It is important to document one's view of the future as it is a test of understanding and the weighting of current events - especially economic forecasts. I say current events because the economy does not turn on a dime, and current events should be the drivers for the first six months of 2016.

Follow up:

After re-reading my "forecast" of 2015, it seems I did reasonably well - with only my uncertainty of low oil prices continuing being "slightly" off base. The conclusion of my crystal ball last year:

There is always uncertainty about the future - and the weighting of the uncertainty is problematic in making predictions. It seems most uncertainty is over-weighted, and ends up having little effect on the economy. But we are NOT talking about the economy here, but the markets and business cycles (which are related but not joined at the hips).

I see oil prices as the major uncertainty for 2015 followed closely by the relative strength of the US dollar and the slowing of the global economies. This is a war in the USA between the benefits and the damage which will be inflicted by these dynamics.

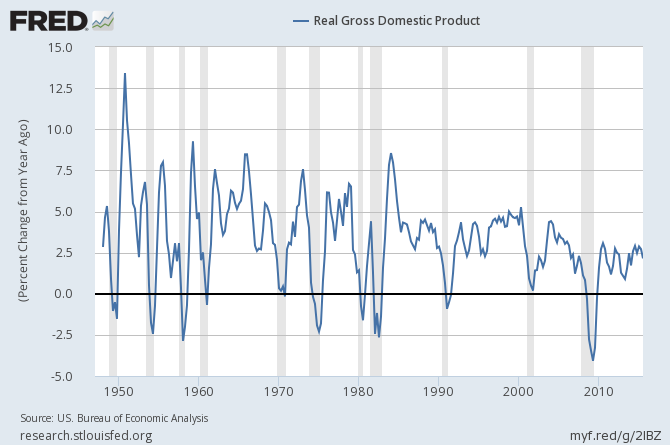

As it turned out, the USA ended 2015 with anemic growth, low oil prices, a strong dollar, weak global growth. The question for 2016 is what will change?

As there is little movement in the current trend-lines, one should draw the conclusion that the first half of 2016 will be similar to the last half of 2015. This means continues slowing rate of employment growth, continuing low energy prices, soft industrial production, consumer income growth continuing to outpace consumer spending and soft global growth - all indicating USA GDP growth remaining around 2.5 %.

So the uncertainty is the second half of 2016.

- I continue to be concerned with the collapse of the transport sector. Rail, which generally moves items which will be used by the end users months from now remains deeply in contraction. Truck movements are also contracting.

- I see no dynamic which would cause energy prices to increase. I do think there will be a modest growth in inflation as we view inflation year-over-year - and we are comparing against very low inflation period.

- There is no visible dynamic which would indicate any significant change to global economic growth - so there should be little change in export levels.

- I know many are forecasting a weaker dollar - but with many global central bank's aggressive monetary policy - I see little change in the US dollar's relationship with major currencies.

- Many are forecasting better growth due to an uptick in the business cycle. I suspect that the second half of 2016 will be better than the first half, but for the average Joe - it will be insignificant.

Wishing all a great New Year.

Other Economic News this Week:

The Econintersect Economic Index for December 2015 declined - and remains in the low range of index values seen since the end of the Great Recession. The most tracked sectors of the economy generally showed some growth. Still our economic index remains in a long term decline since late 2014.

Current ECRI WLI Growth Index

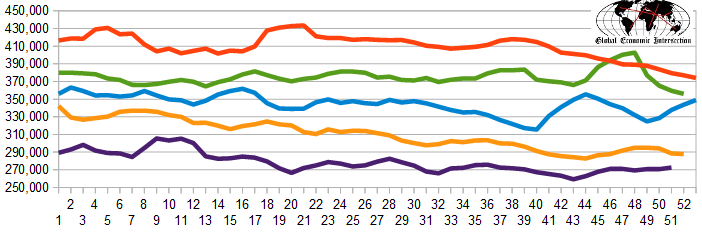

The market (from Bloomberg) was expecting the weekly initial unemployment claims at 267 K to 275 K (consensus 270,000) vs the 267,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 270,750 (reported last week as 270,500) to 272,500. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: None

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: