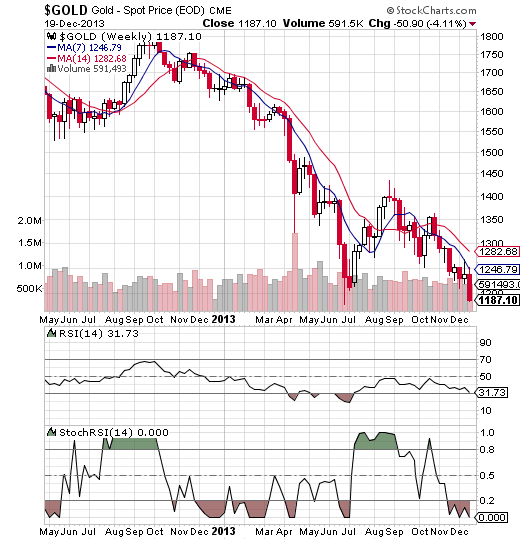

Last year around this time, gold was about $450 an ounce more expensive. Back then, it was even speculated that gold was heading towards the $2,000 mark, but instead the downward slope began the following month in January. It tumbled from almost $1,700 an ounce all the way down to around $1,200 today. The last time it traded around this price level was in July 2010, so more than 3 years ago! Will gold prices continue to drop next year? There are certainly key factors in play that this could be very well possible. I've never been a commodity trader really, but this is an opportunity not to be missed!

First of all, the US dollar is strengthening and probably will continue to do so in the next year now that the Fed is tapering, which brings me to my second point, the US and world economy is improving - risk appetite is back and therefore 'safe havens' such as gold are becoming less important. Third, the gold production is expected to increase - and so is the mining production costs which makes gold much less profitable, of course this affects the price of gold.

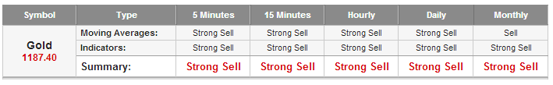

Now, from a technical standpoint it is a 'Strong Sell' all across the board, no matter which chart you pull up. This doesn't happen very often. Usually a chart with a different time frame will also have a different signal like 'neutral' or 'buy'.

For me it's enough evidence to be bearish on gold this upcoming year, expecting to see prices well below $1,000 an ounce. Also, gold doesn't seem to be able to find any support.

If I were a gold producer, I would be pretty worried right now and wonder how this will affect my bottom line. Now the 'support' level is $1,200, but gold now even broke through that psychological level. Are we indeed heading to $1,000 and lower? We'll see. I entered a short at $1,200, which was my conformation level that the ride down is far from over. My target? $1,000.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

What Will Gold Do In 2014?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.