-$1.07 billion, up from the prior guidance of $1.03-$1.05 billion.

Notably, Zillow’s shares have gained 25.3% year to date, significantly outperforming the industry’s 19.5% rally.

Let's see how things are shaping up for this announcement.

Factors at Play

Zillow’s increased advertising effectiveness, continuous product innovation and effective free marketing channels are helping it to gain audience. The growing Premier Agent and Rentals business is a positive for the company’s top-line growth. The Premier Agent business grew 30% year over year in the first quarter. Zillow Group brands' mobile apps and websites also witnessed a 7% year-over-year increase in traffic in the same period.

Zillow has more than 580 Multiple Listing Services (MLS) around the country, having added about 20 new MLS in the second quarter. The continuous growth in new MLS partnerships is enabling the company to deliver high quality listing information to home buyers and sellers. Partnership with REcolorado and MetroList, the largest MLS in Colorado and Northern California, respectively shows Zillow’s growing command in the market.

Moreover, in May 2017, the company launched its consumer real estate brand “RealEstate.com”, which we believe will enhance its audience base further.

However, competitive landscape, increasing mortgage interest rates and advertising spend remain headwinds.

Earnings Whispers

Our proven model does not conclusively show that Zillow Group is likely to deliver a positive surprise this quarter. This is because a stock needs to have both a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here as you will see below:

Zacks ESP: Zillow Group’s Earnings ESP is -6.67%. This is because the Most Accurate estimate is pegged at a loss of 16 cents while the Zacks Consensus Estimate stands at a loss of 15 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Zillow Group’s Zacks Rank #3 increases the predictive power of ESP. However, we need to have a positive ESP to be confident about an earnings surprise.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are a few companies that you may want to consider as our model shows that these have the right combination of elements to deliver an earnings beat in their upcoming release:

Luxoft Holding (NYSE:LXFT) with an Earnings ESP of +5.17% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Broadcom (NASDAQ:AVGO) with an Earnings ESP of +2.57% and a Zacks Rank #2.

CACI International (NYSE:CACI) with an Earnings ESP of +1.83% and a Zacks Rank #2.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Zillow Group, Inc. (ZG): Free Stock Analysis Report

Luxoft Holding, Inc. (LXFT): Free Stock Analysis Report

CACI International, Inc. (CACI): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

Original post