Varian Medical Systems Inc. (NYSE:VAR) is set to report first-quarter fiscal 2018 results on Jan 24, after the market closes. In the previous quarter, the company reported adjusted earnings per share of $1.09, which missed the Zacks Consensus Estimate of $1.19. Further, adjusted earnings declined from $1.38 in the year-ago quarter.

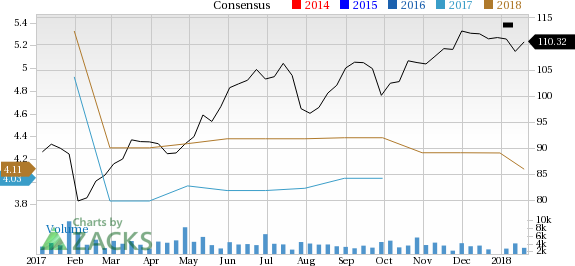

On an average, the company delivered a negative earnings surprise of 6.6% in the trailing four quarters. Also, a lackluster price performance is a woe. Over the last year, the stock has returned 22.6% compared with the industry’s rally of 33.2%.

Let’s see how things are shaping up prior to this announcement.

Factors at Play

Declining Financials:

Varian Medical experienced declining revenues in fourth-quarter of 2017. The trend is expected to continue in the quarter-to-be-reported as well. Lackluster performance by the company’s Halcyon cancer-treatment device will hamper sales in Latin America. In fact, sales in the Halcyon platform declined 46% in Latin America in the fourth quarter, thanks to several tenders pushing out, mainly from public-sector deals. Revenues from Asia-Pacific and Japan are also expected to decline significantly due to plummeting orders of Halcyon.

Further, softness in the market for freestanding clinics is a headwind for Varian Medical in the to-be-reported quarter.

Performance in the proton-therapy unit has been dampened due to intense competition in the niche space. This is anticipated to be a major concern for Varian Medical.

Narrowing Customer Base:

The majority of Varian Medical's X-Ray tube and flat panel detector sales cater to a small number of (large imaging system) original equipment manufacturer (OEM) customers. The equipment manufacturing majors incorporate these X-Ray products into their own medical diagnostic imaging systems and industrial imaging systems. Due to the pattern of client concentration, a loss of any one of these clients may have an adverse effect on Varian Medical’s operating results.

Earnings Whispers

Buoyed by the above factors, our proven model does not conclusively indicate earnings beat for Varian Medical in this quarter. This is because a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Varian Medical currently has an Earnings ESP of +0.76%. This is because the Most Accurate estimate is pegged at 99 cents, while the Zacks Consensus Estimate is at 98 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Varian Medical currently carries a Zacks Rank #4 (Sell). This decreases the predictive power of ESP and makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 and 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revision.

Stocks to Consider

Here are some companies you may want to consider, per our model, which have the right combination of elements to post earnings beat this quarter.

AbbVie Inc. (NYSE:ABBV) has an Earnings ESP of +1.30% and a Zacks Rank #3.

Agios Pharmaceuticals Inc. (NASDAQ:AGIO) has an earnings ESP of +0.12% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Alexion Pharmaceuticals (NASDAQ:ALXN) has an earnings ESP of +5.93% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

AbbVie Inc. (ABBV): Free Stock Analysis Report

Varian Medical Systems, Inc. (VAR): Free Stock Analysis Report

Agios Pharmaceuticals, Inc. (AGIO): Free Stock Analysis Report

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Original post

Zacks Investment Research