Estée Lauder Companies Inc. (NYSE:EL) is slated to report fourth-quarter and fiscal 2017 results on Aug 18, before the opening bell. The question lingering in investors’ minds is whether this leading manufacturer and marketer of skin care and hair care products will be able to maintain its positive earnings surprise streak in the to-be-reported quarter.

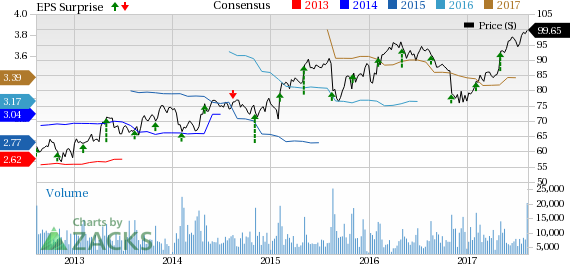

We note that the company has delivered a positive surprise in the trailing four quarters, with an average beat of 10.9%. In fact, its earnings have outpaced the Zacks Consensus Estimate for 11 straight quarters now.

Let’s delve deeper how things are shaping up for this announcement.

What Does the Zacks Model Unveil?

Our proven model does not show that Estée Lauder is likely to beat estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Estée Lauder has an Earnings ESP of -2.38% as the Most Accurate estimate is at 41 cents, while the Zacks Consensus Estimate is pegged at 42 cents. The company’s Zacks Rank #2 increases the predictive power of ESP. However, we need to have a positive ESP to be confident about an earnings surprise.

Estimate Revisions

Let’s look at the estimate revisions in order to get a clear picture of what analysts are thinking about the company right before earnings release. The Zacks Consensus Estimate for the fourth quarter has been stable over the last 30 days at 42 cents while for fiscal 2017 it has increased by a cent to $3.40. Estimates for the quarter depict a year-over-year decline of 2.3% while the same for the fiscal year depicts a growth of 6.1%.

Further, analysts polled by Zacks expect revenues of $2.85 billion, up 7.7% from the prior-year quarter. The same for fiscal 2017 are anticipated to be $11.78 billion, depicting a growth of 4.6% from the previous year.

Estee Lauder Companies, Inc. (The) Price, Consensus and EPS Surprise

Factors at Play

Estée Lauder’s strategic acquisitions have aided the company to enhance its portfolio. The acquisitions of BECCA and Too Faced (during the first-quarter fiscal 2017) has strengthened its fastest growing prestige portfolio. It has contributed approximately half the reported sales growth in the third quarter of fiscal 2017. Lately, the company invested in DECIEM, a rapidly growing multi-brand company, which will also aid beauty sales. In addition to acquisitions, the company also emphasizes on marketing, through digital media and social networking sites.

Under the Leading Beauty Forward initiative, the company continues to reallocate resources and reduce costs in order to drive beauty business. After its full implementation, the company expects Leading Beauty Forward to yield annual net benefits, primarily in selling, general and administrative expenses, of between $200 million and $300 million, before taxes.

Estée Lauder also has a strong e-Commerce business and expects it to be a major growth engine for the upcoming years. Moreover, the company’s strong presence in emerging markets insulates it from the macroeconomic headwinds in the matured markets. Such factors combined with a solid portfolio of brands, have aided Estée Lauder’s stocks to march ahead of the industry in the past six months. Shares of the company have gained 19.7% compared with the industry’s growth of 7.7%.

Although Estée Lauder expects continued growth opportunities in the global prestige beauty industry, currency volatility, economic challenges, terrorism and social and political issues are affecting consumer behavior in few countries. In this respect, slower retail growth in Hong Kong and decline in consumer spending in France, the Middle East and in the U.S. have been posing concerns. For fiscal 2017, foreign currency is expected to negatively impact sales by 2%. Nevertheless, the company’s strategic policies are well on track to aid its performance and overcome industry related challenges.

Other Favorable Picks

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Churchill Downs Inc. (NASDAQ:CHDN) has an Earnings ESP of +3.23% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Lululemon Athletica Inc. (NASDAQ:LULU) has an Earnings ESP of +8.57% and carries a Zacks Rank #2.

SP Plus Corp. (NASDAQ:SP) has an Earnings ESP of +7.32% and holds a Zacks Rank #2.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Churchill Downs, Incorporated (CHDN): Free Stock Analysis Report

Estee Lauder Companies, Inc. (The) (EL): Free Stock Analysis Report

lululemon athletica inc. (LULU): Free Stock Analysis Report

SP Plus Corporation (SP): Free Stock Analysis Report

Original post

Zacks Investment Research