Appfolio Inc. (NASDAQ:APPF) is set to report second-quarter 2017 results on Aug 7.

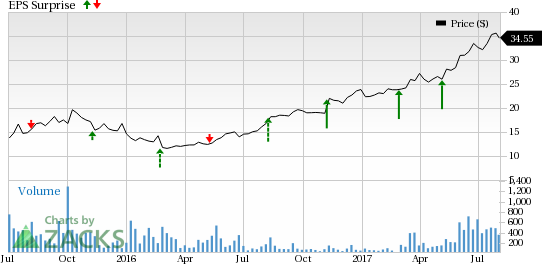

Last quarter, the company reported earnings of 2 cents while the Zacks Consensus Estimate was pegged at a loss of 7 cents. Notably, the company has a positive earnings surprise track record. It has beaten estimates in each of the trailing four quarters, delivering an average positive surprise of 75.33%.

Revenues increased 38% year over year to $32.1 million and beat the Zacks Consensus Estimate of $30 million.

Notably, Appfolio shares have gained 44.8%, substantially outperforming the 17.2% rally of the industry it belongs to. The outperformance can be attributed to the increasing adoption of Appfolio’s products in the market.

Let's see how things are shaping up for this announcement.

Factors at Play

Appfolio’s remarkable increase in customers in the property management and legal market is the key growth driver. In the first quarter, property management and legal customers increased 19% and 27%, respectively, on a year-over-year basis. The company’s Value + services were driven by increased usage of electronic payment platform and resident screening services. These are likely to aid its second-quarter results.

Appfolio is highly focused on product and technology innovation. The company’s software applications, Appfolio Property Manager and MyCase, are helping it to further leverage cloud-based business software solutions. The company is continuously enhancing product features per customer specifications, which is expected to expand its customer base further.

However, intensifying competition in the cloud-based business software solutions space remains a concern.

Earnings Whispers

Our proven model does not conclusively show that Appfolio is likely to deliver a positive surprise this quarter. This is because a stock needs to have both a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here as you will see below:

Zacks ESP: Appfolio’s Earnings ESP is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at break even. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Appfolio’s Zacks Rank #3 increases the predictive power of ESP. However, we need to have a positive ESP to be confident about an earnings surprise.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are a few companies that you may want to consider as our model shows that these have the right combination of elements to deliver an earnings beat in their upcoming release:

Broadcom (NASDAQ:AVGO) with an Earnings ESP of +2.57% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

CACI International (NYSE:CACI) with an Earnings ESP of +1.83% and a Zacks Rank #2.

NetEase (NASDAQ:NTES) with an Earnings ESP of +0.25% and a Zacks Rank #2.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

NetEase, Inc. (NTES): Free Stock Analysis Report

AppFolio, Inc. (APPF): Free Stock Analysis Report

CACI International, Inc. (CACI): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

Original post

Zacks Investment Research