Gold and gold stocks, in particular, have made a short-term low.

The gold and silver stocks have been fairly oversold, while the smaller juniors have been very oversold, so a rebound is not surprising.

I was hoping to see GDX and GDXJ test $30 and $41 and reach extremely oversold readings, but I digress.

While an oversold bounce is a catalyst in its own right, the sector needs a different kind of catalyst to begin an impulsive advance.

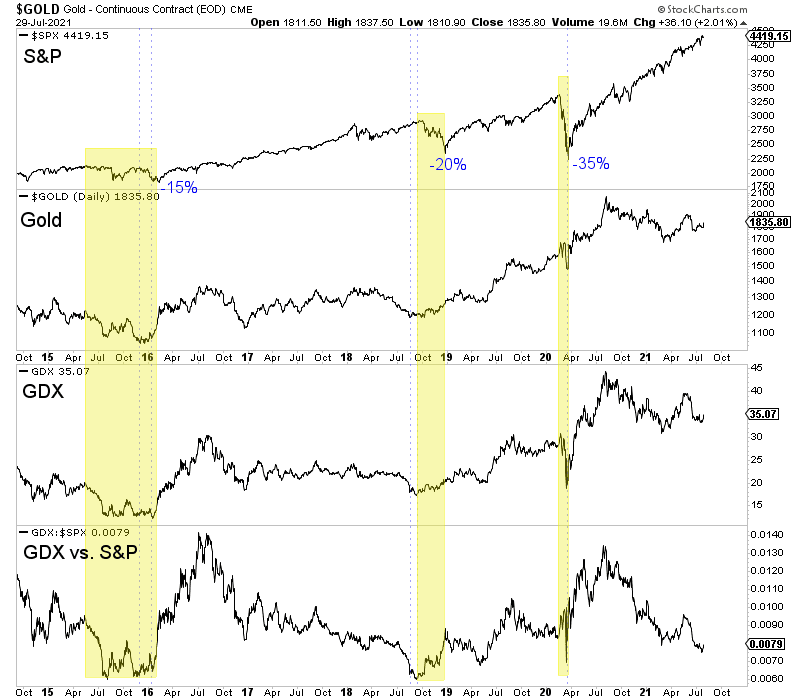

And this catalyst revolves around stock market weakness.

The three biggest moves in precious metals since 2015 coincided with the three biggest declines in the stock market.

It didn’t matter if precious metals declined with the stock market, as they did in two of the three cases. Soon enough, they exploded past previous highs.

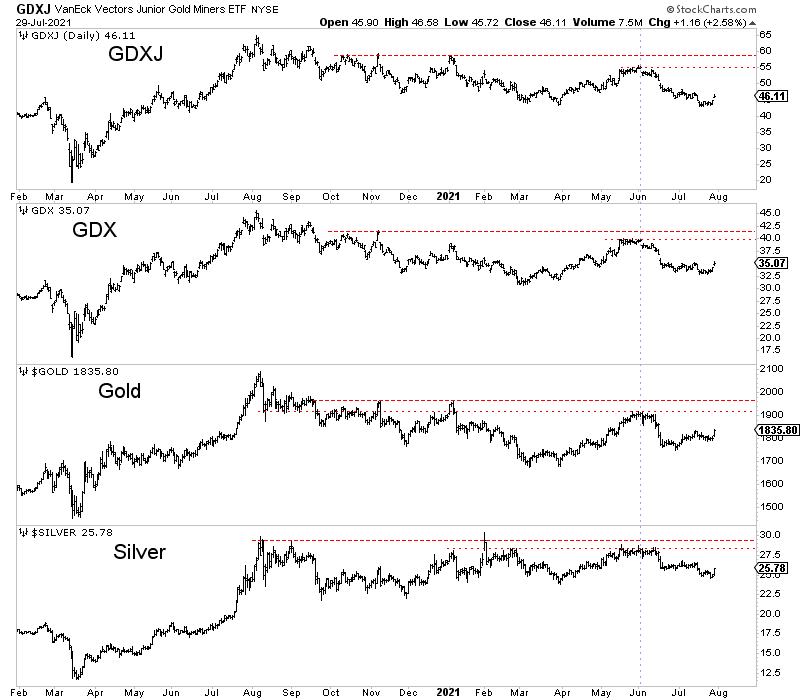

Below is a look at the daily bar charts across the precious metals complex.

The rally that peaked at the start of June marked a lower high for everything (though Silver almost avoided the same fate).

The miners, in particular, could have a decent rebound but still make a lower high relative to the early June high.

It is possible that the precious metals complex could rally back to the June highs without strongly outperforming the stock market.

However, the sector will not break out without the help of a decline in the stock market.

Because the correction is ongoing (in my view), my focus is on finding quality companies that can add value (via exploration or production growth).

If one can buy fundamental quality at oversold points and compelling values (and there are some right now) and hold through the next breakout in Gold, they can achieve returns of 500% and more.