If you are teaching or taking an introductory macroeconomics course this fall, you will, at some point, encounter the money multiplier. The multipier posits that there is a stable ratio between M2, the stock of ordinary money in the economy, which consists of currency and bank deposits, and the monetary base, also known as high-powered money, which consists of paper currency issued by the Fed plus reserve balances that commercial banks hold on deposit at the Fed.

Your textbook will go on to explain that the money multiplier gives the Fed great power over the economy. The Fed is able to use open market operations (purchases and sales of government bonds) to control the monetary base. The monetary base, in turn, serves as the raw material from which banks create ordinary money for the rest of us. If the money multiplier has a value of, say, eight, then banks can and will create eight dollars of deposit money for each dollar of high-powered money. Add in the assumption that the quantity of money in circulation powerfully influences investment and consumption spending, and you can see why we obsess so much about quantitative easing, who will win appointment as the Federal Reserve Chair, and every comma in every press release that issues from the stately Eccles building on Constitution Avenue.

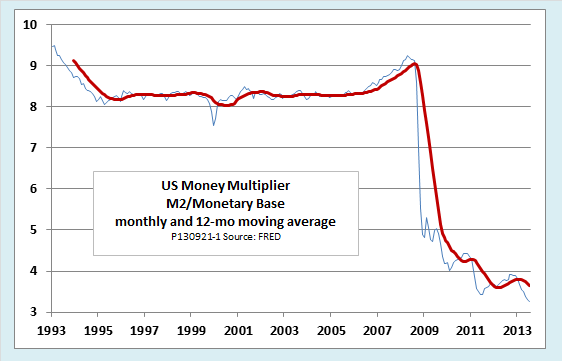

There is just one problem. As the following chart shows, something has gone badly wrong with the money multiplier in recent years. For most of the 1990s and 2000s, it was steady as a rock. From 1994 to 2007, the 12-month moving average of the multiplier stayed in a narrow range, between 8.0 and 8.4. Then it fell off a cliff. By July of this year, it had reached a record low of 3.24.

What happened? To answer that question, we need to look a little more closely at the textbook explanation of how the money multiplier is supposed to work, at some features of the banking system that the multiplier model downplays, and finally, at some recent research.

How the money multiplier is supposed to work: The reserve constraint

As the textbooks explain, the money multiplier arises from the proposition that banks are constrained in their lending by the quantity of reserves they hold in the form of currency in their vaults and reserve deposits at the Fed. Suppose, for example, they must hold reserves that are no less than 12.5 percent of their deposits. Every time they make a loan, they credit the loan proceeds to the borrower’s checking deposit, and the money supply, most of which consists of such deposits, increases. With a reserve requirement of 12.5 percent, it is easy to see that banks can, at most, create $8 of deposits for each $1 of reserves.

Suppose now that the Fed buys $100 million of government bonds on the open market. When it does so, it pays for them by crediting $100 million to the reserve account of the bank that sells those bonds (or of the bank where the seller does business, if the seller is not a bank). Banks suddenly have more than the minimum quantity of reserves they need to maintain the 12.5 percent ratio, so they can make more loans and create more deposits. As they do so, they gradually use up their excess reserves until the ratio is restored.

If the Fed sucks reserves out of the banking system by selling bonds, the process works in reverse. Banks find themselves short on reserves. They react by tightening up on their lending. As borrowers pay off old loans, banks do not fully replace them with new loans. The quantity of deposit money in the economy falls until the ratio of deposits to reserves reaches the 12.5 percent limit again.

The process is a little messier when part of the money stock consists of currency in the hands of the public or of balances like certificates of deposit and money market funds that are not subject to reserve requirements. However, those items do not fatally undermine the money multiplier theory, provided there is a stable ratio of non-reservable forms of money to reservable bank deposits.

Remember, though, that the whole money multiplier story depends of the proposition that banks are reserve constrained. Are they? Let’s look closer.

Why banks may not be reserve constrained

Some textbooks present a “reserves first” version of the money multiplier in which a bank must wait passively for a deposit to bring in new reserves before it makes a loan. The new reserves then pass from bank to bank as the borrower and then the borrower’s payees use the loan proceeds to make purchases. As they do so, the money supply grows step by step until it asymptotically reaches the limit set by the multiplier.

Critics have long derided the “reserves first” version of the multiplier as unrealistic. In reality, banks operate on a “loans first” basis. If they see a good lending opportunity, they commit to it. If they later find themselves short on reserves, they can easily borrow them from another bank on the interbank market. In short, despite what some textbooks say, individual banks are not and never have been reserve constrained.

A somewhat more realistic version of the money multiplier acknowledges the role of interbank loans and applies the reserve constraint only to the banking system as a whole. In this version, banks can make loans until the reserve ratio for the system as a whole reaches the permitted minimum. However, even that version is open to two important objections.

One is that, in reality, not all components of the money stock are subject to reserves. For example, in U.S. practice, money market mutual fund deposits and large certificates of deposit, both of which account for large shares of M2, are not subject to reserve requirements. In other countries, for example, the UK, the central bank does not impose reserve requirements on any types of deposit. In the U.S. case, banks could escape the reserve constraint by funding their loans with non-reservable liabilities, and in the British case, there is no reserve constraint to begin with.

The money multiplier can be rescued from this particular difficulty, at least in part, by noting that even where there are no legal minimum reserve requirements, banks need some reserves to operate safely and efficiently. They need currency to stock their ATMs and serve over-the-counter customers, and they need balances at the central bank in order to clear interbank payments. It that is the case, we could replace the legally binding reserve requirement with a minimum target reserve ratio that banks set for themselves in the interests of safety and efficiency. However, that approach to saving the money multiplier runs up against a second objection.

