Alcoa, Inc. (Alcoa Inc (NYSE:AA)

Materials Metals & Mining | Reports October 11, After Market Close

Key Takeaways:

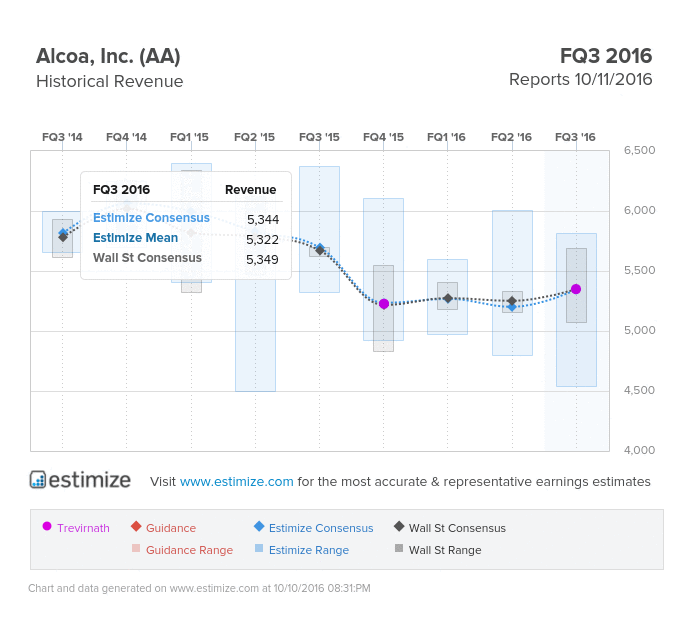

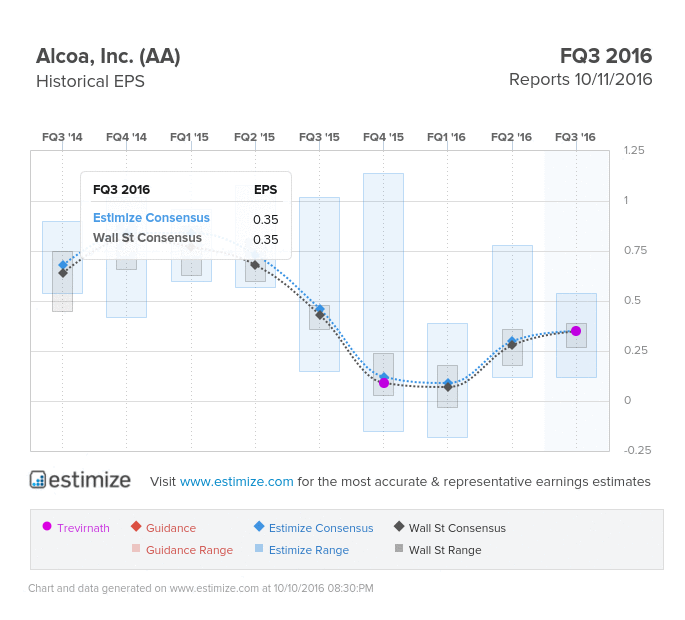

- The Estimize consensus is calling for earnings per share of 35 cents on $5.34 billion in revenue, 10 cents lower than Wall Street on the bottom line and $17 million on the top

- This will be Alcoa’s last report before the split that will result in one company that handles its legacy aluminum business and the other that takes care of its value added sector

- Global market uncertainty, especially in China, and weak commodity prices are taking its toll on revenue and margins

Alcoa, as it usually does, kicks off earnings season with its third quarter report today after the closing bell. This will be the last earnings release before it splits into two publicly traded companies; Alcoa and Arconic. Alcoa will continue to handle the legacy aluminum business while Arconic will manage the thriving value added segment. This includes global rolled products, engineered products and solutions and transportation and construction solutions. Shareholders will need to get through one last report before this split occurs with expectations relatively muted heading into today’s report.

Analysts at Estimize are calling for earnings per share of 35 cents, 190% higher than the same period last year. That estimate has climbed almost 100% since Alcoa’s most recent report in early July. Revenue for the period is estimated 5% lower to $5.34 billion, marking a 5th consecutive quarter of negative growth. Regardless, shares are up 13% in the past 6 months and historically jump 1% immediately following an earnings report.

Alcoa primarily deals with the production of aluminum and alumina metals. Unfortunately, aluminum has suffered from oversupply and weakness in China. As a result, the metal has reached a six year low and has put pressure on corporate earnings. Alcoa has struggled with a slowdown in non-residential building and construction divisions in Europe, Canada and the United States. Topping it all off, the strong U.S. dollar, weak commodity prices and global volatility should take their toll on earnings.

Fortunately the company’s booming value added business has offset some of its upstream losses. Last quarter, revenue from its value added segment increased 1% driven by a 17% increase in global rolled products and 9% in engineered products and solutions. Alcoa is seeing steady demand from aerospace, heavy truck and trailer sectors consisting of around $15 billion worth of supply deals with Lockheed Martin (NYSE:LMT) and Boeing (NYSE:BA). While Aluminum products is expected to trend lower, the company recently signed a lucrative deal with Ford (NYSE:F) to produce aluminum sheeting for its F-150 pickup truck. This deal, coupled with global expansion, will help keep the namesake Alcoa brand afloat after the split.

Management is expected to speak on the transition during the conference call. This could very well be more important than the actual report if investors believe one company has more upside than the other.