On Wednesday, May 2, after the US market close, five months into 2018, we'll finally get our first look at Tesla's (NASDAQ:TSLA) business results so far this year when the electric vehicle and energy storage mega cap reports earnings for Q1 2018. Tesla is expected to post revenue of $3.14 billion, and a negative EPS of - $3.44. It's been a pretty bumpy ride for Tesla investors since the year began.

The stock started 2018 on an up-note, climbing to a high for the year of $360 on January 23. However, an investigation by the US's National Transportation Safety Board into a fatal crash on March 23 that killed the driver of the company's Model X while the car's autopilot feature was engaged has weighed heavily on Tesla shares. By April 2 they'd lost 33% of their value, falling to a low of $244 before rebounding. Shares are now trading for $299.92 as of yesterday's close.

This is quite a comedown from the stock's all-time high of $389, reached on September 18, 2017. Tesla shares would need to appreciate by almost 30% to regain that lofty position. So, what's keeping Tesla shares down?

Over Promising and Under Delivering

It's worth starting with Tesla's IPO in 2010. For years, Musk's strategy was clear and made sense for a newly publicly-traded, industry disruptive company. Tesla was young and needed money. So Musk told investors what they wanted to hear, offering up optimistic projections of how Tesla could change the world.

Since at that point the project was largely theoretical, plus Musk can be charming and his goals were and are admirable, investors ate it up, boosting Tesla's stock price to an astonishing level for a company that had still not delivered an actual product.

Why wouldn't investors jump in on the bright and shiny rhetoric? Musk's charismatic brand evangelism made it sound like owning Tesla shares was a way to participate in this new, electric technology revolution which would make the world a greener place while turning a profit. It all seemed too attractive to pass up.

However, as big ideas met cold, hard reality, delivering on towering promises wasn't nearly as easy as simply expounding about them repeatedly.

Execution has been a vexing problem for the automaker. Musk reportedly sleeps on the floor of Tesla's factory to save time.

He's also admitted that "excessive automation" at Tesla has been a mistake. Of course, this hasn't kept Musk and Tesla from trying to produce more cars and promising to add additional models—including both a pick-up truck and full size truck.

Though setting the bar too high might be important for securing funds, over promising without the capacity to deliver eventually catches up to you. In Tesla's case, big-time.

Model 3 Production Hell

A lot has already been reported about Tesla's production problems. Musk knew going in that the Model 3 would be, in his own words, "production hell." However, it's unlikely he imagined the process was going to be this slow.

Last summer, Tesla's official expectation for Model 3 production was that they would be turning out 20,000 vehicles a month by the end of 2017. That's not even close to what actually happened.

For the final week of March, 2018, Tesla was turning out just 2,020 Model 3s, or 8,080 per month. That reportedly even missed Tesla's internal, severely downsized target of 2,500 cars by the end of March.

Readers who are following closely will see an interesting pattern emerging. According to Tesla, they're missing deadlines but "making progress." And progress, of course, sounds good, so…well, all is good, right? But business, like so many other things, doesn't really work that way.

Can Elon Musk build cars on a massive scale? Apparently not.

Would hiring a highly qualified specialist with extensive experience in automobile manufacturing make things better? Probably. But it might also put paid to Musk's dream of doing things differently. Still, injecting manufacturing knowledge into the process would undoubtedly improve Tesla's ability to deliver. So that's the tightrope on which Tesla is currently balancing.

Management has to figure out how to hit production goals while not appearing to be exactly the same as competitors. Ironically, even with its paltry production, Tesla still has a market cap of $48 billion dollars, putting it on par with General Motors (NYSE:GM) at $55 billion, and Ford (NYSE:F) at $45 billion—two US-based manufacturing powerhouses.

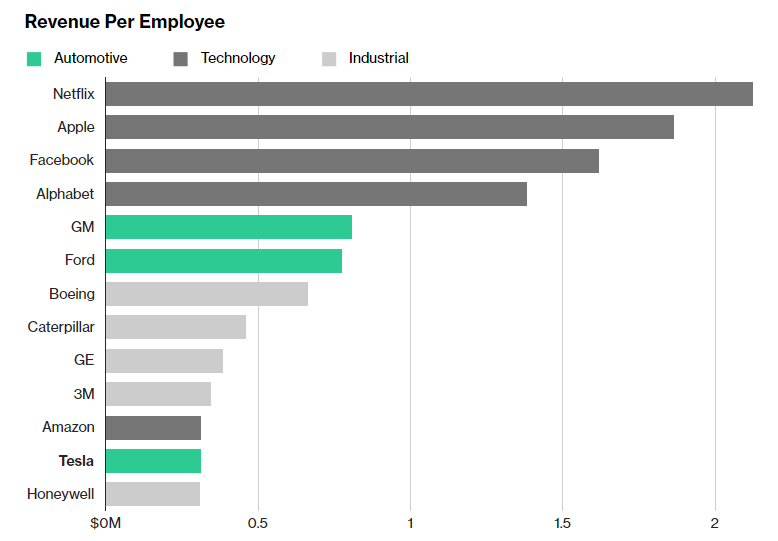

According to the chart below, courtesy Bloomberg, Tesla's revenue per employee is less than half that of GM and Ford.

That alone should signal to Tesla, and Musk, that the time may have arrived to start doing things differently—perhaps by taking a page from the industry's 'best practices' playbook.

Increasing Cash Burn

Insofar as revenue, Tesla's free cash flow is only getting worse. The company had one positive cash flow quarter during the past four years, and that was the result of intense efforts by Musk to somehow provide a green quarter with which to flaunt the company's supposed upside. In order to achieve those numbers, among other things, Tesla sold millions of ZEV credits to pump up the revenue stats and make things look healthier than they actually may have been for that specific quarter.

Tesla has $9.4 billion in outstanding debt. With its ballooning capital expenditures, the company has absolutely no chance of repaying this debt without making another foray into the debt market. Is Tesla too big to fail and go bankrupt? Possibly. Nevertheless, a positive response to that question does not make Tesla a good investment opportunity. Just the fact that the question is being asked at all should be an enormous red flag.

Vanity Side Projects

For a man who says he has to sleep on Tesla's factory floor in order to keep production moving, how is it that Musk seems to also have the time to design and market flamethrowers? Or create "The Boring Company"? Or send people to Mars? Or frequently tweet out weird statements?

I would expect the CEO and Chairman of a struggling company to be way more focused on the problems on his production line, rather than carving out new side projects on the strength of one's persona. To be clear, we're not questioning Musk's commitment to Tesla. However if we were investors, wouldn't it be our right to insist that all of the CEO's attention be focused on Tesla's problems, which appear to be big and systemic. Wouldn't it make complete sense to become indignant when Musk seemingly strays, for even a few minutes, from fixing Tesla's significant issues? Without doubt.

Bottom Line

Tesla shares are known to whipsaw aggressively after earnings are reported. Following its last two reports the stock lost 10% of its value afterward, on February 7 and November 1. In both cases, the price ended up drifting back to where it was previously. It's our view that fundamentally, Tesla is a short.

However, like the old adage says, "the market can remain irrational longer than you can remain solvent". So short at your own risk.

Tesla, guided by founder and CEO Musk, is walking down a familiar, visionary path. That means there's a large and enthusiastic group of followers, but an apparent inability by the visionary himself to nail the details and succeed at actual execution. As long as Tesla continues to live off borrowed money, it's living on borrowed time.

What has been is what will be, and what has been done is what will be done, and there is nothing new under the sun. ~ Ecclesiastes 1:9