Gold has had a nice bounce now off the bottom set in December of 2013, but are we off to the races just yet? Here is what I wrote last month where I concluded ”we could go higher from here for a bit to trap more of the bulls who say the bottom is in.”

We should start to see gold and silver begin their meteoric 3rd phase rise beginning sometime this year. Before that occurs I have been calling for one more test of the lows and will wait patiently for it. If you call me and ask what I think, I tell you, despite the fact that most other gold dealers will say you have to buy because of a “falling dollar,” “hyperinflation” or some other nonsense. I am dollar bullish which is something that most who sell gold don’t understand. I don’t see hyperinflation in a country that has the economic power that the U.S. does. I do see a government trying to screw it all up, despite all you hear that the economy is recovering. In fact, I do see a higher stock market for now and another test of the highs in the coming months.

But I also see things that can change my mind quickly. Europe has their issues and they will start to come to fruition towards the end of the year. We’ve already seen the negativity of what emerging markets are bringing, causing the DOW to fall over 1,000 points off its high, currently sitting at 15,440. Treasuries have been strong and with interest rates low this has allowed the Fed to taper another $10 billion a month. I watch the 3% level as my line in the sand as to Fed tapering. Anything above that and we’re back to QE. I also at some point see the dollar and gold moving higher together, but this may not happen till later in the year when Europe runs into more problems.

Gold and silver will begin to be buoyed by the world chasing the monetary metals. We have seen a taste of it in January and we’ll see more of it later this year. But watch the Market Makers try and scare you out one more time. We could go higher from here for a bit to trap more of the bulls who say the bottom is in. But I know I’m one of the few who think we have one more test of the lows. I hope we get it as I’ll be ready to write my “all in” article and become the biggest bull around! There are literally trillions of reasons to be bullish and while we may not time the bottom perfectly, most of my clients who are dollar cost averaging into a position will be very happy with their allocations into precious metals in the years to come.

Gold and Silver Price Action

When I wrote that comment above, gold was at $1,266 after topping at $1,372 earlier today and now gold is sitting just over $100 higher. Silver was $19.92 then, but is only 34 cents higher today, presently sitting at $22.26. Silver is acting more like copper, utilizing its industrial side, rather than it’s monetary side. But please know that I believe once silver bottoms, it will outperform gold. This leaves us to try and answer the question; when will we bottom?

Anyone who has followed me for awhile knows that I don’t write articles every day trying to predict what gold and silver will do next. I look at a site like Kitco.com and their headlines change from day to day depending on the news of the day, but they grasp at the reasons why gold is going up or down. If the gold price is moving higher, they’ll say it’s because of “safe-haven demand” or “Ukraine concerns,” or possibly a “weaker dollar.” But the next day when gold declines, they’ll say it’s because of “profit taking” or a “weaker dollar.” Anyone can write those headlines and pick a “reason” for the bullishness or bearishness. I’d rather spend that time writing a book and you’d rather spend that time following whatever is important in your life (assuming you already have a position in gold).

You will know when we are off to the races in gold. First off, I will tell you by writing my “all-in” article. Second, it won’t be because the “dollar is crashing” or “hyperinflation is around the corner.” All currencies will have their issues, but when they are priced in each other, it is impossible for any of the major currencies to crash. It is most likely however, for it to take more of any currency to purchase gold moving forward once we bottom out.

The Yen’s Future

I first started cautioning about the troubles with the Yen in December of 2009. The dollar has risen 13% since then and 38% from the where the Yen topped out.

USD/JPY

USD/JPY" title="" align="bottom" border="0" height="242" width="474">

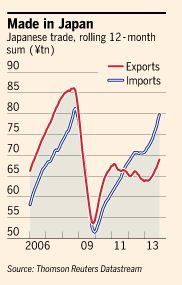

The Yen would crash before the dollar would as their debt is unsustainable (highest debt to GDP ratio for major countries) and their economy hasn’t crashed yet because they have been buoyed by historically being a net exporter. But even with Prime Minister Abe Shinzo’s weaker Yen policy from last year, Japan has been importing more than exporting. What do you think Japan’s choices are?

It’s quite obvious to me: print Yen.The Euro’s Future

The Euro would be the next currency to have issues, especially with their banking uncertainty moving forward. While there has been a rebound in some southern countries in Europe, they are not out of the woods just yet. According to

Blackrock’s 2014 Investment Outlook;

A future crisis in a larger southern-tier nation could spark a deposit flight that is impossible to stem. Europe is stuck in a monetary corset: it needs a weaker currency to export its way out of debt and import some inflation. Yet the euro is rising due to a trade surplus and reduced financial risk. This is deflationary.

