Fundamental Analysis

Gold prices are experiencing absolute insanity over the last 24 hours as traders are trying to make sense of Janet Yellen’s comments. The US Treasury Secretary has confused traders about the Fed’s monetary policy. Her initial comments about the US interest rate were completely at odds with Jerome Powell’s, the Fed Chairman’s view of the US monetary policy.

Yellen said that the US would need to increase the interest rates soon, and this particular comment broke the back of gold traders who experienced an intense sell-off in gold prices. Yellen did her best to backtrack from her earlier comments by saying that she isn’t suggesting anything, but traders have become confused now.

It is possible that in the coming days, we may hear more from her on this point, and she may try her best to convince markets that interest rates aren’t going anywhere anytime soon.

Technical Analysis

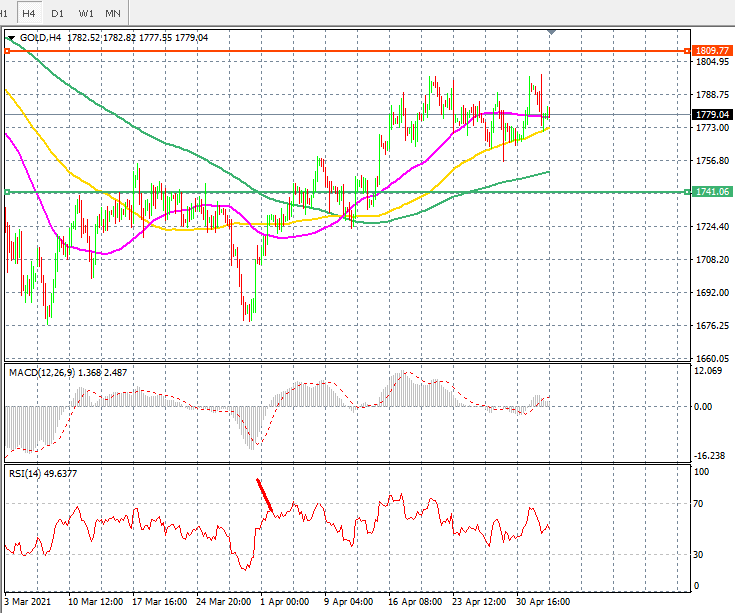

Speaking from a technical analysis price point, gold prices are trading in battle with the 50-day SMA on the 4-hour time frame. As long as the price stays above this price point, we are likely to see bullish strength coming back, and the price could move above the 1,800 price level. However, if the gold price breaks below the 50-day SMA and stays below this moving average, we could see some more pain for the gold price.

The near terms resistance for gold price is 1810, and the support is at 1,741.