Public Storage (NYSE:PSA) is slated to release fourth-quarter numbers on Feb 26, after market close. The company’s funds from operations (FFO) per share, as well as revenues are anticipated to display year-over-year improvement in the quarter.

In the last reported quarter, this self-storage real estate investment trust (REIT) reported better-than-expected performance in terms of FFO per share, delivering a positive surprise of 0.75%. Results highlighted improvement in net operating income (NOI) from same-store and non-same store facilities.

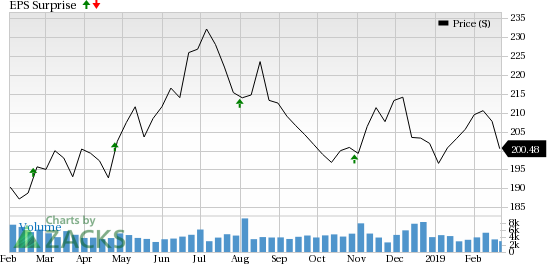

The company has a decent surprise history. In fact, it exceeded estimates in each of the preceding four quarters, resulting in average positive surprise of 1.05%. This is depicted in the graph below:

Let’s see how things are shaping up for this announcement.

Factors to Consider

Public Storage is one of the largest owners and operators of storage facilities in the United States. The ‘Public Storage’ brand is the most recognized and established name in the self-storage industry, with presence in all major metropolitan markets of the United States.

The company is likely to benefit from favorable fundamentals in the self-storage industry as favorable demographic changes, improving job market and rising incomes are likely to drive demand for self-storage spaces.

In addition, acquisition and expansion initiatives are anticipated to stoke growth. In fact, since the beginning of 2013 through Sep 30, 2018, the company acquired 287 facilities with 20 million net rentable square feet from third parties for around $2.6 billion. Further, the company opened newly-developed and expanded self-storage space for $1.2 billion, adding approximately 10.7 million net rentable square feet during this period.

Also, following Sep 30, 2018, the company acquired or was under contract to acquire nine self-storage facilities, spanning 0.6 million net rentable square feet of space, for $79.7 million. Apart from these, as of Sep 30, 2018, the company had several facilities in development (1.6 million net rentable square feet), with an estimated cost of $251 million, as well as expansion projects (3.8 million net rentable square feet) worth roughly $346 million. Such efforts are likely to have continued in the fourth quarter, boosting the company’s performance.

Public Storage is likely to have benefited from the steady demand in the self-storage industry, as well as growth in revenues and NOI. The Zacks Consensus Estimate for revenues is pegged at $692.7 million, depicting 3%.growth.

However, in recent years, supply has been high in a number of markets and deliveries are estimated to have remained elevated in the fourth quarter as well. This is a concern as high supply affects the company’s pricing power. In fact, the company operates in a highly fragmented market in the United States, with intense competition from numerous private, regional and local operators. This limits its power to raise rents and turn on more discounting.

Furthermore, Public Storage’s activities during the quarter did not gain analysts’ confidence. Consequently, the Zacks Consensus Estimate for FFO per share remained unrevised over the last 30 days and is currently pegged at $2.79. Nevertheless, the figure indicates nearly 1.5% rise, year over year.

Here is what our quantitative model predicts:

Public Storage does not have the right combination of two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Public Storage is -0.05%.

Zacks Rank: Public Storage has a Zacks Rank of 3, which increases the predictive power of ESP. However, we also need a positive ESP to be confident of a positive surprise.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

Hersha Hospitality Trust (NYSE:HT) , scheduled to release earnings on Feb 25, has an Earnings ESP of +3.81% and carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Senior Housing Properties Trust (NASDAQ:SNH) , slated to release fourth-quarter results on Mar 1, has an Earnings ESP of +36.36% and holds a Zacks Rank of 2.

American Tower Corporation (NYSE:AMT) , set to release earnings on Feb 27, has an Earnings ESP of +0.29% and carries a Zacks Rank of 3.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

American Tower Corporation (REIT) (AMT): Free Stock Analysis Report

Hersha Hospitality Trust (HT): Free Stock Analysis Report

Public Storage (PSA): Free Stock Analysis Report

Senior Housing Properties Trust (SNH): Free Stock Analysis Report

Original post

Zacks Investment Research