Regency Centers Corp. (NASDAQ:REG) is slated to report fourth-quarter and full-year 2019 results on Feb 12, after the closing bell. While funds from operations (FFO) per share are anticipated to have been stable, year on year, revenues are likely to reflect an increase.

In the last reported quarter, this Jacksonville, FL-based retail real estate investment trust (REIT) delivered a positive surprise of 3.13% in terms of FFO per share. The quarterly results reflected a rise in revenues, mainly driven by increase in lease income. Also, decent leasing activity and rent spreads aided its performance.

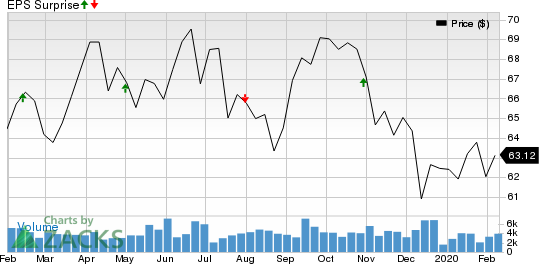

Further, the company has a decent surprise history. It beat the Zacks Consensus Estimate in three of the trailing four quarters, the average positive surprise being 2.11%. This is depicted in the graph below:

Let’s see how things have shaped up for this announcement.

Factors at Play

Regency has a considerable experience in the retail real estate industry, and has developed several retail real estate projects over the past few years. The company is able to differentiate itself by strategically focusing on building a premium portfolio of grocery-anchored shopping centers. Such centers are usually necessity driven and drive a dependable traffic.

Together with the presence of leading grocers in its tenant roster, the company also has restaurants and service providers. The company is targeting having a superior merchandising mix, consisting mainly of best-in-class necessity, value and service-oriented retailers that draw consumers and drive foot traffic, and are usually resistant to store rationalization from disruptors, including e-commerce.

Also, the company’s properties are primarily located in strong trade areas characterized by higher spending power. This helps the company attract top grocers and retailers. Its investments in value-accretive developments also augur well.

However, store closures and bankruptcies have been affecting the retail real estate market, for long, which has been undergoing structural changes. In addition, the recent data from Reis shows that the retail and the Mall vacancy rates both increased in the quarter. Particularly, the retail vacancy rate inched up 0.1% to 10.2% in the December-end quarter. Further, retail rent growth was just 0.1%, while mall rents remained flat.

Regency, too, is not immune to move outs, store closures and retailer bankruptcies. The choppy retail real estate environment is likely to have curbed its growth momentum in the to-be-reported quarter to some extent as secular industry headwinds continue to dampen industry fundamentals. Moreover, significant upfront costs involved with the development and redevelopment pipeline might have strained its margins. Contribution from redevelopment is likely to have remained muted during the period in discussion.

Amid these, the Zacks Consensus Estimate for the fourth-quarter revenues is pegged at $281.8 million, indicating a year-over-year increase of 1.7%. Additionally, Regency’s activities during the October-December period were inadequate to gain analyst confidence. The Zacks Consensus Estimate for FFO per share witnessed no revisions over the past month and is currently pinned at 98 cents. The figure remained stable year over year.

For full-year 2019, Regency expects FFO per share of $3.84-$3.87 and same-property NOI growth, excluding termination fees, of 2%. The Zacks Consensus Estimate for 2019 FFO per share is currently pinned at $3.87, indicating 1.04% year-over-year increase on revenues of $1.12 billion.

Here is what our quantitative model predicts:

Our proven model does not conclusively predict a positive surprise in terms of FFO per share for Regency this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a FFO beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Though Regency has Earnings ESP of +0.34%, its Zacks Rank of 4 makes surprise prediction difficult.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

Healthpeak Properties, Inc. (NYSE:PEAK) , slated to release fourth-quarter earnings on Feb 11, has an Earnings ESP of +1.15% and carries a Zacks Rank of 3, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Vornado Realty Trust (NYSE:VNO) , set to report quarterly numbers on Feb 18, has an Earnings ESP of +5.62% and carries a Zacks Rank of 3, currently.

Host Hotels & Resorts, Inc. (NYSE:HST) , scheduled to release December-end quarter results on Feb 19, has an Earnings ESP of +1.52% and currently holds a Zacks Rank #3.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Vornado Realty Trust (VNO): Free Stock Analysis Report

Regency Centers Corporation (REG): Free Stock Analysis Report

Host Hotels & Resorts, Inc. (HST): Free Stock Analysis Report

Healthpeak Properties, Inc. (PEAK): Free Stock Analysis Report

Original post