While ECB President Mario Draghi has kept interest rates low, he has one problem that I have been talking about which will surface later this year. He’s trying to tie any future money given to the banks with a directive that forces the banks to lend the money out rather than repair their own balance sheets. If you are a banker in Italy or even here in the U.S., even with the fact that demand for loans are down and the credit requirements are stricter, why would you want to lock in a low rate for years to come, possibly decades, if interest rates are at historical lows? Where is the profit in that? That’s why banks go out and try to find profit anywhere else they can today, besides making loans.

A couple of headlines caught my eye just yesterday regarding what’s coming down the road for European banks.

In an early sign of the hefty toll the ECB’s probe could take on eurozone banks,

UniCredit, Italy’s largest bank, said on Tuesday that efforts to clean up its balance sheet before the review and stress tests

contributed to a €14bn loss for 2013 that surprised markets.

Europe’s banking union plans are in danger of unraveling amid a protracted political stand-off over the system for shutting failing banks.

As you can see, banks want one thing and the European banking union wants another, and Draghi just wants it to all go away. It won’t.

What do you think Europe’s choices are? It’s quite obvious to me; print Euro’s.

The U.S. Dollar’s Future

Banks here in the U.S. have taken money from the Fed and instead of loaning it out, have repaired their balance sheets.

“Problem banks,” those at risk of failure, fell for the 11th straight quarter to 467, down from 515 in the third quarter and 47% below a recent high of 888 as of March 2011. That’s less than 7% of the 6,798 banks and thrifts the FDIC said were operating as of Wednesday

Hidden of course in this “good news” for banks is the fact that even as of today, 6 years after the crisis, 467 banks are still at risk of failure here in the U.S.

The dollar itself has fallen back below 80 on the index, but it does this typically once or twice a year of late. While the Yen has got hammered, most of the fall in the dollar can be attributed to the Euro breaking out of a pattern higher. This too won’t last and towards the end of the year we’ll see the dollar regain its strength as the Euro falters under the weight of its banking industry disarray.

By default, the dollar will become stronger. Just look at how strong Treasuries are.

While we may want a policy of a weaker dollar in the U.S., perception around the world is the dollar is the place to be. Those in Argentina who are seeing some serious inflation appear are looking to exchange Peso’s into dollars. 70% of the world is still on the dollar standard. Most every other country can undercut our prices and there’s not much we can do about it when our companies have so many regulations to overcome and high prices employees. How long will we allow the dollar to stay so strong in spite of an out of control debt and never ending budget deficits?

The reason I keep an eye closely on the 10 year is because it tells me the Fed is still in control. Once we shoot above 3%, all bets are off and you better be in gold. For now, I see stronger treasuries ahead, especially if I am right about the Euro and Yen. Please note the upward trend in the dollar is still intact since the bottom of 2011, ironically the same time that gold peaked. The dollar is still a part of the puzzle that needs to be considered in deciphering what gold may do next.

What Does More Fiscal Stimulus Mean?

There are consequences of course to all of the fiscal stimulus that the Bank of Japan, ECB and the Fed implement. It can best be summed up in a

Working Paper; Fiscal Stimulus in Times of High Debt written by the ECB’s Christiane Nickel and Andreas Tudyka WHU – Otto Beisheim School of Management;

The Euro issues with banks and other security firms as well as most every other countries issues, including that of the U.S. banks and the likes of J.P. Morgan and Citigroup, which I will discuss in future articles, is summed up in another

paper coming out of the ECB on Shadow Banking written in 2010.

Deflation vs. Inflation

Despite the so called recovery and token tapering by the Fed here in the U.S., we and most every other major country are still fighting Deflation. Just looking at the problem assets on the books of the banks and the fact that many are still in trouble shows the underlying truth, at least what we hear about. There is much I am sure that we don’t know about too. Many banks are still involved in lawsuits and much of J.P. Morgan’s profit have gone to pay for their past decisions. Heck, I still know people who haven’t paid a dime on their mortgage since the crisis and the banks have not yet foreclosed. Why would that be?

