Juno Therapeutics Inc. (NASDAQ:JUNO) is expected to report fourth-quarter 2017 results on Mar 7, after the market closes. Last quarter, the company delivered a positive earnings surprise of 10.98%.

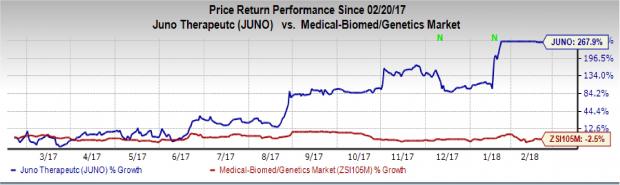

Juno’s shares have significantly outperformed the industry in a year’s time. The stock has skyrocketed 267.9% compared with the industry’s 2.5% decline.

The company’s poor earnings history shows negative surprises in three of the last four quarters with a positive one just once. The average negative earnings surprise for the trailing four quarters is 1.12%.

Let’s see, how things are shaping up for this announcement.

Factors at Play

Last month, Celgene Corporation (NASDAQ:CELG) announced that it will acquire its partner Juno for $87 per share in cash or a total of approximately $9 billion, net of cash and marketable securities acquired. Notably, the former already owns approximately 9.7% of the latter's outstanding shares. The transaction is expected to close during first-quarter 2018. We expect investors to approach management with queries on this merger.

With no approved products in its portfolio, Juno is yet to generate product revenues. Thus, investors’ focus will primarily be on the company’s cash burn and its pipeline updates in the to-be-reported quarter.

Juno’s most advanced pipeline candidates include JCAR017 and JCAR014, which use CAR T-cell technology to target CD19 (Cluster of Differentiation 19).

JCAR017 is in a phase I study for non-Hodgkin lymphoma (NHL) and a phase I/II trial on pediatric and young adults with acute lymphoblastic leukemia (r/r ALL). In December 2017, the company reported positive results from the phase I program, demonstrating improved overall and complete responses in the core group. The company plans to bring JCAR017 to the market for NHL as early as 2018 and for multiple indications by the end of 2019.

We remind investors that last year, Novartis’ CAR T Kymriah and Gilead’s Yescarta received the FDA approvals in August and October for acute lymphoblastic leukemia and non-Hodgkin lymphoma, respectively. Hence on fourth-quarter conference call, we expect investors to focus on updates from the company’s plans to introduce JCAR017 into the market space. The candidate JCAR017 has already induced competition due to the above-mentioned approvals.

Earnings Whispers

Our proven model does not conclusively show that Juno is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here as you will see below.

Zacks ESP: Juno has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at a loss of $1.15. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Juno carries a Zacks Rank #4 (Sell), which lowers the predictive power of ESP. Notably, we caution against all Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions. Moreover, a company’s 0.00% ESP makes surprise prediction difficult.

Stocks That Warrant a Look

Here are a couple of health care stocks with the right combination of elements to beat on earnings this time around:

Exelixis, Inc. (NASDAQ:EXEL) is scheduled to announce fourth-quarter results on Feb 26. The company has an Earnings ESP of +8.94% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Puma Biotechnology, Inc. (NASDAQ:PBYI) is slated to release fourth-quarter financial numbers on Mar 1. The company has an Earnings ESP of +2.02% and a Zacks Rank #3.

Can Hackers Put Money INTO Your Portfolio?

Earlier this month, credit bureau Equifax (NYSE:EFX) announced a massive data breach affecting 2 out of every 3 Americans. The cybersecurity industry is expanding quickly in response to this and similar events. But some stocks are better investments than others.

Zacks has just released Cybersecurity! An Investor’s Guide to help Zacks.com readers make the most of the $170 billion per year investment opportunity created by hackers and other threats. It reveals 4 stocks worth looking into right away.

Celgene Corporation (CELG): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Juno Therapeutics, Inc. (JUNO): Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI): Free Stock Analysis Report

Original post

Zacks Investment Research