The second objection is that whether or not commercial banks are subject to legal reserve ratios or voluntary reserve targets, modern central banks do not, in practice, limit the quantity of reserves available to the system. If banks want more reserves than the central bank has provided through open market operations, they can simply borrow them from the central bank itself. Even during its most restrictive period, at the end of the 1980s, the Fed maintained a tight target only for non-borrowed reserves, not total reserves. True, at that time, it discouraged unlimited borrowing of reserves by putting administrative pressure on banks that borrowed too much or too often at the discount window. Today, however, the Fed has abandoned those administrative pressures. For all practical purposes, banks can borrow all the reserves they want at the posted discount rate.

Formally, a model that includes a minimum reserve ratio or target plus unlimited access to borrowed reserves would not violate the multiplier model, in the sense that at any given time, the money stock would be equal to the multiplier times the sum of borrowed and non-borrowed reserves. However, the multiplier would have no functional effect, since the availability of reserves would no longer act as a constraint on the money supply. Economists describe such a situation as one of endogenous money, by which they mean that the quantity of money is determined from the inside by the behavior of banks and their customers, not from the outside by the central bank.

Other constraints to lending and money creation

If, as argued in the previous section, banks are not constrained by reserves, what does constrain their ability to make loans and create money? We next consider two important constraints to bank lending that largely escape notice in the traditional textbook discussion of the money multiplier.

The first of these constraints is the demand for loans. No matter how much they hold in reserves, banks will not make loans unless they see lending opportunities that produce a sufficiently high risk-adjusted return to allow a profit, after taking into account the cost of funding the loan and an appropriate margin for administrative costs. Absent adequate loan demand, any attempt by the Fed to pump more reserves into the system through open market operations will simply lead banks to accumulate excess reserves, not to make more loans.

The second constraint is bank capital. The T-accounts given in the textbooks show clearly enough that for any given quantity of reserves, new lending by the banking system lowers the ratio of reserves to deposits. What they typically neglect to show is that such lending also lowers the ratio of capital to total assets. The capital-asset ratio (or its inverse, the leverage ratio), is also subject to regulation. Even given the assumptions of the money multiplier model, it is perfectly possible for the banking system to find itself in a situation where its ability to expand its assets through lending bumps up against the minimum permitted capital ratio before it reaches the minimum reserve ratio.

In a demand-constrained or capital-constrained banking system, the money multiplier not only ceases to operate, it becomes entirely irrelevant. As far as all the important things are concerned—money, credit, aggregate demand—questions of reserve requirements vs. reserve targets or the elasticity of supply for borrowed reserves no longer matter at all.

If the money multiplier is dead, when did it die?

Look back now at the chart that appears at the beginning of this post. It shows a stable ratio of the M2 money stock to the monetary base from the mid-1990s up to onset of the financial crisis in 2007. That period of stability suggests a way to let textbook writers off the hook: Perhaps the money multiplier was alive and well up to 2007. Perhaps it is only the extraordinary circumstances of the financial crisis—a weak economy, stringent regulatory changes, and massive asset purchases by central banks—that have temporarily made loan demand and/or capital ratios the binding constraints for banks, rendering the money multiplier inoperative. If so, then when things return to normal, the multiplier may once more come into its own.

Unfortunately, recent research calls that simple explanation into question. Papers like this one by Benjamin M. Friedman (Harvard) and Kenneth N. Kuttner (Williams) and this one by Seth B. Carpenter and Selva Demiralp of the Federal Reserve staff present convincing evidence that important elements of the money multiplier model were inoperative already in the 1990s. Neither changes in loan volume nor changes in the money stock had statistically significant relationships to bank reserves. The Fed was able to bring about announced changes in interest rate targets without using open market operations to make large-scale changes in bank reserves. There were a number of episodes when bank lending increased following a monetary tightening or in which total reserves changed in the same direction as interest rates, rather than in the opposite direction, as called for by the multiplier model.

In fact, the cited studies, and others, make the apparent stability of the money multiplier during the 1990s and early 2000s somewhat of a mystery. Perhaps the relatively constant value of the multiplier was the coincidental outcome of multiple changing circumstances that happened to offset one another. Perhaps it was an empty formality with no significance for monetary control. Perhaps it was an example of Goodhart’s Law, according to which apparent statistical regularities tend to break down when an attempt is made to use them for purposes of control.

If the money multiplier did not die in 2007, if it was already inoperational in the 1990s, did it ever have any validity? This is not the place for a complete analysis of the historical record, but we should note that banking institutions and regulations have changed substantially since the early 1980s. Plausibly, we might trace the demise of the money multiplier to the cumulative effect of those changes.

- A general reduction in the level of reserve requirements, including the complete elimination of required reserves on non-transaction deposits.

- The rise of money market mutual funds, which represent a form of money supplied entirely outside the banking system.

- The end of Regulation Q, which prohibited interest on transaction deposits, and other regulatory changes changes that make non-reservable forms of money closer substitutes for those that are subject to reserves.

- A relaxation of administrative restraints on the borrowing of reserves.

- The introduction of interest on reserves deposited at the Fed.

- A world-wide tightening of capital requirements under Basel III.

In any event, whether or not the multiplier model may have been valid at some time in the distant past, take it with a grain of salt when you teach or take that econ course this fall. Try using this blog post as a supplemental reading for the relevant chapter in your textbook.

Original post