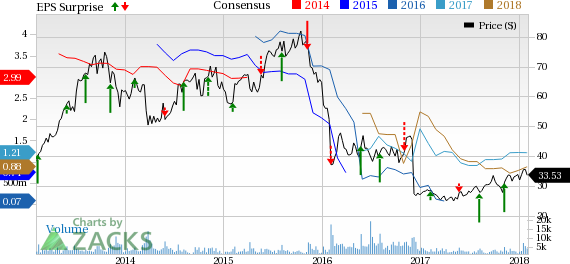

Lions Gate Entertainment Corp. LGF.A, producer and distributor of motion pictures for theatrical and straight-to-video release, is scheduled to report third-quarter fiscal 2018 results on Feb 8, after the closing bell. Over the trailing four quarters, the company outperformed the Zacks Consensus Estimate by an average of 75.5%. Let’s see how things are shaping up for this announcement.

Factors Influencing the Quarter

Lions Gate’s strategic acquisitions and alliances to enhance its competitive position and maximize returns, along with building a diversified portfolio, bode well for the company. In second-quarter fiscal 2018, the Media Networks segment formed after the acquisition of Starz reported revenue growth of 7% year over year, largely gaining from strong subscription growth at Star. Incidentally, Starz witnessed subscription growth of 400,000 on a sequential basis, aided by Power and Outlander.

Notably, the addition of Starz is aiding Lions Gate to emerge as a major player in the TV space and helping it regain lost ground in the streaming network. Moreover, the company has invested in The Immortals to capitalize on the increasing popularity of eSports. It expects the eSports market to grow more than$1 billion in 2018.

However, fewer movie releases in fiscal 2018 compared with the previous year might hurt Motion Pictures revenue performance. Dismal television production performance in the past few quarters has also been a concern for investors. In the fiscal second quarter, Television Production revenues declined 4.7%, following a fall of 18.6% in the preceding quarter. Further, the escalating cost of motion picture production and marketing in recent years may jeopardize Lions Gate’s margins.

Lions Gate Entertainment Corporation Price, Consensus and EPS Surprise

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that Lions Gate is likely to beat on earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Lions Gate has an Earnings ESP of -4.19% as the Most Accurate estimate is at 20 cents, while the Zacks Consensus Estimate is pegged higher at 21 cents. The company carries a Zacks Rank #3, which when combined with the negative Earnings ESP, makes surprise prediction difficult. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

World Wrestling Entertainment, Inc. (NYSE:WWE) has an Earnings ESP of +2.56% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Activision Blizzard, Inc. (NASDAQ:ATVI) has an Earnings ESP of +4.99% and a Zacks Rank #3.

Discovery Communications, Inc. (NASDAQ:DISCA) has an Earnings ESP of +6.50% and a Zacks Rank #3.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

World Wrestling Entertainment, Inc. (WWE): Free Stock Analysis Report

Discovery Communications, Inc. (DISCA): Free Stock Analysis Report

Lions Gate Entertainment Corporation (LGF.A): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Original post

Zacks Investment Research