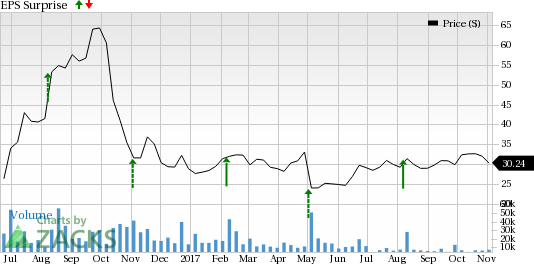

Twilio Inc. (NYSE:TWLO) is slated to release third-quarter 2017 results on Nov 8. Notably, the company delivered positive earnings surprises in four straight quarters with an average beat of 61.9%. Let’s see how things are shaping up prior to this announcement.

Factors at Play

Twilio offers multiple products which are broadly classified in three categories — Programmable Messaging, Programmable Voice and Programmable Video. The company has been witnessing tremendous demand for its programmable voice and messaging products, which is driving top-line performance. Furthermore, Twilio’s consistent efforts toward developing innovative use case products will continue to boost its revenues.

Furthermore, Twilio’s strategies for expanding global footprint are commendable. The company has been continuously making investments to meet the requirements of a broader range of global developers and enterprises. Also, it is making strategic alliances and has employed more employees outside the U.S. office to enhance international operations.

These efforts have paid off well for the company as evident from the rise in revenue contribution from outside the U.S. market to 16% in 2016 from 13% in 2013. The global expansion initiative is likely to drive the company’s top-line performance in the quarter.

However, Uber’s strategy of managing communication services in-house will have a negative impact on Twilio’s overall prospects throughout this year. Furthermore, intensifying competition in the communications market and growing prevalence of in-app push notifications are major concerns.

Earnings Whispers

Our proven model does not conclusively show that Twilio will beat earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Earnings ESP for Twilio is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate stand at a loss of 8 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Twilio carries a Zacks Rank #3. Though this increases the predictive power of ESP, the company’s ESP of 0.00% makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

NVIDIA Corporation (NASDAQ:NVDA) has an Earnings ESP of +1.60% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Texas Instruments Incorporated (NASDAQ:TXN) with an Earnings ESP of +0.42% and a Zacks Rank #1.

Adobe Systems Incorporated (NASDAQ:ADBE) with an Earnings ESP of +0.25% and a Zacks Rank #1.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Twilio Inc. (TWLO): Free Stock Analysis Report

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research