The Buckle, Inc. (NYSE:BKE) is slated to report second-quarter fiscal 2017 results on Aug 17, before the opening bell. This retailer of casual apparel, footwear and accessories has reported negative earnings surprise in three out of the trailing four quarters, with an average miss of 2.1%. With this in mind, let’s now look into some factors that are likely to impact second-quarter results.

What Does the Zacks Model Unveil?

Our proven model does not show that Buckle is likely to beat estimates this quarter. This is because a stock needs to have a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) as well as a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Buckle has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 22 cents. Moreover, the company carries a Zacks Rank #4 (Sell). We caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Estimate Revisions

A look into estimate revisions give us an idea of what analysts are thinking about the company right before earnings release. The Zacks Consensus Estimate for the second quarter and for the fiscal year 2017 has declined by a penny over the past 30 days to 22 cents and $1.63, respectively. Estimated earnings for the second quarter depict a fall of 31.3% from the prior-year period. The same for the fiscal year shows a decline of 19.7%.

Further, analysts polled by Zacks expect revenues of $195.7 million for the second quarter, down approximately 7.8% from prior-year quarter. Revenues for fiscal 2017 are expected to be $907.4 million, down 6.9% from the previous year.

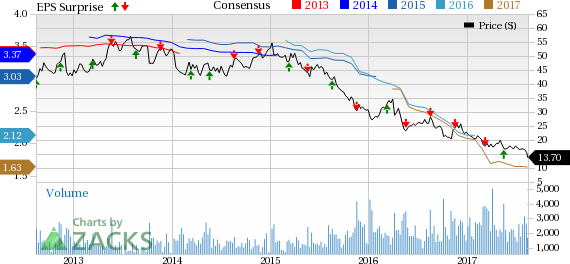

Buckle, Inc. (The) Price, Consensus and EPS Surprise

Investors Remain Skeptical

The stock has plunged approximately 18.5% in the past three months, wider than the industry’s decline of 12%. However, the broader Retail-Wholesale sector has gained 3.3% in the said time frame. In fact, investors aren’t enthusiastic, ahead of Buckle’s earnings release. We observe that the stock has declined roughly 12.2% in the past six days.

Factors at Play

We are skeptical about Buckles performance in the second quarter, given its sluggish comparable store sales (comps). Comps for the four-week period ended Jul 29, declined 8.4% year over year. This was preceded by a decrease of 5.8% in June, 9% in May, 3.5% in April, 10.1% in March, 23.2% in February and 17.6% in January.

The company has not been able to turn around the performance of its Women’s business. It has also been witnessing weakness in its Men’s segment and combined accessory sales. Women's merchandise sales were down about 16% in the first quarter of fiscal 2017, while Men's merchandise sales dropped 11%. Women’s merchandise contributed 53% to total sales, while the Men’s business input was 47%. Combined accessory sales fell nearly 13%, while footwear sales declined 16%, during the first quarter. Further, a competitive retail landscape and cautious consumer spending have been weighing upon the company’s performance.

However, in an effort to improve overall performance the company has been focusing on store refurbishment and technology upgrades. These initiatives are yet to bear significant impact upon the company’s top line.

Do Retail Stocks Interest You? Check These

Here are some other retail companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Wal-Mart Stores, Inc. (NYSE:WMT) has an Earnings ESP of +0.94% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +4.00% and carries a Zacks Rank #2.

Best Buy Co., Inc. (NYSE:BBY) has an Earnings ESP of +1.59% and carries a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaries,"" but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Buckle, Inc. (The) (BKE): Free Stock Analysis Report

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research