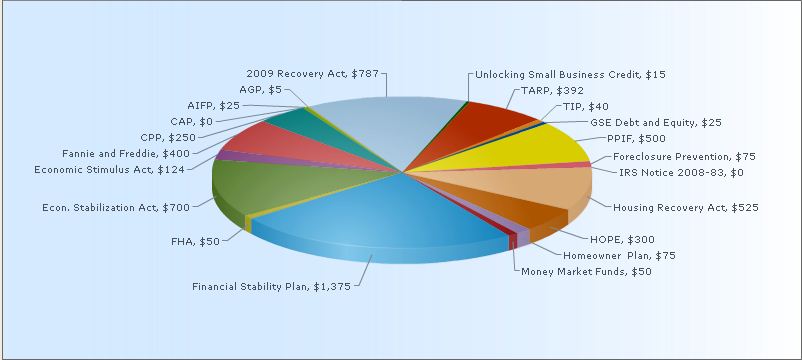

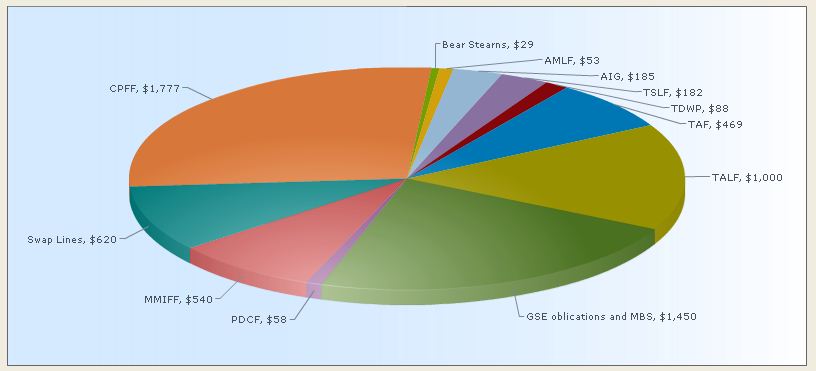

It takes awhile for a deflationary credit contraction to resolve itself and with the ECB, Bank of Japan and the Fed fighting it all the way, it is simply making things worse, dragging it out longer before we hit the final bottom. Enjoy the fun while you can, especially if you have profited from it, but at some point you will need some insurance just in case these Central Bank experts that run our monetary systems don’t see the forest beyond the trees and something worse than 2008 comes to fruition. Based on what the Fed and U.S. Congress had to do last time they didn’t see what was coming is reason enough for you to buy gold now and in the future. Just look at all of the over $9.8 Trillion worth of pieces they had to bring together in attempting to put this current Humpty Dumpty economy together after the last financial crisis.

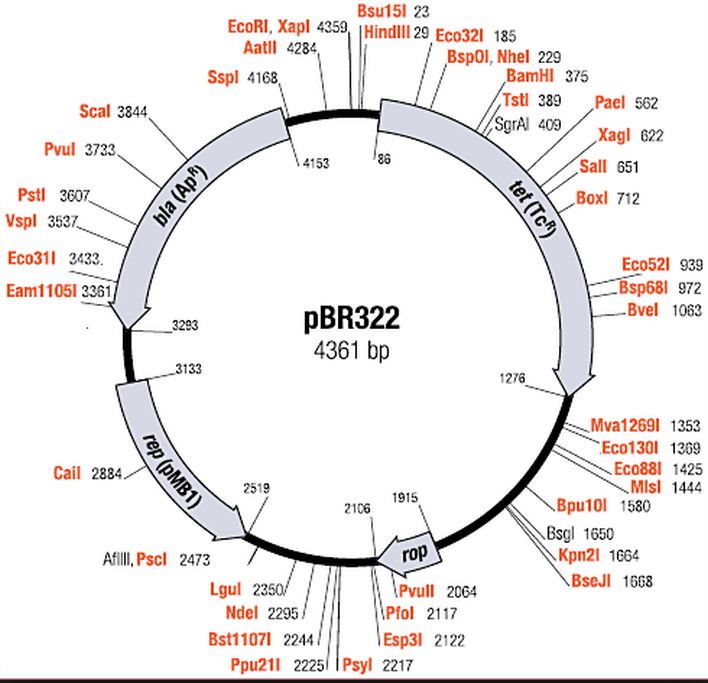

Those charts kind of look like the breakdown of DNA don’t they?

Of course this DNA is isolated from E. coli, which can cause serious infections. Do you see any risk of serious infection for the economy in the first two charts? Did Dodd or Frank?

What Will Gold and Silver Prices do Next?

We are close to a short term top in my opinion, probably within $50 in gold and silver I just don’t think has the legs to continue much higher. I would be dollar cost averaging out of short term positions now and look to buy again lower. Gold and silver are not going “to the moon” just yet. Despite some issues and concerns abroad and many gold bulls calling it a “safe haven” at present, I don’t think you are seeing a small group of Ukrainians knocking down the door of the local gold dealer as I don’t think they even have gold dealers in the Ukraine (at least when

I Googled them).

If you are long gold and silver right now, a little more patience is needed. You also have to believe that the cracks in the Humpty Dumpty economy are only slabbed over with patchwork policies and that eventually “all the kings horses and all the kings men” won’t be able to put this economy together again; albeit they will try and try and try. Just look at how much it took them to accomplish the task last time ($9.8 trillion worth), the result of which is we’re still mired in mystery of what’s to come.

In trying to prognosticate short term movements in the price of metals, I admit it’s not easy. I just simply call things the way I see them and have told many clients to hold off in purchasing because of the way I see things unfolding. If I am right, great, as many will be able to buy gold and silver at lower prices. If I am wrong, and the price of gold moves higher and starts to take off, this is the reason to own some physical now. I only put a 10% probability on that occurring right now.