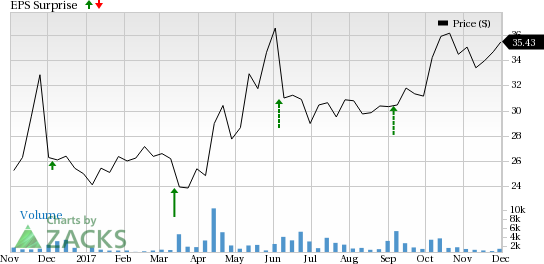

Coupa Software Inc. (NASDAQ:COUP) is set to release third-quarter fiscal 2018 results on Dec 4. The company beat the Zacks Consensus Estimate in three of the trailing four quarters, with an average positive surprise of 37.94%.

In the preceding quarter, the company delivered a positive earnings surprise of 41.18%. Moreover, Coupa beat the Zacks Consensus Estimate for revenues in three of the last four quarters.

For third-quarter fiscal 2018, revenues are anticipated in the range of $44.8-45.3 million. Subscription revenues are forecast between $40.8 million and $41.3 million, while professional services revenues are projected at approximately $4 million.

Management projects non-GAAP gross margins between 67% and 69%. Moreover, non-GAAP loss from operations is anticipated in the range of $5.5-$6.5 million. Net loss is anticipated in the range of 10-12 cents per share.

Notably, Coupa’s shares have returned 41.7% year to date, slightly better than the 29.8% rally of the industry.

Let’s see how things are shaping up for this announcement.

Key Factors

Coupa provides unified, cloud-based spend management platform that helps enterprises keep a tab of daily expenditures. Cumulative spending over the platform since its launch has surpassed $500 billion (at the end of second-quarter fiscal 2018). This reflects growing adoption of its solutions by the likes of Amazon.com Inc (NASDAQ:AMZN) , salesforce (NYSE:CRM) , Caterpillar (NYSE:CAT), Unilever (LON:ULVR) and others.

Moreover, an expanding partner base is expected to drive top-line growth. The partnership with Software AG makes it easy for companies to integrate Coupa with most leading enterprise resource planning (ERP) systems, including those from SAP and Oracle (NYSE:ORCL). The company has expanded CoupaLink certified solutions by adding Software AG’s webMethods Connector.

In the last quarter, Coupa launched its next-generation cloud platform and added more than 70 new capabilities. We believe that the platform will help the company gain new customers rapidly, which will drive result in the soon-to-be reported quarter.

Moreover, the availability of Coupa Open Buy with Amazon Business in the United States is a growth driver.

Earnings Whisper

Nevertheless, Coupa is unlikely to deliver a positive earnings surprise in third-quarter fiscal 2018 due to an unfavorable combination of Zacks Rank #3 (Hold) and an Earnings ESP of 0.00%.

This is because, as per our model, a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

We don’t recommend Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stock to Consider

Here is a stock you may consider, per our model, which has the right combination of elements to post an earnings beat this quarter.

Broadcom (NASDAQ:AVGO) has an Earnings ESP of +0.51% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

COUPA SOFTWARE (COUP): Free Stock Analysis Report

Salesforce.com Inc (CRM): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

Original post

Zacks Investment Research